The Euro has fallen below $1.06, reaching its lowest point since October 2023. This drop is largely due to a strong U.S. dollar following Donald Trump’s victory in the U.S. presidential election. Investors are concerned because Trump has suggested imposing trade tariffs, which could harm European exports—especially in the automobile industry.

U.S. Threatens Eurozone Over Trade Imbalances

Moreover, Trump warned that the eurozone would “pay a big price” for not buying enough American goods. This statement has heightened fears of a potential trade conflict between the U.S. and Europe.

In addition to these worries, the Euro is under pressure from political uncertainty in Germany. After Chancellor Olaf Scholz’s governing coalition collapsed, snap elections are scheduled for February 23. This upcoming election adds another layer of unpredictability to the situation.

Anticipate Minor ECB Rate Cut This December

Meanwhile, financial markets have adjusted their expectations about the European Central Bank’s interest rate decisions. They anticipate a 25 basis point cut in December, with lower chances of a larger reduction.

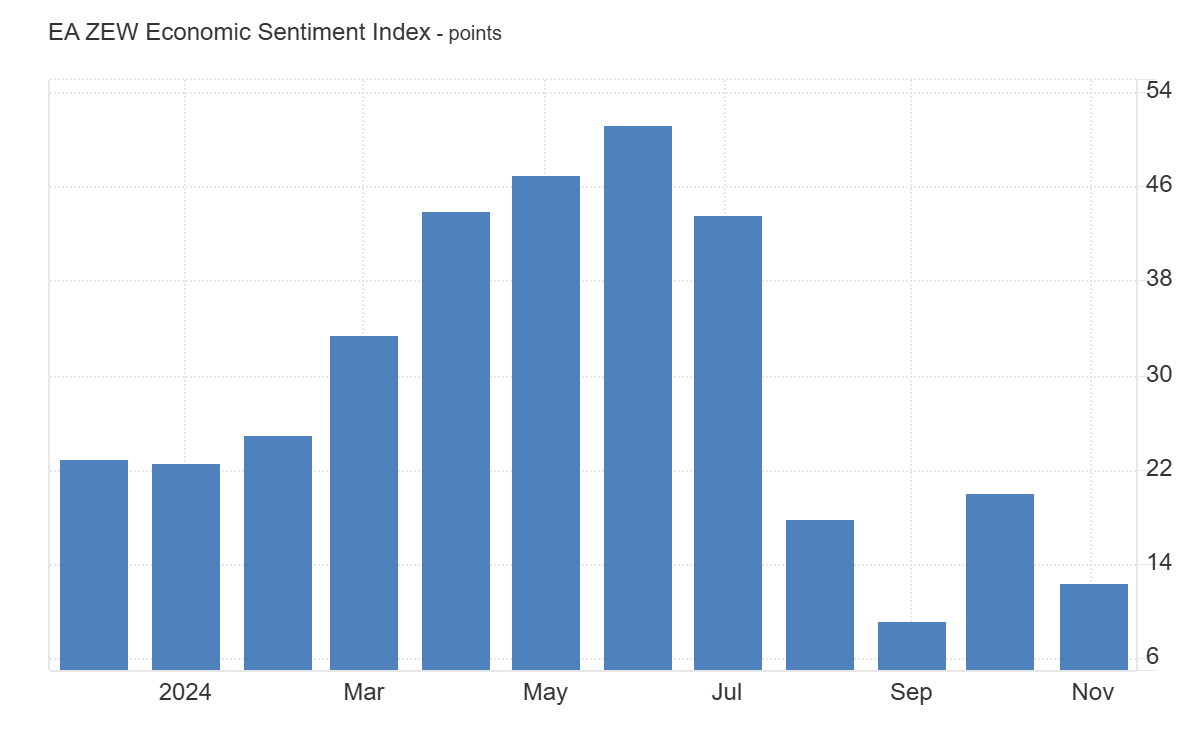

Germany’s ZEW Sentiment Plunges Below Forecasts

On the economic data front, Germany’s ZEW Indicator of Economic Sentiment dropped more than expected. It decreased to 7.4 in November from 13.1 in October, while experts had predicted a figure of 13. This decline suggests that confidence in Germany’s economic outlook is waning.

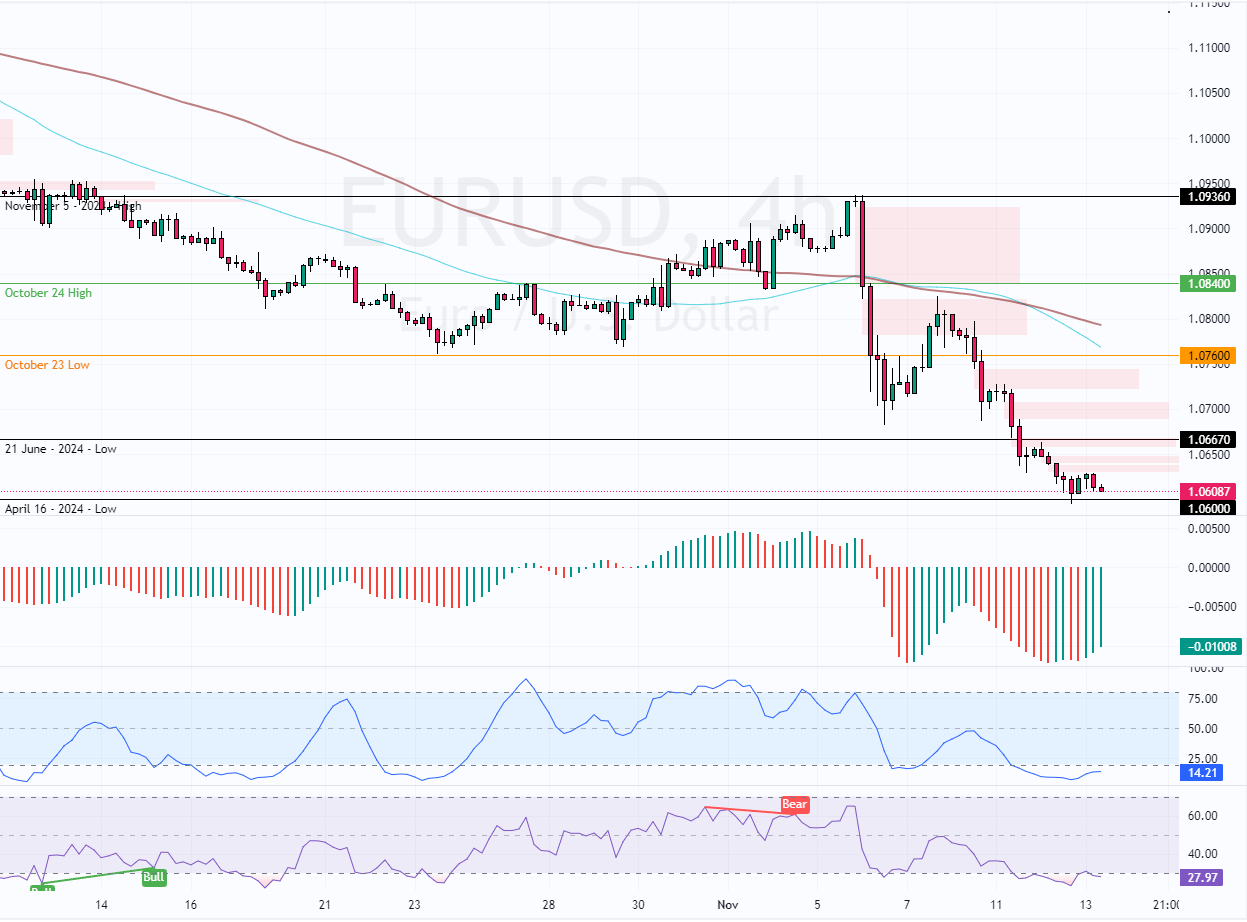

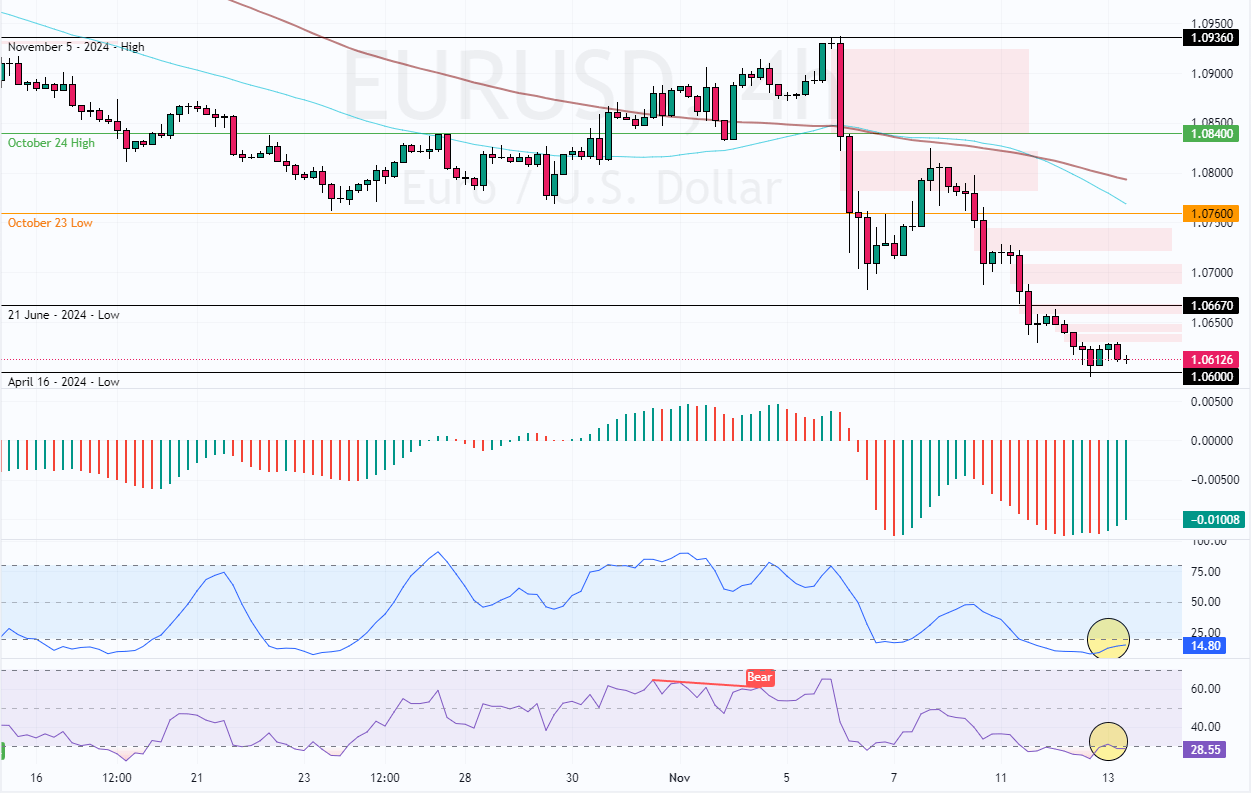

EURUSD Technical Analysis – 13-November-2024

The currency pair is oversold, trading at approximately $1.061 as of this writing. As for the technical indicators, the Stochastic and RSI hover in the oversold territory, depicting 14 and 28 in the description. This means the EUR/USD is extremely oversold, and market participants expect a consolidation phase before the downtrend resumes.

The immediate resistance is at $1.066. A new consolidation phase would emerge if EUR/USD closes and stabilizes above this resistance. In this scenario, the Euro will likely be able to erase some of its recent losses by aiming toward 1.076 (October 23 Low).

Final Word

Please note that EUR/USD is oversold; therefore, joining the bear market at this price is not advisable. Traders and investors should wait patiently for the market to stabilize near 1.076, monitoring that ceiling for bearish signals, such as candlestick patterns.