Governor Kazuo Ueda of the Bank of Japan announced that the central bank will closely watch the yen’s exchange rate against major currencies. He stated that once Donald Trump, the incoming U.S. president, provides more details about his policies, the Bank of Japan will include their potential effects in its economic projections.

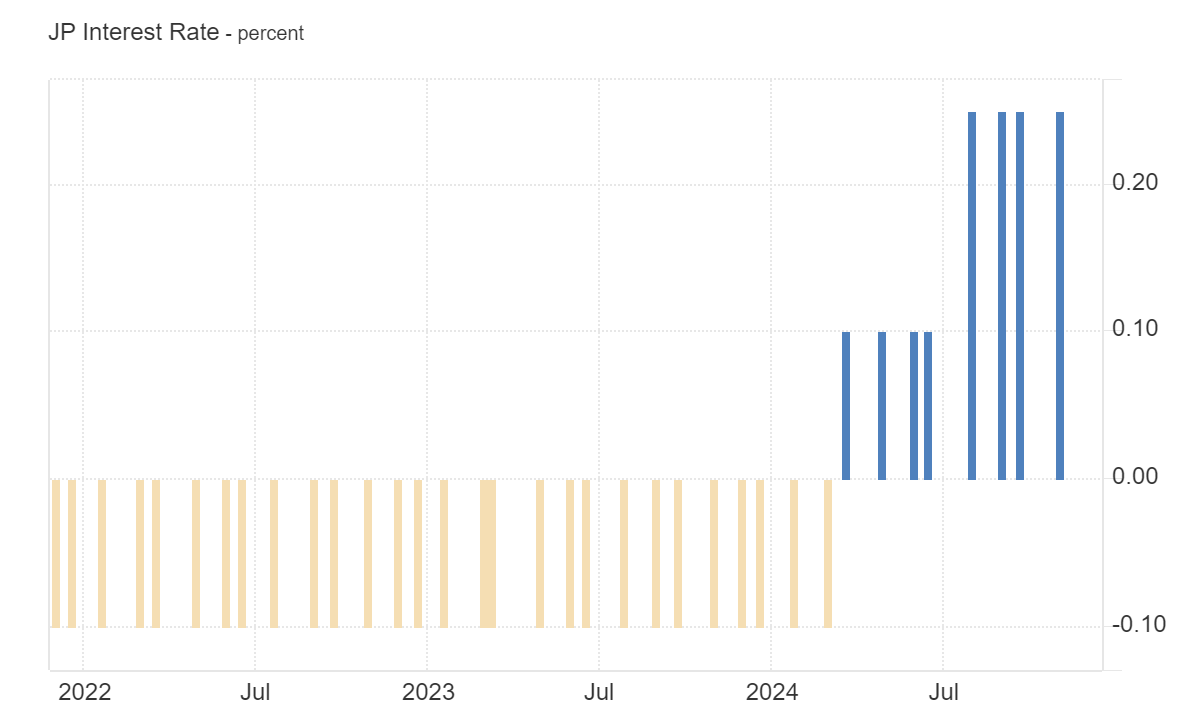

Bank of Japan Eyes More Rate Hikes

Regarding monetary policy, Ueda mentioned that the Bank of Japan will make decisions at each meeting based on the latest economic data.

He also recently indicated that he is prepared to raise interest rates again if Japan’s economy and inflation align with the central bank’s predictions.

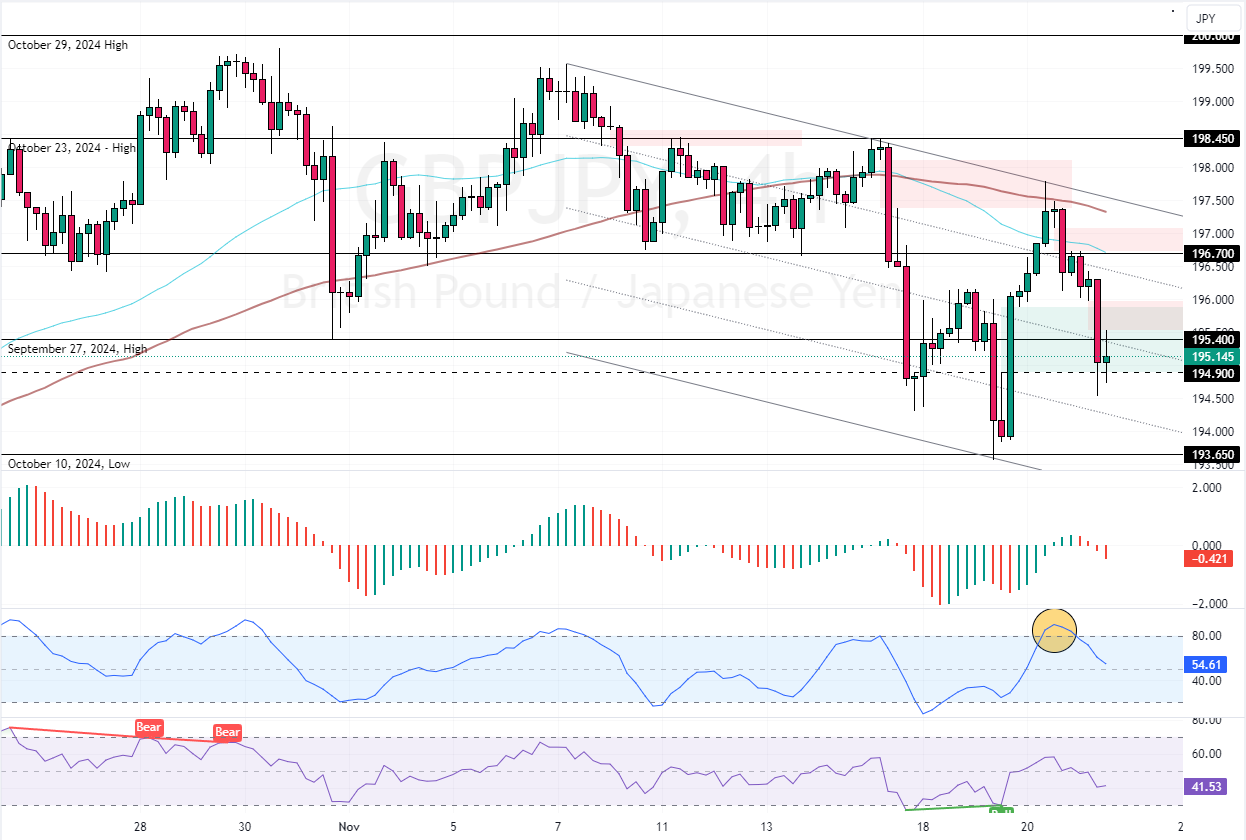

GBPJPY Technical Analysis

The British pound lost 0.7% of its value against the Japanese yen today, trading at approximately 195.1 as of this writing. Today’s bearish wave was anticipated due to Stochastic’s oversold signal when the indicator depicted 86 in the description.

Furthermore, the GBP/JPY primary trend should be considered bearish because the prices are below the 50- and 100-period simple moving averages. That said, the immediate support that kept the currency pair’s value from falling further is at 194.9.

GBPJPY Price Forecast

From a technical perspective, the downtrend will likely resume if GBP/JPY bears push the prices below the support. In this scenario, the next bearish target could be revisiting the October 10 low at 193.6.

Please note that the bearish outlook remains valid as long as the prices are below the 196.7 resistance.

GBPJPY Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 194.9 / 193.65

- Resistance: 196.7 / 198.45