In this BTCUSD analysis, we delve into the significant news and events that could potentially influence the price of Bitcoin.

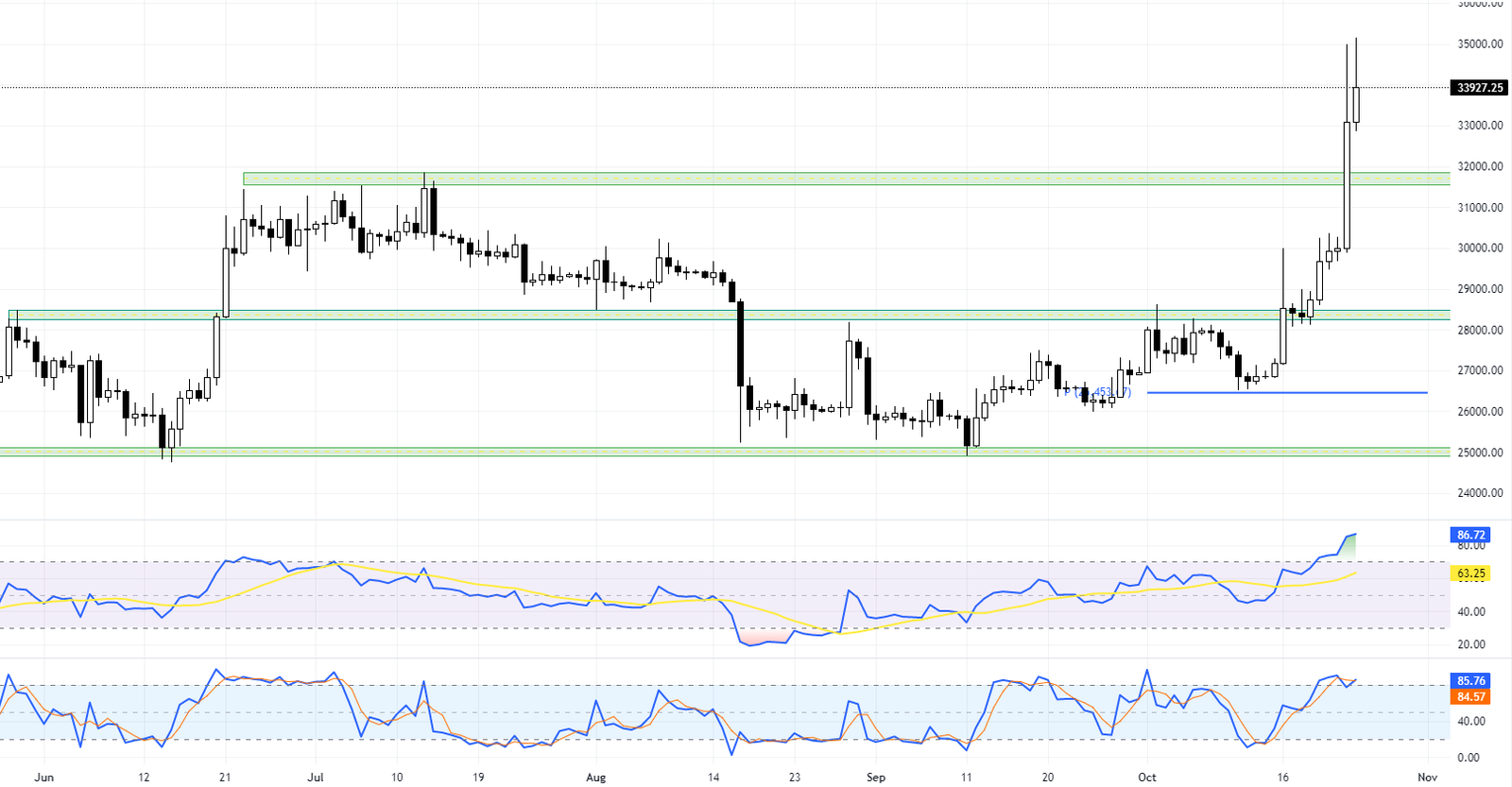

Bitcoin’s price has again caught everyone’s attention, crossing the $33,000 mark. This has made people wonder if another big wave is coming in the digital currency world.

Market Shake-up

Some experts believe that the market might experience a major change soon. This belief is strengthened by a billionaire’s decision to increase his gold and Bitcoin holdings due to concerns about a possible drop in the value of the US dollar.

The excitement grew even more when a false news report claimed that the US Securities and Exchange Commission (SEC) had approved a Bitcoin ETF. This caused a rush in the market, affecting even stable digital currencies like Ethereum and XRP. If the US adopts a Bitcoin spot ETF, it could add a massive $1 trillion to the crypto market’s value.

Anticipation for Bitcoin Halving Event

As we approach the much-talked-about Bitcoin halving event, people worldwide who trade, invest in, or are just interested in crypto are waiting to see what will happen in the market.

Grayscale Verdict and SEC Review

The US Court has ordered Grayscale Verdict, paving the way for the SEC’s review of a Bitcoin Spot ETF. This is a significant step forward. The US Court of Appeals has instructed the SEC to reconsider Grayscale Investments’ request for a Bitcoin spot exchange-traded fund (ETF). This order comes from an Oct 23 document in the US Court of Appeals for the District of Columbia Circuit. It follows the SEC’s decision not to contest the court’s initial ruling on Aug 29.

The Oct 23 order supports the court’s Aug 29 decision and gives Grayscale another chance to turn its Grayscale Bitcoin Trust into a Bitcoin ETF on the market. The SEC has consistently denied approval for spot crypto ETFs on US exchanges. However, it has approved investments linked to Bitcoin and Ether futures.

Grayscale’s Position Strengthened

On Oct 19, Grayscale strengthened its position by submitting a registration statement to the SEC. The company hopes to list its Bitcoin trust shares on the New York Stock Exchange Arca under the GBTC ticker. Other major companies, including BlackRock, ARK Investment, and Valkyrie, have similar spot crypto ETF applications awaiting SEC approval.

Potential Impact on Bitcoin Price

This development could potentially boost Bitcoin’s price. If Grayscale’s application is approved, it could indicate increased institution acceptance. This would increase liquidity and confidence in the crypto market.

Moreover, as major companies like BlackRock and ARK Investment wait for decisions on their applications, anticipation and speculation could also cause short-term price changes.