FxNews—The Euro has fallen to its lowest value in two months, trading around $1.09. This drop is mainly due to the strong performance of the U.S. dollar, which is being influenced by expectations that the Federal Reserve will slow down in reducing borrowing costs.

ECB’s Anticipated Rate Cut

Next week, the European Central Bank (ECB) will likely decrease its deposit rate by 0.25%. This follows previous reductions in September and June. Market participants expect the ECB to continue this trend, reducing rates by 0.25% at each meeting until March.

The inflation rate in the Eurozone has decreased to 1.8% as of September 2024, marking the lowest rate since April 2021. This significant drop highlights a slowing in price increases across the region.

EURUSD Technical Analysis – 14-October-2024

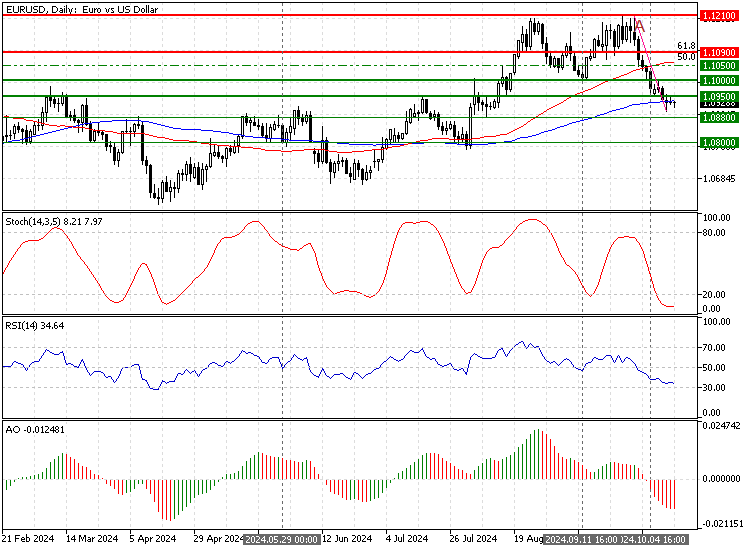

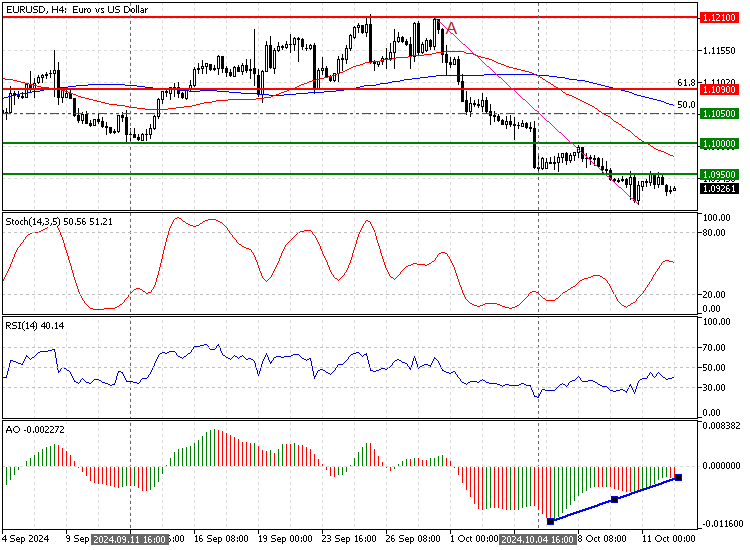

The euro trades bearishly against the U.S. dollar, below the 50- and 100-period simple moving averages. Last week, the currency pair tested the October 4 low at $1.095, trading at approximately 1.092 as of this writing.

As for the technical indicators, the Awesome oscillator signals divergence, which is interpreted as a trend that has the potential to step into a consolidation phase or reverse.

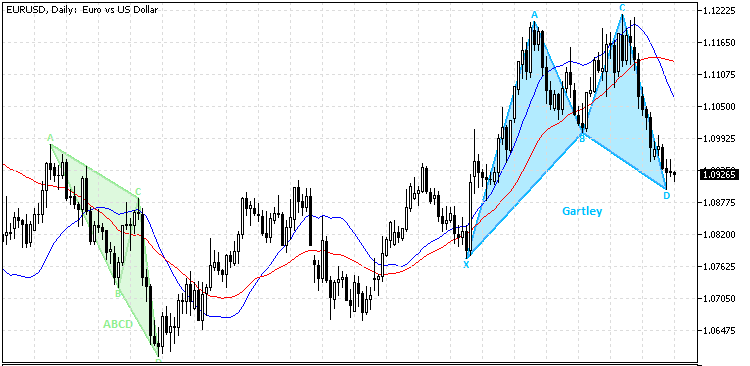

Furthermore, the EUR/USD daily chart formed a bullish ‘Gartley’ pattern, meaning the trend could reverse from a bear market to a bull market.

Overall, the technical indicators and the harmonic pattern suggest the primary trend is bearish, but the EUR/USD pair can potentially reverse or consolidate.

EURUSD Forecast – 14-October-2024

Due to Awesome Oscillator’s divergence signal, it is not advisable to join the bear market. Hence, traders and investors should wait patiently for the EUR/USD price to consolidate near the upper resistance levels.

That being said, the immediate resistance is at $1.095. If bulls (buyers) close and stabilize the EUR/USD price above the immediate resistance, the market will likely consolidate near the September 11 low at approximately $1.10.

It is worth mentioning that before executing a sell order, traders and investors should monitor this level for bearish signals, such as a bearish engulfing pattern or a long-wick bearish candlestick pattern.

EURUSD Support and Resistance Levels – 14-October

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $1.088 / $1.08

- Resistance: $1.095 / $1.10