FxNews—In today’s comprehensive EURCNH forecast, we will first scrutinize the current economic conditions in China. Then, we will meticulously delve into the details of the EURCNH pair’s technical analysis.

The Chinese yuan has been climbing, recently surpassing the 7.30 mark against the dollar, a peak it hasn’t reached in nearly four weeks. This uptick comes as the US dollar isn’t doing as well, partly because the latest US job numbers weren’t as strong as people thought they would be. This has led many to believe that the Federal Reserve might not raise interest rates anymore.

Economic Health Check-Up

Bloomberg—Investors are now waiting for new data on China’s trade and inflation to help them understand how the country’s economy is doing. Just last week, the yuan felt some heat when reports revealed a surprising drop in China’s manufacturing activities and a slowdown in the growth of the service sector, hitting a low not seen in almost a year.

Additionally, the Chinese government has announced plans to borrow more and inject more money into the economy, which has sparked conversations about whether they’ll loosen up their money policies even further.

EURCNH Forecast – Bullish Trend with Potential for Buy

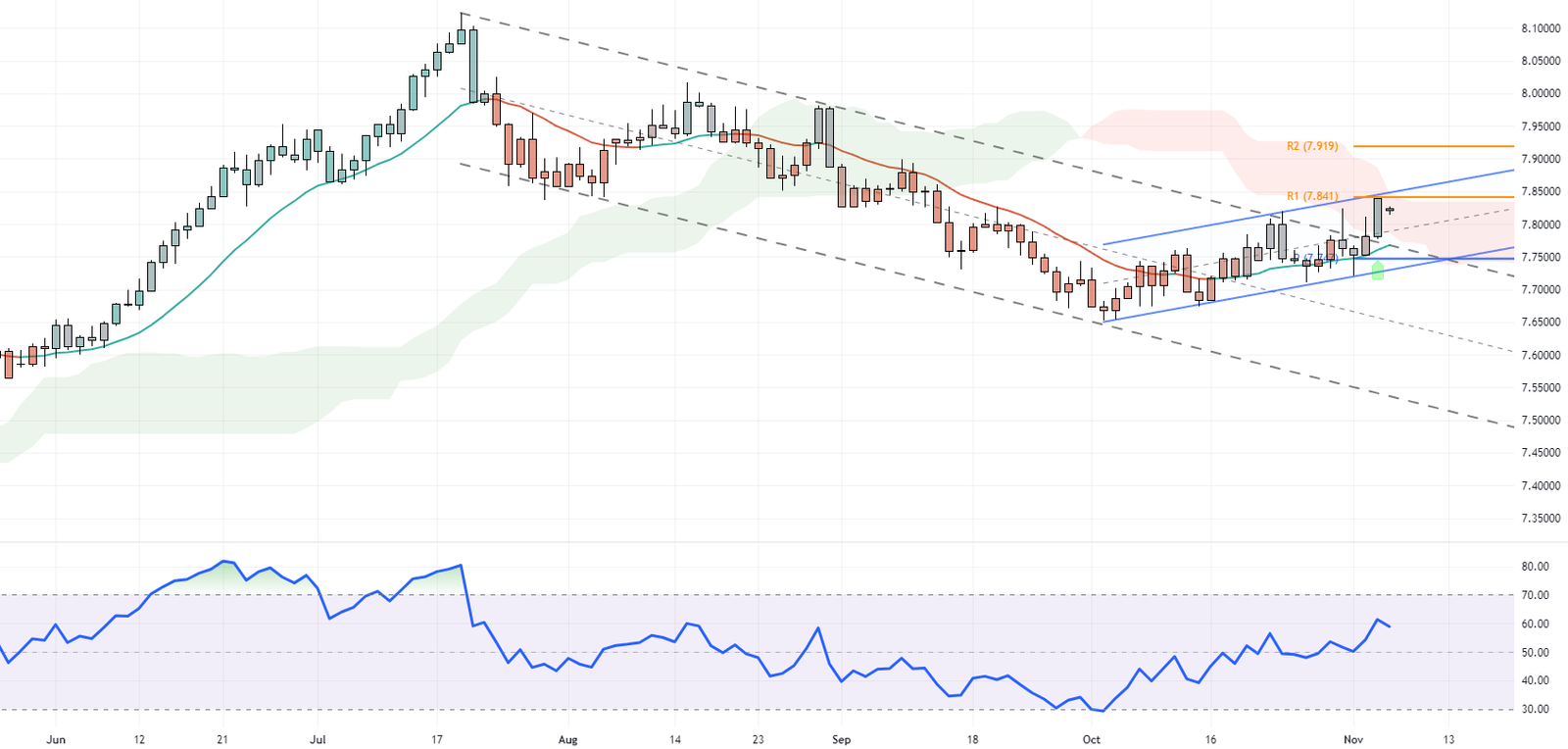

The daily chart shows that the EURCNH pair has recently broken out of its bearish channel. It’s testing the 7.841 resistance level, which aligns with the upper band of the bullish channel and the Ichimoku cloud. The overall trend for EURCNH is bullish, with the RSI indicator consistently above the 50 level. Therefore, analysts at FxNews suggest that this could be a good time to look for opportunities to place buy orders.

For a more detailed view of the EURCNH price action, we turn to the 4-hour chart. The RSI is nearing the overbought zone and showing divergence, signaling a potential price correction or trend reversal. Based on these chart data, there’s a possibility that the price might fall to the middle line of the bullish channel, followed by S1. Both these levels could offer attractive prices for long-term EURCNH.

Remember, monitoring these key levels and indicators is essential to make informed trading decisions. Stay tuned for more updates and analysis on the EURCNH pair.