In today’s comprehensive EURCHF forecast, we will first examine the current economic conditions in Switzerland. Then, we will meticulously delve into the details of the EURCHF pair’s technical analysis.

Dip in Swiss Confidence

Bloomberg—As the year winds down, Switzerland’s consumer sentiment has dipped to its lowest. The latest figures reveal a decline to -40 this quarter, a notable drop from the -27 recorded previously. This number starkly contrasts the long-term average of -6 and is the lowest since the end of the previous year. This downtrend underscores growing worries among consumers about their financial prospects and the broader economic outlook.

The statistics reflect a significant drop in optimism for economic progress, with the expected economic development index plummeting to -37.3 from -6.8 in the third quarter. The outlook for personal financial situations has similarly darkened, sliding to -37.8 from -25.0.

Additionally, reflections on past financial situations fell sharply to -50.9 from -38.2. In a slightly more positive light, attitudes towards making major purchases have improved somewhat, with the index moving to a less damaging -33.8 from the previous -38.0. This subtle shift slightly eases consumers’ reluctance to engage in larger investments.

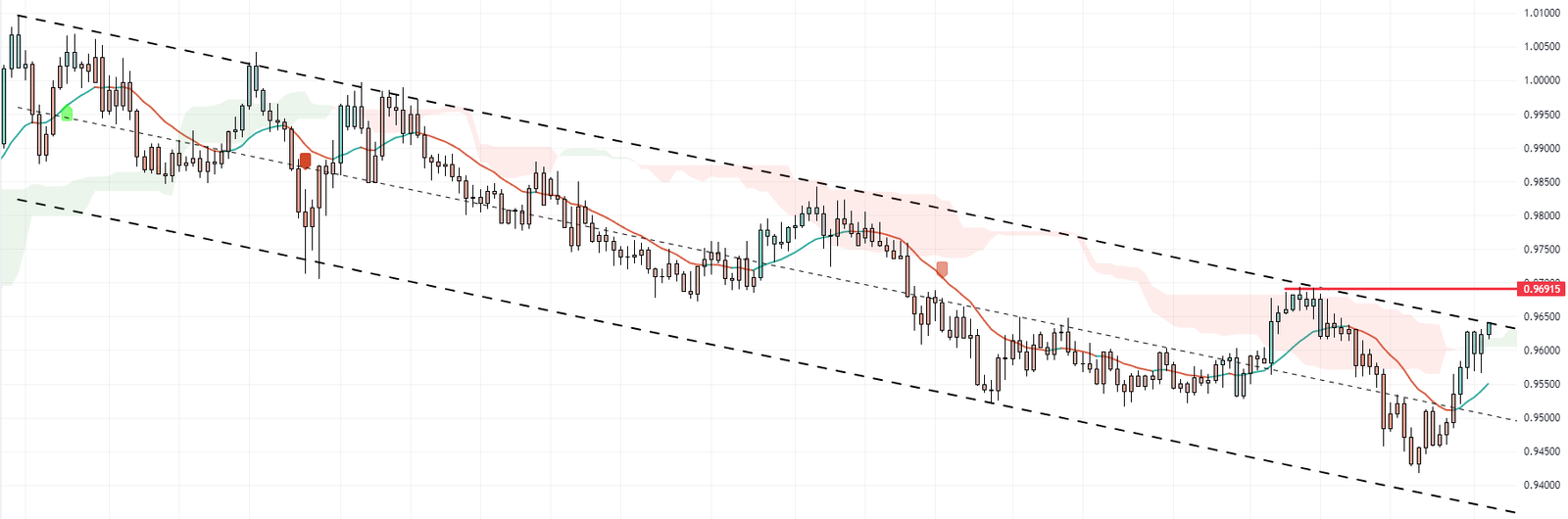

EURCHF Forecast: Navigating the Bearish Channel

The EURCHF pair is currently navigating a bearish channel, with EURCHF bulls challenging the upper line of this channel, a formidable resistance. This bearish channel has remained unbroken since January 2023. Given the influence of this channel, we recommend exploring selling opportunities.

Please note that even if the price surpasses the bearish channel, it must settle above the horizontal resistance at 0.9691 to negate the bearish sentiment on the currency pair.

For a more detailed view, let’s zoom into the 4H chart for a comprehensive EURCHF forecast. The bullish bias prevails in the 4H chart; however, the RSI indicator shows divergence, which is a signal for a trend reversal or price correction. Considering the EURNZD price in the daily chart, it is suggested to wait for the pair to close below the Kernel. If the price closes below the Kernel line, it is likely that the pair will continue its main bearish trend.

0.9691 plays the main resistance for the bearish scenario. The bulls must close above this level to invalidate the bearish scenario.