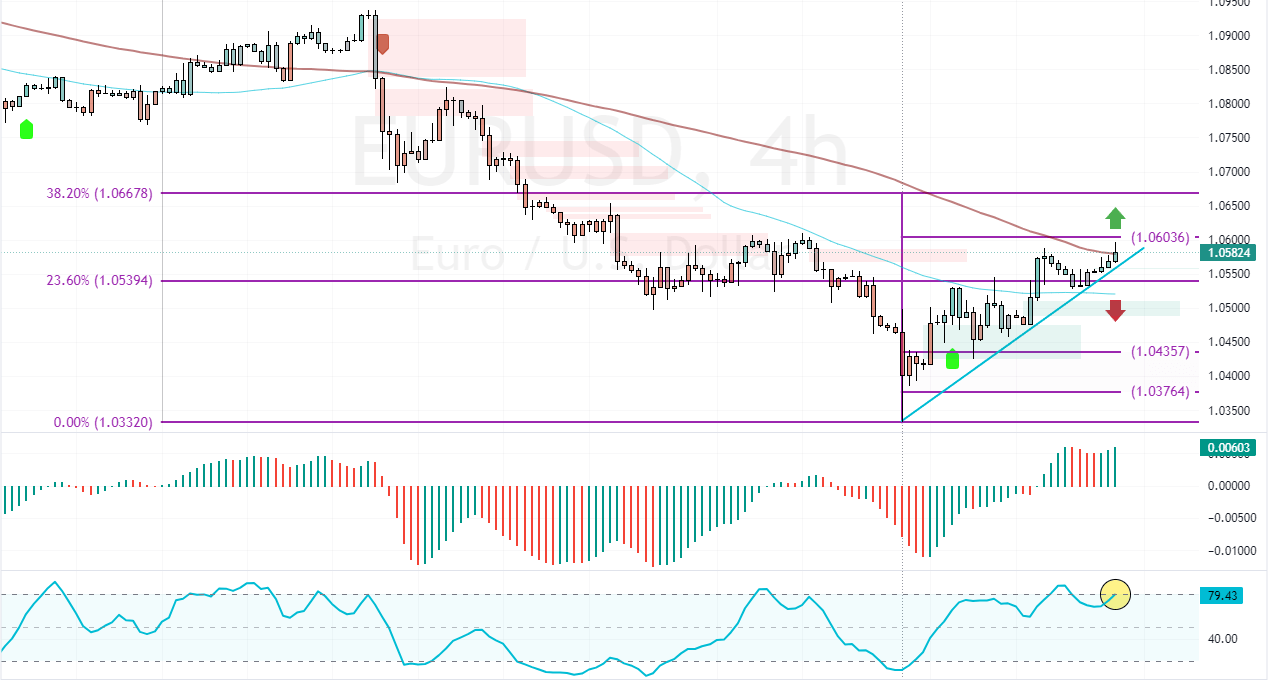

FxNews—The EUR/USD resumed its bullish momentum from $1.033, testing the 100-period simple moving average in the 4-hour chart. The buying pressure that began on November 22 resulted in the Stochastic Oscillator hinting at an overbought market.

Therefore, the market expects a consolidation phase or a trend reversal.

As of this writing, the currency pair trades at approximately $1.059, testing the 1.06 immediate resistance. However, the EUR/USD trend outlook remains bearish as long as the prices are below the 38.2% Fibonacci retracement level at $1.066.

EURUSD Forecast – 29-November-2024

That said, a new bearish trend could emerge if bears push the prices below the 23.6% Fibonacci at 1.053. In this scenario, EUR/USD will likely initiate a new bearish wave, targeting $1.043 followed by $1.037.

On the other hand, if bulls push the price above the immediate resistance ($1.060), the current bullish force could clear the patch for EUR/USD to test the $1.066 critical resistance.