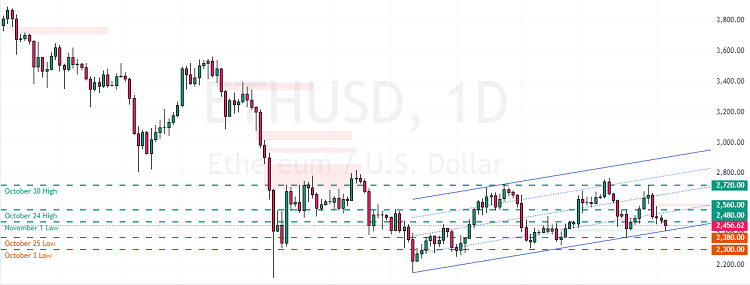

FxNews—Ethereum trades in a bear market and tested the ascending trendline as support in today’s trading session. As of this writing, the Ethereum price is experiencing a pullback from the trendline, trading at approximately $2,450.

The daily price chart below demonstrates the price, support, and resistance levels and technical indicators utilized in today’s analysis.

Ethereum Technical Analysis – 3-October-2024

Robust selling pressure began on October 30, causing the Stochastic Oscillator to enter oversold territory. Additionally, the Awesome Oscillator’s histogram is red, below the signal line, meaning the bear market should prevail.

Overall, the technical indicators suggest that while the primary trend is bearish, the downtrend could resume after a minor consolidation, or the trend has the potential to reverse from this point.

Ethereum Price Forecast – 3-October-2024

The immediate resistance rests at $2,480, backed by the Fair Value Gap area. From a technical standpoint, the bearish outlook remains valid as long as ETH/USD is below the $2,480 mark.

Furthermore, a new downtrend will likely be triggered if Ethereum falls below the $2,380 immediate support, the October 25 low. In this scenario, the next bearish target could be $2,300, the October 3 low.

Bullish Scenario

Conversely, if bulls pull ETH/USD above the $2,480 resistance, today’s bounce will likely extend to the next resistance level. If this scenario unfolds, the next bullish target could be the October 24 high at $2,560.

Ethereum Support and Resistance Levels – 3-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 2,380 / 2,300

- Resistance: 2,480 / 2,560