FxNews—The American dollar is in a downtrend against the Norwegian Krone, testing the June 6 low at 10.43. This development in the USD/NOK price resulted in the Awesome oscillator forming a divergence signal in the daily chart, meaning the trend can potentially reverse or consolidate near the upper resistance levels.

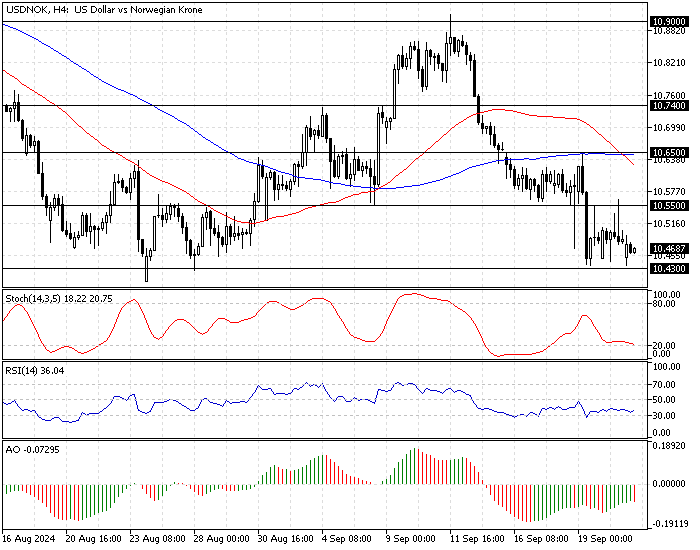

As of this writing, the currency pair in discussion trades at approximately 10.46. The daily chart below demonstrates the price, support, resistance levels, and technical indicators used in today’s analysis.

USDNOK Forecast – 23-September-2024

The immediate resistance at 10.43 keeps the USD/NOK from declining further. The Awesome oscillator divergence is also evident in the 4-hour chart, signifying that the currency pair’s price can rise.

From a technical perspective, USD/NOK can grow higher and initially retest the 10.55 resistance (September 17 High) if 10.43 holds firmly. Furthermore, the rise could extend to 10.65 (September 19 High) if the bulls pull the price above the 10.55 mark.

Please note that the primary trend is bearish because the USD/NOK price is below the 50- and 100-period simple moving averages. The trend should be invalidated if the pair crosses above the 100-period SMA at 10.65.

- Also read: USD/MXN Forecast – 20-September-2024

USDNOK Bearish Scenario – 23-September-2024

The immediate support is at 10.43. If the bears (sellers) push the price below 10.43, the downtrend could be triggered. If this scenario unfolds, the downtrend resumes and the next bearish target will likely be 10.23.

USDNOK Support and Resistance Levels – 23-September-2024

Traders and investors should closely monitor the below USD/NOK key levels to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 10.43 / 10.23

- Resistance: 10.55 / 10.65 / 10.74

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.