There are numerous terms and mechanisms that traders must familiarize themselves with. One term often misunderstood yet pivotal is the ‘forex swap.’ This article aims to demystify the concept of forex swaps, ensuring that even those new to the trading world can grasp its significance. Let’s dive deep into this captivating subject, and along the way, we’ll pepper in some illustrative examples to enhance clarity.

What is a Forex Swap?

At its core, a forex swap is a simultaneous purchase and sale of identical amounts of one currency for another with two different value dates. It can be viewed as an interest differential between two currencies expressed over a specified period.

The Mechanics Behind Forex Swaps

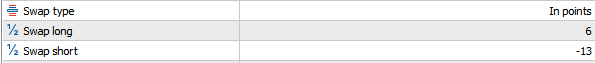

Imagine you’re a trader who has taken a position in a currency pair, expecting it to rise. However, you don’t plan to close your position at the end of the trading day. Here’s where the forex swap comes into play. Your broker will ‘swap’ your position to the next trading day, ensuring you can keep your trade open. This process involves a small interest fee, which can either be credited to or debited from your account, depending on the interest rate differential between the two currencies in the pair.

Example: Let’s say you’re trading the EUR/USD pair. Suppose the European Central Bank’s interest rate is higher than the Federal Reserve’s, and you hold a long position (buying Euros and selling Dollars). In that case, you might receive an interest payment. Conversely, if the rates were reversed, you might have to pay interest.

The Dual Nature of Forex Swaps

Forex swaps can be both beneficial and costly for traders:

- Beneficial: Traders can earn rollover interest (also known as “carry”) if they’re in a position that has a higher interest rate than the opposing currency.

- Costly: Conversely, if traders are in a position where their currency has a lower interest rate than the opposing currency, they’ll have to pay the interest differential.

Why are Forex Swaps Important?

Forex swaps play a pivotal role in the forex market for several reasons:

- Liquidity: They provide liquidity, ensuring that traders keep positions open beyond the trading day.

- Risk Management: Swaps can be used as a hedging tool, allowing businesses to manage their foreign exchange risk.

- Profit Opportunities: Forex swaps can be a source of profit for those who understand the interest rate differentials between currencies.

The Broader Implications of Forex Swap

Beyond individual traders, forex swaps have broader implications in the global financial system. Central banks, for instance, use forex swaps as a monetary policy tool. By engaging in these swaps, they can influence currency values and interest rates, thereby impacting global trade and economics.

Key Takeaways

- Forex swaps are a fundamental aspect of the forex trading world, allowing traders to roll over positions to the next trading day.

- They involve an interest fee, which can be a credit or a debit, based on the interest rate differential of the currencies involved.

- Understanding forex swaps can provide traders with additional profit opportunities and risk management tools.

In conclusion, the world of forex trading is vast and multifaceted, with forex swaps being a cornerstone of this dynamic environment. By understanding its mechanics and implications, traders can navigate the forex market with greater confidence and understanding. Whether you’re a seasoned trader or just starting out, grasping the concept of forex swaps is crucial for a successful trading journey.