The British pound remained below the 23.6% Fibonacci retracement level at $1.27 against the Greenback. This decline occurred amid growing tensions between Russia and Ukraine. Specifically, reports surfaced that Ukraine had used UK-supplied cruise missiles to strike Russia for the first time.

Earlier in the day, the pound had reached $1.271 after the UK reported higher-than-expected inflation numbers. This unexpected rise in inflation made the Bank of England more cautious about cutting interest rates in the near future.

In October, the UK’s annual inflation rate climbed to 2.3%, up from 1.7% in September. This was the highest rate in six months and above the Bank of England’s target and market expectations of 2.2%. Additionally, inflation in the services sector—which the central bank watches closely as a sign of domestic price pressures—increased slightly to 5% from 4.9%.

Due to these factors, financial markets now estimate only a 14% chance of another quarter-point interest rate cut this year and predict just two rate cuts in 2025.

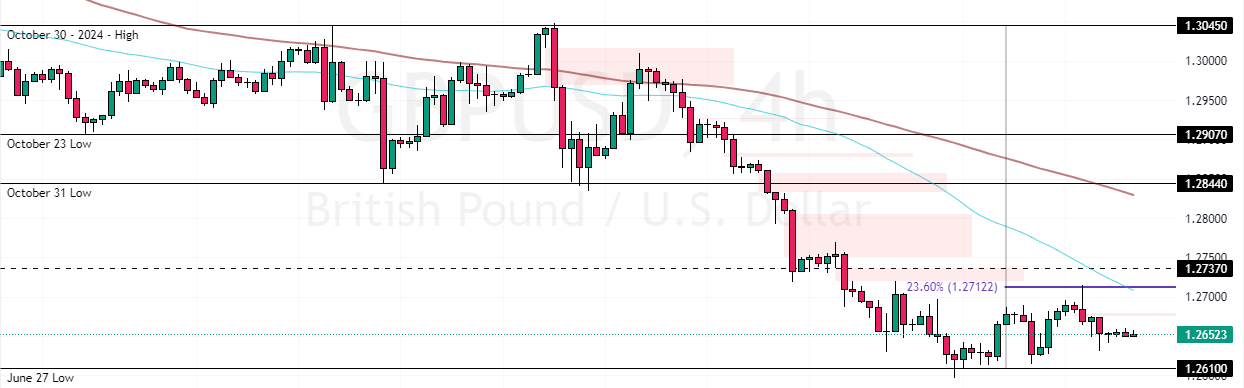

GBPUSD Technical Analysis – 21-November-2024

The trend outlook remains bearish as long as GBP/USD trades below the 50-period simple moving average at approximately $1.27. In this scenario, the currency pair’s value is expected to drop to the May 9 low at $1.245.

Please note that the downtrend should be invalidated if GBP/USD exceeds the 50-period SMA, backed by the 23.6% Fibonacci level.