GBPCAD Forecast – Inverted Hammers Signal Downtrend

In today’s comprehensive GBPCAD forecast, we will first examine Canada’s current economic conditions. Then, we will meticulously delve into the details of the technical analysis of the GBPCAD pair.

Canadian Stock Market’s Winning Streak Ends

Bloomberg—The S&P/TSX Composite index concluded Monday’s trading session with a slight dip of 0.4%, settling at 19,743. This minor setback came from a nearly 6% rally last week. The rise in Treasury yields dampened rate-sensitive stocks, causing investors to reevaluate key commodity markets crucial to Canada’s economy and the future direction of the Fed’s and BoC’s policy rates.

Tech firms were among the hardest hit, with Shopify’s shares experiencing a 1.7% drop. The banking sector also saw a reversal in fortunes, ending its winning streak from the previous week as Canadian government bonds made modest gains.

Energy companies didn’t fare much better, closing the day in negative territory. Despite an uptick in crude oil prices, Canadian Natural Resources and Cenovus Energy saw their shares drop by 0.7% and 1.5%, respectively. The mining sector also hit, with Barrick Gold’s shares falling 0.8%, in line with a decrease in bullion prices.

On a positive note, the Ivey PMI figures indicate that Canada’s business activity continues to expand. This suggests that the overall economic outlook remains positive despite the day’s losses.

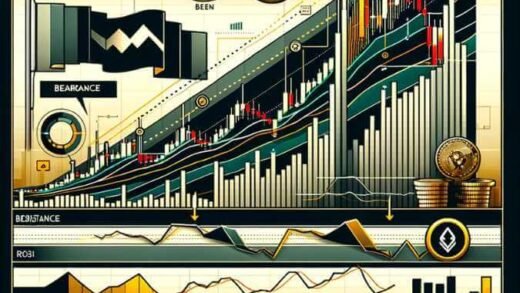

GBPCAD Forecast – Inverted Hammers Signal Downtrend

GBPCAD Forecast – Inverted Hammers Signal Downtrend – 4H Chart

The GBPCAD currency pair is navigating a bullish channel on the 4-hour chart. In the most recent trading session, the chart exhibited two inverted hammers, often interpreted as a sign of a potential slowdown in the uptrend. This could indicate that the GBPCAD bears are gearing up to drive the price down towards the S1 support level at 1.68.

Stay tuned for more updates on the GBPCAD forecast.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.