FxNews—In this comprehensive forex technical analysis, we examine the USDCZK currency pair on a daily and 4-hour chart. By the end of this article, you will learn how to efficiently utilize trendlines, channels, and Fibonacci levels on your chart.

These techniques will assist you in extracting priceless information from a chart. Consequently, they will guide you in predicting the Forex market and filtering out false signals.

Forex Technical Analysis Workshop – USDCZK Forecast

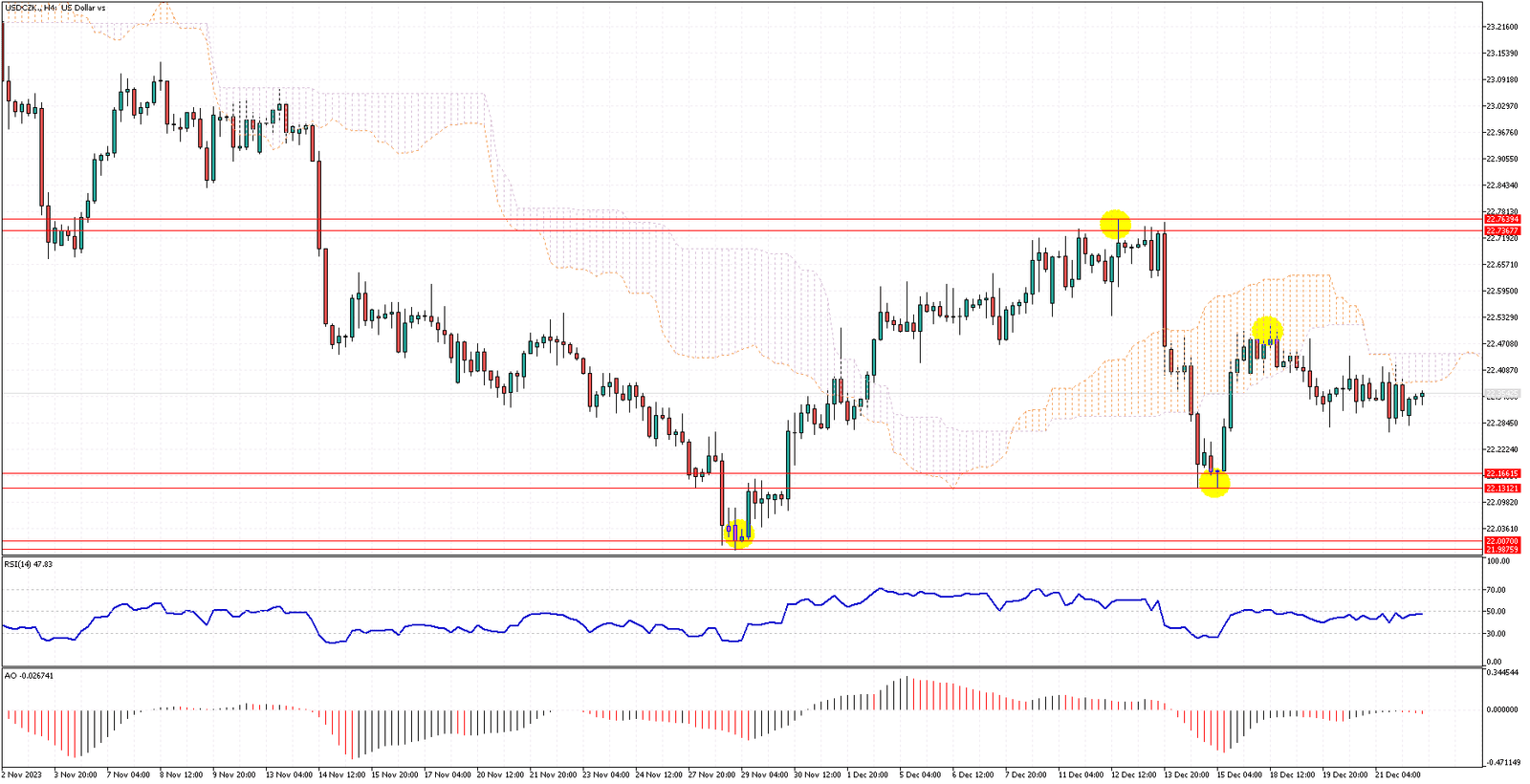

The USDCZK currency pair rose to the 22.7 resistance area in conjunction with the Ichimoku cloud. Once again, the currency pair’s value decreased and closed below the 50% Fibonacci support level. However, the bullish trendline halted the decline, as shown in the USDCZK daily chart.

Reading the Forex Technical Indicators

The pair is attempting to stabilize itself above the 50% level of the Fibonacci support. The technical indicators provide mixed data. The Awesome Oscillator bars are green, suggesting the bullish wave may continue. On the other hand, the RSI indicator hovers below the median line, signaling that bearish momentum is prevailing.

Despite the mixed data from the forex technical indicators, the USDCZK pair ranges above the bullish trendline, supporting the bulls as long as the pair hovers.

Support and Resistance in Forex: The Sweet Spots

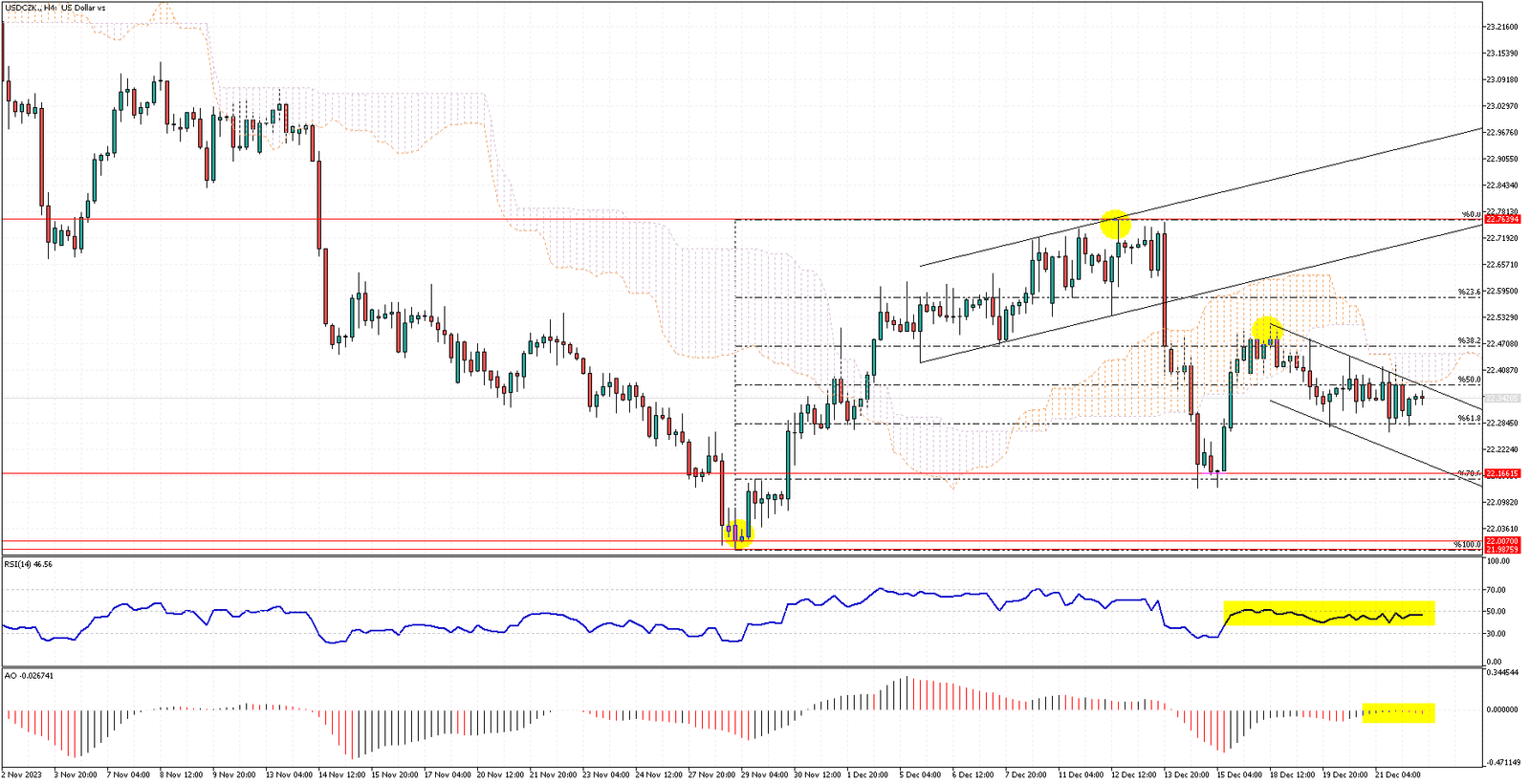

We shall zoom in on the lower time frame to gain better insight into the USDCZK forecast and technical analysis. First and foremost, we should identify highs and lows in the currency pair’s 4-hour chart and then draw lines, channels, and trendlines.

Please refer to the chart below, which offers valuable data on price action. The currency pair closed above the Ichimoku cloud in mid-December. However, it failed to sustain its position, resulting in the price falling below the Ichimoku cloud. The first signal for the end of the bullish wave was when the sellers crossed below the rising channel in the 4-hour chart.

Consequently, the decline eased at the 78.6% Fibonacci support.

So far, we have gathered valuable data from the daily and 4-hour charts. We conclude that the USDCZK pair has erratic moves, and trading the pair seems risky since it constantly changes direction. The technical indicators in the 4-hour chart provide mixed signals. The price is below the Ichimoku cloud, a sign of a bearish trend.

However, our momentum indicators are at a level of uncertainty. The Awesome Oscillator bars have narrowed down, and the RSI indicator has been clinging to the middle line for almost a week now.

Final Thoughts

In conclusion, the market trend is bearish as long as the pair hovers below the Ichimoku cloud. This resistance area has further support from the 38.2% Fibonacci level. In this scenario, we expect the USDCZK price to experience a decline to its recent lows, which are located around the 78.6% level. This support area is in conjunction with the bearish channel.

Conversely, the bearish technical analysis should be invalidated if the USDCZK price exceeds the cloud.

Please note that the more you trade, the more you expose yourself to risk. Therefore, it’s wise to understand market behavior before it’s too late. This approach helps manage risks and prevent significant losses. I aim to guide you in avoiding common mistakes when trading forex and other CFD products.

Recently, the USDCZK has surprised investors. In such situations, a forex trader’s best move is to hedge their positions or shift to a more stable trading instrument. Adopting this strategy can help you sidestep errors, and hundreds of trading products are available. Remember, mistakes in Forex often lead to financial loss. So, be cautious and gather as much data as possible before entering the market.

I wish you all happy and successful trading.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.