Discover the latest EURUSD analysis with our expert insights. We regularly update our EURUSD technical analysis, shedding light on the trend direction and technical indicators. Ultimately, we provide a detailed EURUSD forecast based on recent economic data.

So, if you are a fan of trading currency pairs, stay with us and bookmark this page to make informed trading decisions.

EURUSD Live Chart

The EUR/USD live chart below is from TradingView, a reliable source and platform endorsed by traders and investors worldwide. I featured the chart with my favorite indicators, which I utilize in almost all of my technical analyses.

EURUSD Analysis: Bullish Market Above $1.034

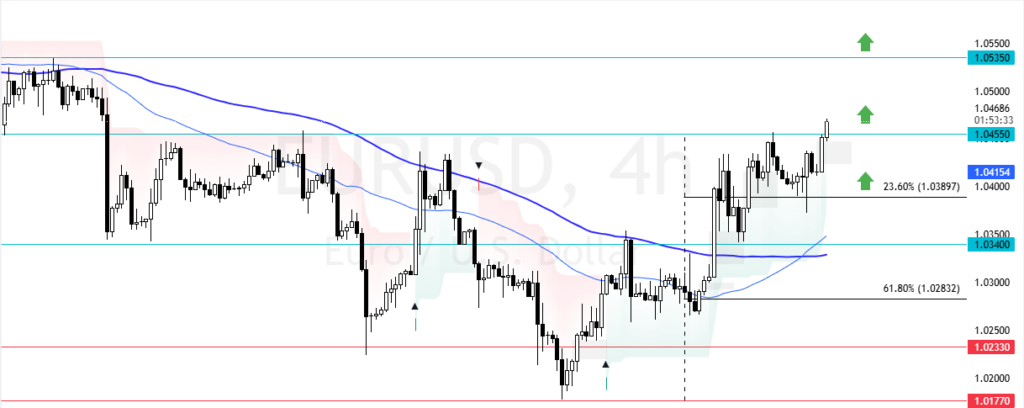

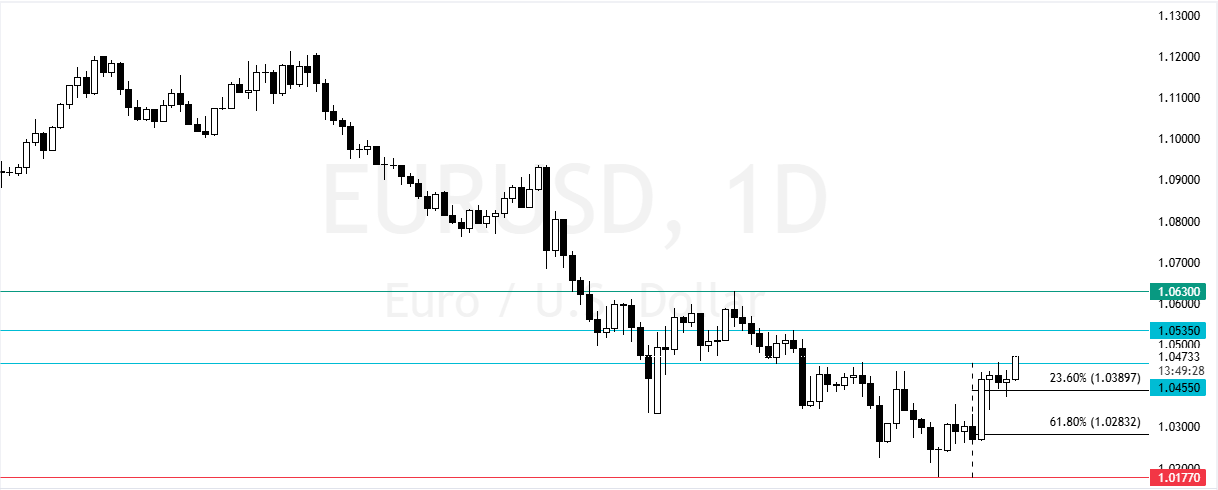

FxNews—The European currency (euro) is in a bull market against the greenback (Dollar), trading above the 50- and 100-period simple moving averages in the 4-hour chart. The pullback from $1.0177 resulted in the prices shifting above the 100-period SMA, making the primary trend bullish.

As of this writing, EUR/USD is testing the $1.0455 resistance, resuming its bullish trajectory.

EURUSD Technical Analysis: What Do Indicators Reveal?

- The price is above the 50- and 100-period simple moving average, indicating a bull market.

- The RSI 14 value is 65.0, meaning the market is not overbought, so the uptrend can potentially resume.

- The Stochastic Oscillator value is rising, recording 73 in the description. This is a hint that the bull market is strengthened.

- The Awesome Oscillator histogram is green, above zero, interpreted as the uptrend should prevail.

Overall, the technical indicators suggest that the primary trend is bullish, and should resume.

EURUSD Forecast: The Bullish Scenario

The immediate support is at $1.0389, backed by the 23.6% Fibonacci level. From a technical perspective, the uptrend could extend to higher resistance levels if EUR/USD holds above $1.0389.

In this scenario, the next bullish target could be $1.0535. Furthermore, if the buying pressure pushes the price above $1.0535, it could aim for the $1.063 resistance. Please note that the bullish outlook should be invalidated if the prices fall below $1.038.

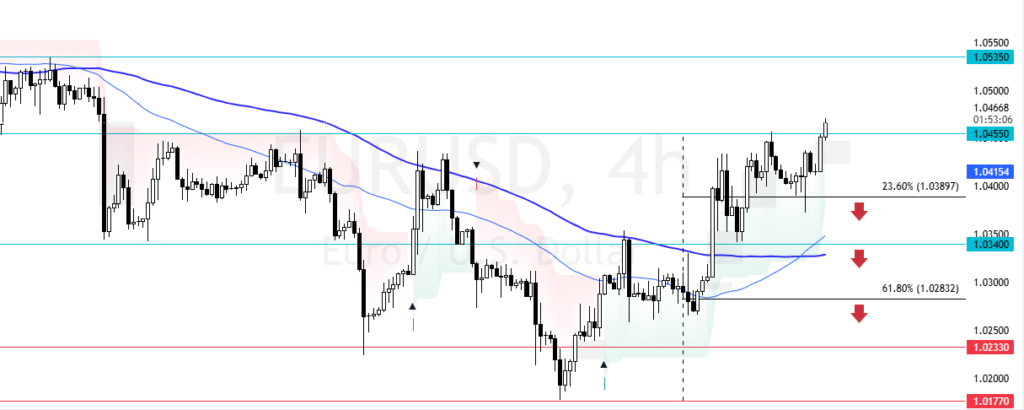

The Bearish Scenario

The immediate support is at $1.0389, backed by the 23.6% Fibonacci support level. On a technical front, the euro’s uptrend could be paused if it falls toward lower support levels if the bears close and stabilizes below $1.0389.

If this scenario unfolds, the next bearish target could be the $1.034 support, backed by the 100-period SMA in the 4-hour chart. Furthermore, if the selling pressure pushes the prices below $1.034, the 61.8% Fibonacci support level at $1.0282 would be the next bearish milestone.

EURUSD Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

| EURUSD Support and Resistance Levels | |||

|---|---|---|---|

| Support | 1.0389 | 1.034 | 1.0283 |

| Resistance | 1.0455 | 1.0535 | 1.0630 |

FAQ

What is EUR/USD?

It is one of the most popular currency pairs in the Forex market and has the highest trading volume. It represents the exchange rate between the Euro and the United States dollar. The price of EURUSD represents how many U.S. Dollars one Euro can buy.

How is the exchange rate determined?

The exchange rate is determined by the supply and demand in the Forex market, which depends on several factors, such as economic data, central bank interest rates, political events, and market sentiment.

Why is this Currency pair Important?

This currency pair is important in Forex trading because it represents two big economies: the Eurozone and the United States. The price of EURUSD also affects global trade and worldwide financial stability.

What is the Role of Central Banks?

The ECB (European Central Bank) and FED (Federal Reserve) impact exchange rates through monetary policies, such as interest rate decisions. Any change in interest rates can significantly affect EUR/USD prices.

How to Trade Euro vs Dollar?

You need a Forex broker to trade the pair, or you can visit a local exchange office or bank to convert one currency to another. Depending on the provider for converting your currencies, they will charge a small fee.

What are the risks of trading EURUSD?

Political decisions, economic indicators, supply, and demand generally influence prices. Therefore, the EURUSD market can sometimes be volatile.

Before approaching the market, you must learn about trading by completing courses, reading articles, and constantly monitoring economic news. That said, you also need to build a solid technical strategy for triggering and managing your orders.

Can geopolitical events impact the EUR/USD exchange rate?

Yes, geopolitical events such as recessions, increases or decreases in interest rates, wars, hurricanes, and earthquakes can impact prices. Hence, traders and investors should learn risk management to avoid significant losses.