In today’s comprehensive EURSEK forecast, we will first examine the current economic conditions in Sweden. Then, we will meticulously delve into the details of the EURSEK pair’s technical analysis.

Persistent Contraction in Sweden’s Service Sector

Bloomberg—In October 2023, Sweden’s Services PMI experienced a slight increase, moving from a slightly adjusted 46.1 in the previous month to 48.5. Despite this, the sector remained in a contraction phase for the third consecutive month. Positive changes were observed in new orders and business volumes, with indices rising from their September values to 47.1 and 47.2, respectively. However, both indexes remained below the neutral 50 mark, indicating continued contraction.

On the other hand, the employment sub-index continued its growth trend, reaching 55.9, the highest level since January. Conversely, delivery times experienced a further decline, dropping to 45.2 from 46.1 in September.

Inflationary Pressures

Regarding pricing, input costs increased to 59.2 from 58.8, a significant rise compared to the industry’s falling prices. Jörgen Kennemar, a PMI analyst at Swedbank, commented on the situation, stating that the service sector in Sweden has shown resilience despite the decline in PMI services compared to previous economic downturns. However, he added that the bottom of the contraction phase is yet to be seen.

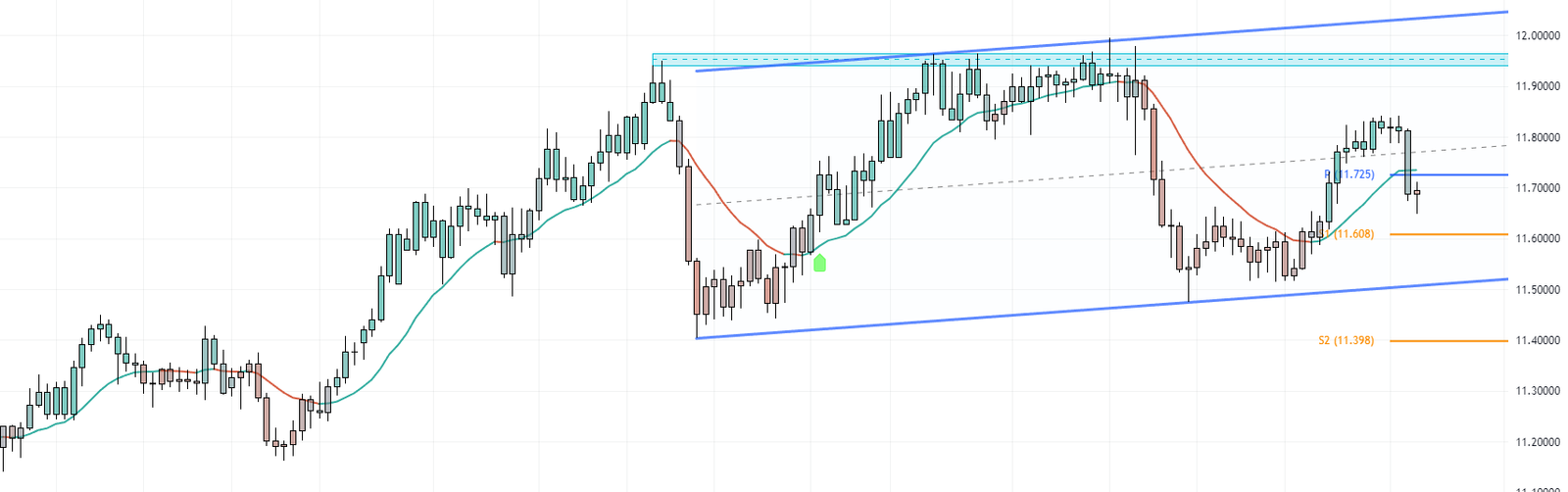

EURSEK Price Forecast – Potential Downtrend Ahead

The EURSEK pair closed below the pivot point on Friday and beneath the Kernel line. This suggests a potential continuation of the price decline for EURSEK. The immediate target is the S1 support level at 11.6, followed by the lower line of the existing bullish channel. Stay tuned for more updates on the EURSEK forecast and potential trading opportunities.