After a significant drop, oil prices have started to recover, bouncing back from a near four-month low. This recovery comes amidst ongoing concerns about a potential decrease in global oil demand triggered by weak economic indicators from several key economies.

Global Oil Demand and Economic Impact

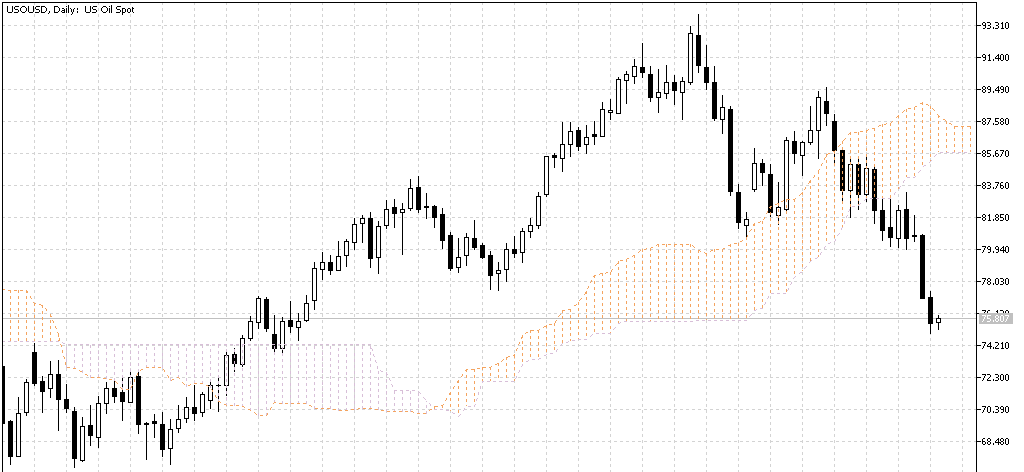

Bloomberg—Earlier this week, Brent crude prices experienced a steep decline, even dipping below the crucial $80 per barrel mark. This was due to a combination of factors negatively impacting the oil markets.

According to the American Petroleum Institute (API), U.S. crude inventories have seen their largest weekly increase since February, with over 11 million barrels added in the week leading up to November 3. This data suggests a possible reduction in U.S. fuel consumption as we head into the winter season. The Energy Information Administration is set to release official inventory data on November 15.

Global Economic Impact on Oil Prices

The strength of the dollar, bolstered by a series of assertive signals from members of the Federal Reserve, has put additional pressure on oil prices. This is due to market fears of further economic growth due to high interest rates.

Moreover, easing concerns over potential supply disruptions resulting from the conflict between Israel and Hamas has led traders to remove the previously included risk premium. As a result, Brent oil futures have risen by 0.5% to $80.11 a barrel, and West Texas Intermediate crude futures have increased by 0.8% to $75.90 a barrel.

Economic Indicators and Their Influence

China, the world’s largest oil importer, re-entered a period of disinflation in October despite Beijing’s repeated attempts to stimulate economic growth. This disinflationary trend was revealed shortly after the country released disappointing trade data. While China’s oil imports remain stable, analysts warn of a potential decrease in crude demand due to high stockpiles and the possibility of reduced export quotas for refiners.

Retail sales have continued to fall throughout the eurozone throughout October, raising fears of a recession. Additionally, GDP data from the U.K., due to be released on Friday, is expected to show an ongoing downturn.

Despite Saudi Arabia’s assurances that crude consumption will remain robust, these signs of sustained economic weakness have made markets question the outlook for steady oil demand this year. Worsening global financial conditions have exacerbated this skepticism.

While Saudi Arabia and Moscow have pledged to continue their supply reductions until the end of 2023, there are doubts about whether this will support crude prices, particularly as other OPEC members have ramped production. U.S. oil production has also been on the rise in recent months.

- Next read: Easing Middle East Tensions Lower Oil Prices

Conclusion

While the rebound in oil prices may benefit oil-producing economies, the underlying factors driving this trend could negatively affect the global economy. The cooling of economic growth, high interest rates, and a potential slowdown in crude demand are all factors that could negatively impact the economy.