In August 2024, Germany’s industrial production significantly increased by 2.9% compared to the previous month. This growth exceeded expectations, as analysts had predicted a modest 0.8% increase.

The recovery comes after a challenging period in July when production dipped by an adjusted 2.9%. This surge marks the most rapid expansion since October 2021, illustrating a robust turnaround in the sector.

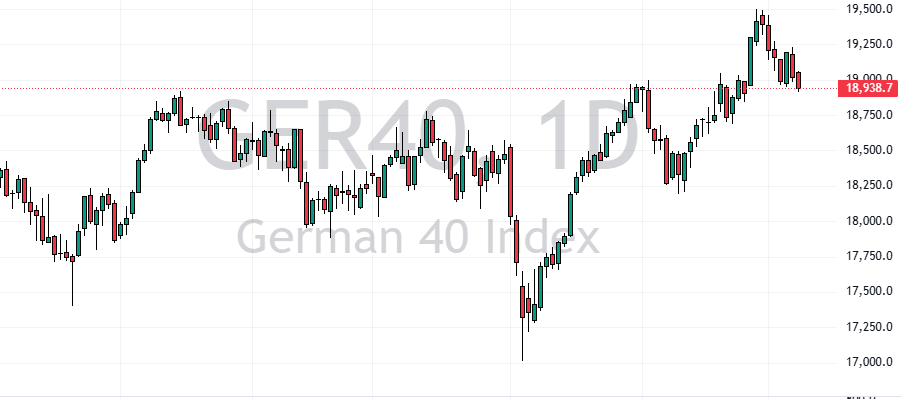

The daily chart below shows the GER40 index is in an uptrend, trading at approximately EUR 18,938.

Automotive Industry Drives Recovery

The automotive sector significantly contributed to this growth, which saw a dramatic turnaround, particularly in producing motor vehicles, trailers, and semi-trailers. These segments soared by 19.3%, a sharp recovery from an 8.2% contraction previously.

Gains in other areas also supported the production landscape. Capital goods production climbed by 6.9%, demonstrating strong demand and investment in equipment and machinery.

Meanwhile, intermediate goods production saw a marginal increase of 0.1%. Consumer goods production remained steady, showing stability in this segment.

Additionally, there were positive movements in energy production and construction activities, which advanced by 2.3% and 0.3%, respectively.

A Closer Look at Recent Trends

Despite the positive monthly data, the three-month outlook from June to August 2024 shows a 1.3% contraction in industrial production compared to the prior quarter, suggesting some underlying volatility.

On an annual basis, industrial output in August decreased by 2.7%, an improvement over the 5.6% year-over-year decline in July. This indicates that the sector is moving towards a more stable footing while challenges remain.

Final Word

By analyzing these developments, it’s clear that while the German industrial sector faces some fluctuations, the strong recovery in critical areas like automotive production and capital goods provides a hopeful outlook for the future. This resilience underscores the industry’s dynamic nature and capacity to rebound from downturns.