FxNews—In today’s comprehensive GBPNZD forecast, we will first scrutinize New Zealand’s current economic conditions. Then, we will meticulously delve into the details of the technical analysis pertaining to the GBPNZD pair.

Kiwi Dollar’s Downward Trend Continues

Bloomberg—The New Zealand dollar declined for the second consecutive day on Tuesday, hovering around $0.59. This retreat comes after reaching a two-week high last week. The ongoing concern is that the Reserve Bank of New Zealand (RBNZ) may not implement further rate hikes in its final monetary policy meeting of the year.

In October, the RBNZ held the cash rates steady at 5.5% for the third consecutive meeting, as inflation showed signs of slowing down in the third quarter of 2023. Meanwhile, New Zealand’s unemployment rate in the September quarter reached a high of 3.9%, unseen in over two years. Employment decreased, and wage growth was lower than expected.

China, a major trading partner, displayed an uneven recovery in its October trade figures. Overseas sales declined for the sixth month in a row, while purchases increased for the first time since February. Upcoming Chinese inflation data this week will shed light on the persistent deflationary pressure and weak domestic demand.

GBPNZD Forecast and Technical Analysis

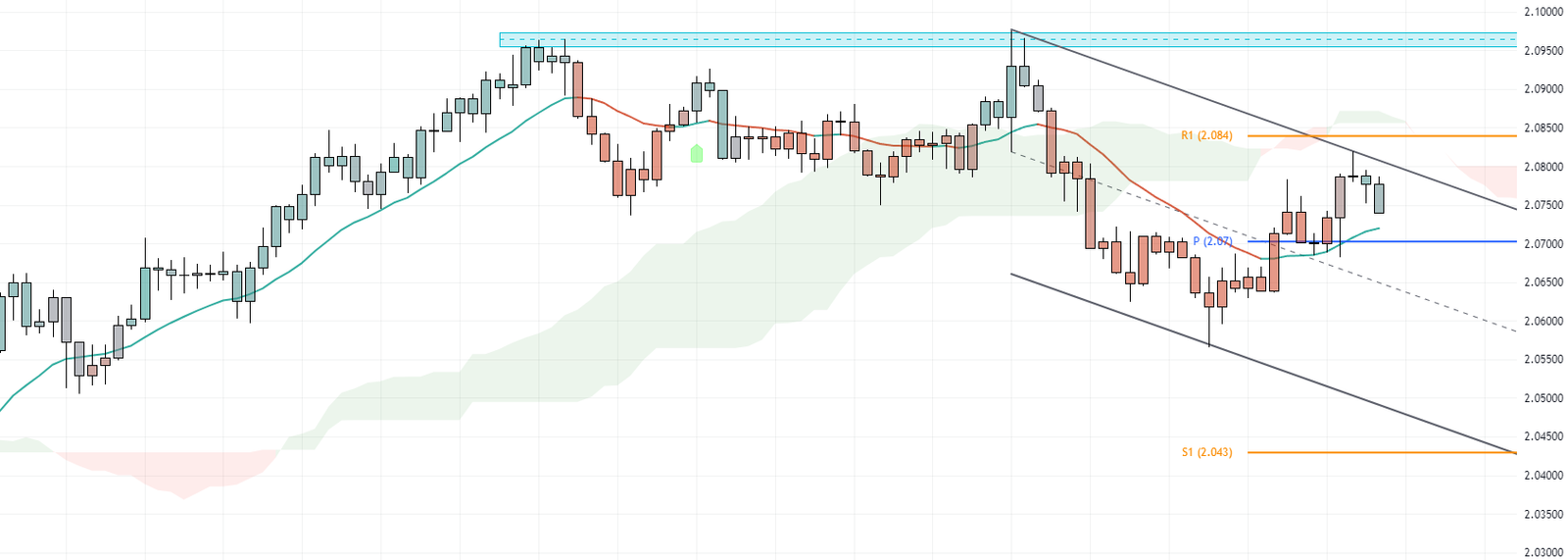

GBPNZD bulls are currently challenging the upper boundary of the bearish channel. This level aligns with the Ichimoku cloud, presenting a formidable obstacle for the GBPNZD bulls to surmount. The trend will stay bearish as long as the price remains within the bearish channel.

Should the GBPNZD bulls break out of the bearish channel, the next resistance stands at 2.1. Despite this, the overall trend leans towards the bearish side. We need to delve into the 4H chart to identify triggers for this bearish trend. In today’s trading session, the pair has formed a long-wick candlestick pattern near R1 (2.08 resistance). If the pair dips below the Kernel line of the Lorentzian Classification indicator, the downtrend will persist, with bears aiming for the lower boundary of the bearish channel.