In today’s comprehensive EURGBP forecast, we will first examine the current economic conditions in the United Kingdom. Then, we will meticulously delve into the details of the EURGBP pair’s technical analysis.

EURGBP Forecast – GBP Stability Ahead of BoE

Bloomberg – The British pound has found equilibrium at approximately $1.21 as markets anticipate the Bank of England’s forthcoming decision on Thursday. It is widely expected that interest rates will remain static. However, the focal point for analysts will likely pivot to the updated economic forecasts, with the prevailing sentiment being that the Bank of England might have to sustain elevated interest rates for a prolonged period, in contrast to other major central banks, due to ongoing high inflation.

Governor Andrew Bailey previously acknowledged that September’s inflation rates aligned with the central bank’s projections, viewing the modest reduction in core inflation as a positive sign. Yet, the broader perspective suggests inflationary pressures continue to loom, potentially necessitating a steadfast approach to interest rate levels.

Bank of England statistics revealed a dip in mortgage approvals this September, with figures falling to the lowest point since January. The data, featuring just 43,328 approvals, mirrors a cooling property market as higher borrowing costs start to weigh on housing demand.

EURGBP Forecast: A Technical Analysis

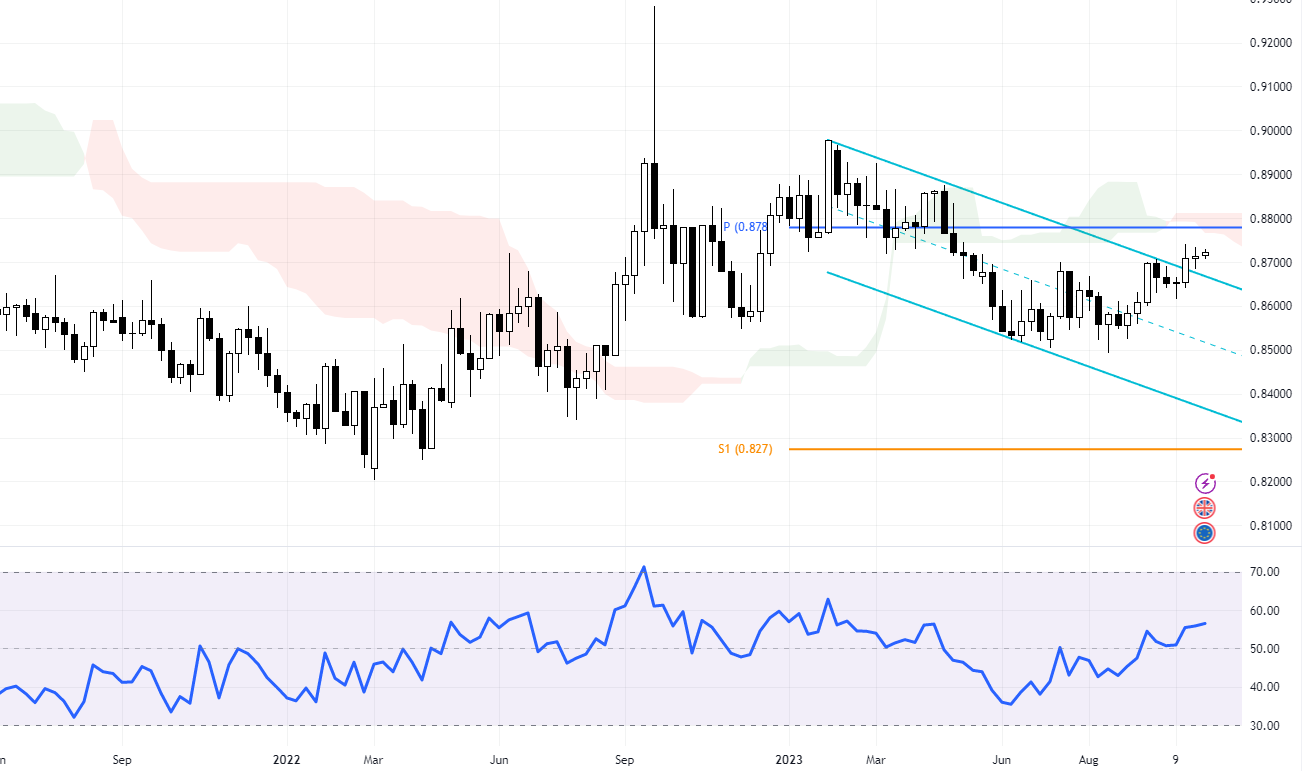

In our latest EURGBP forecast, we’ve observed a significant shift in the market dynamics of the EURGBP currency pair. The pair has successfully broken out of the bearish trendline on the daily chart, indicating a bullish market bias. This change in price behavior, coupled with the RSI indicator rising towards the level of 60, strengthens the bullish scenario.

However, it’s important to note that the currency pair is still trading below the Ichimoku cloud and the monthly pivot (1.0878). To gain a more nuanced understanding of these market trends and to identify trigger points for our EURGBP forecast, we delve deeper into the 4-hour chart.

On the 4-hour chart, the EURGBP pair trades above the Ichimoku cloud and is well-positioned within a bullish channel. Additionally, the price is above the weekly pivot. These factors lead us to anticipate an increase in the value of EURGBP, starting with R1 (0.874) and followed by 0.876.