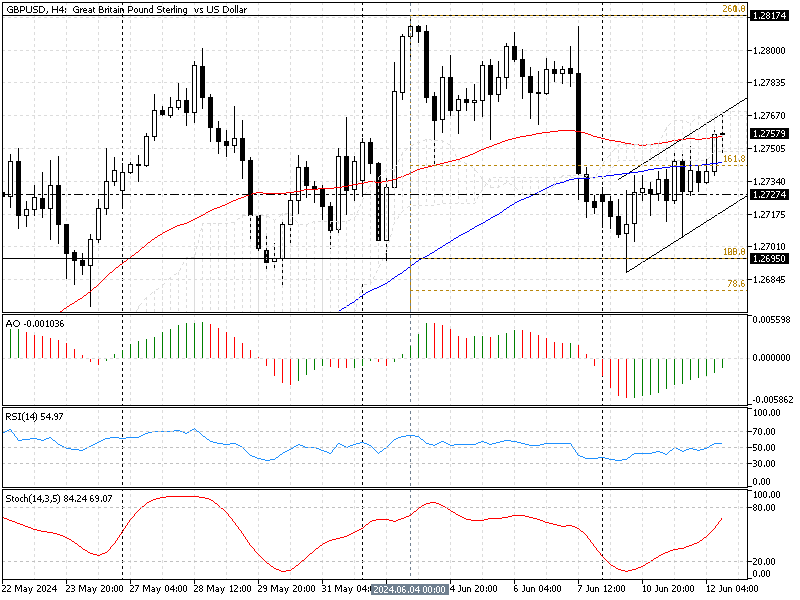

FxNews—The pound sterling traded at about $1.275 against the U.S. Dollar in today’s trading session. The GBP/USD 4-hour chart below shows that the pair ranges in a bullish channel, stabilizing the price above the simple moving average of 50.

GBPUSD Technical Analysis – 12-June-2024

The downtrend from $1.281 eased after the U.S. Dollar hit the 23.6% Fibonacci at $1.269. This development in the dollar’s value against the pound sterling caused the stochastic oscillator to step into oversold territory on June 10. As a result, the bulls stepped in, and the pair experienced a pullback, leading the GBP/USD pair to test the upper line of the bullish flag.

The technical indicators in the GBP/USD 4-hour chart suggest the uptrend will likely resume.

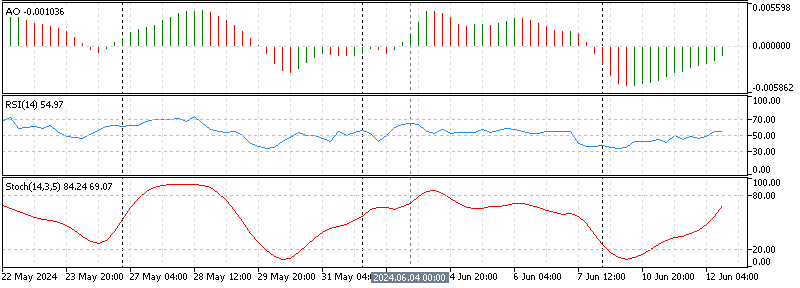

- The awesome oscillator value is -0.001 and rising. This climb in the AO’s green bar means the bullish momentum strengthens.

- The relative strength index flipped above the 50 line, signaling the bullish trend gains momentum.

- The stochastic oscillator value is 69, with 10 points left to become overbought, which interprets that the market is not overbought and that the price has room to grow.

GBPUSD Forecast – 12-June-2024

As explained earlier, the primary trend is bullish because the price is above the 23.65 Fibonacci and the SMA 100. The immediate support is the lower line of the flag at approximately $1.272.

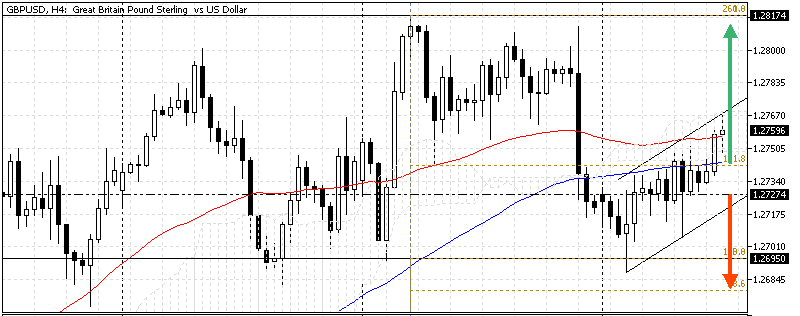

From a technical standpoint, if the GBP/USD bulls maintain a position above the immediate support, the pullback that began at $1.269 will likely target June’s all-time high at $1.281. Furthermore, if the buying pressure exceeds $1.269, the road to March’s all-time peak at $1.289 could be paved.

The 23.6% Fibonacci at $1.269 supports the bullish scenario, and as long as this level is maintained, the uptrend remains valid.

Bearish Scenario

The immediate support is at $1.272. If the GBP/USD price dips below $1.272, the decline can extend to the 23.6% Fibonacci at $1.269. Furthermore, if the price crosses below $1.269, the next bearish target could be the 38.2% Fibonacci level at $1.261.

GBP/USD Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $1.272 / $1.269 / $1.265

- Resistance: $1.281 / $1.286 / $1.289

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.