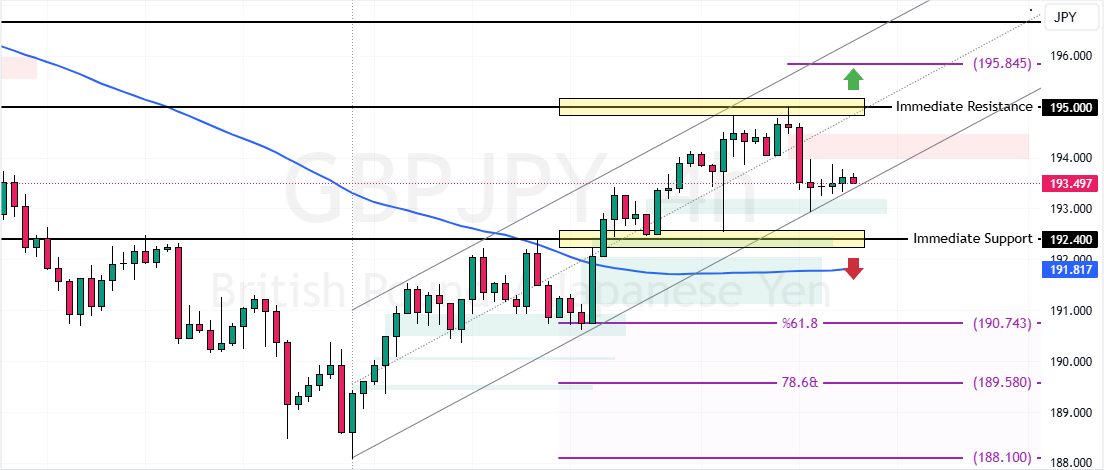

FxNews—GBP/JPY became overbought after the price hit the 195.0 high. Consequently, the currency pair dips toward immediate support at 192.4. The trend outlook remains bullish if the 75-SMA holds and bulls break the 195.0 resistance.

In this scenario, the next bullish target could be 195.8, followed by 196.6.

GBPJPY Technical Analysis – 13-December-2024

The currency pair trades in a bull market, above the 75-period simple moving average. However, the uptrend from 188.1 eased near the 195.0 resistance. As a result, GBP/JPY began consolidating by marching toward the immediate support at 192.4, a bearish move hinted at by the Stochastic Oscillator.

As for the other technical indicators, the Awesome Oscillator histogram is red, approaching zero from above. Additionally, the Stochastic Oscillator dipped below 50, hinting at a soft bull market. Furthermore, the RSI 14 clings to the median line, indicating a low-momentum trend.

Overall, the technical indicators suggest that while the primary trend is bullish, GBP/JPY lacks momentum and is awaiting a bullish or bearish breakout.

GBPJPY Seeks Support at 192.4: What’s Next?

The GBP/JPY trend outlook should be considered bullish as long as the pair trades above 192.4. However, bulls (buyers) should close above the 195.0 mark for the uptrend to resume. In this scenario, the next bullish target could be 195.8, followed by 194.6.

- Also read this analysis: EURUSD Could Hit $1.033 After Breaking Support

The Bearish Scenario

Please note that the bullish outlook should be invalidated if GBP/JPY falls below 192.4. If this scenario unfolds, the bearish wave from 195.0 could extend to 190.7.

Furthermore, if the selling pressure persists, the next support will be the 189.5 mark, backed by the 78.6% Fibonacci level.