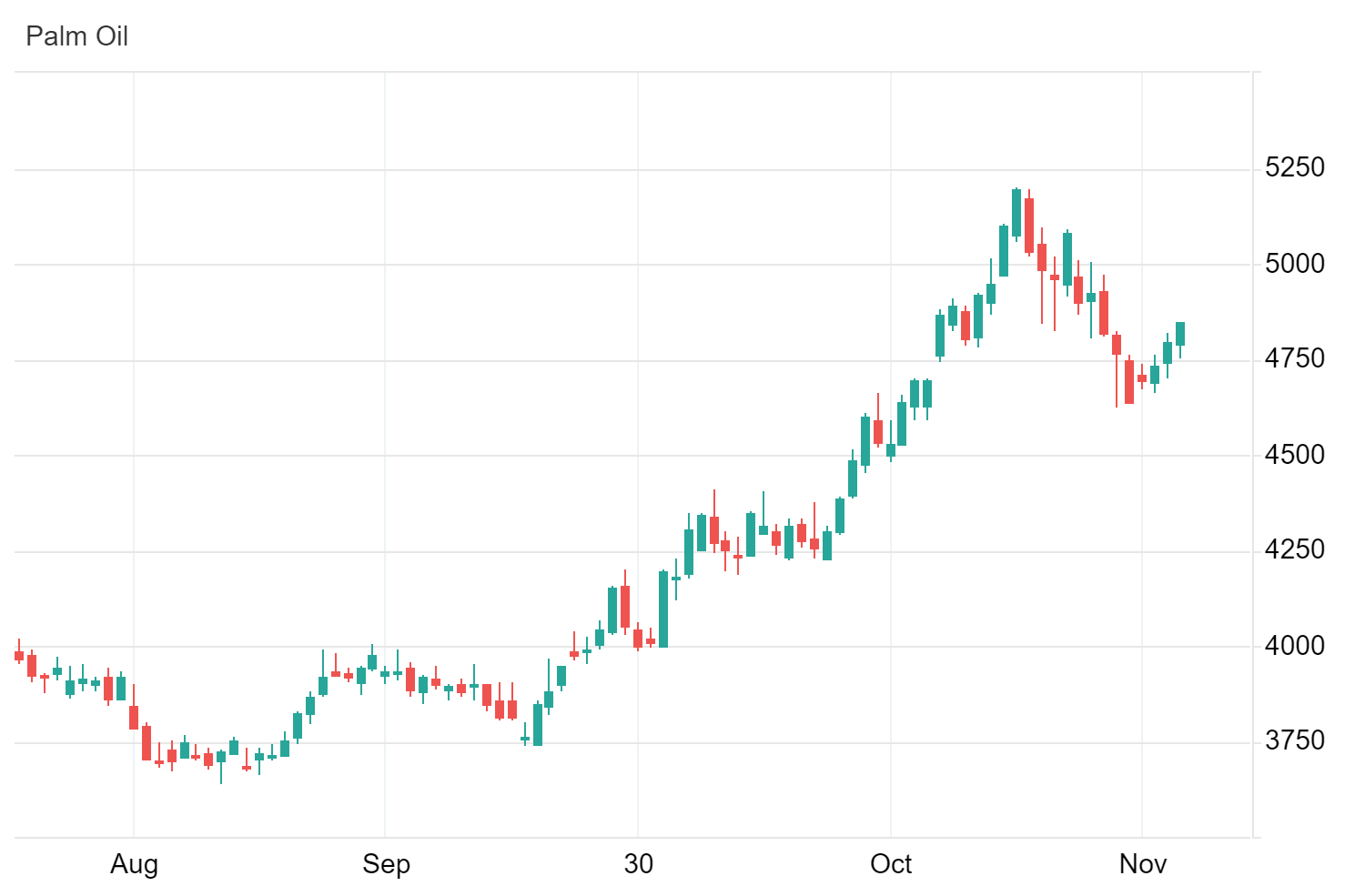

Malaysian palm oil futures have dropped below 4,780 Malaysian Ringgit per tonne, ending a three-day streak of rising prices. Traders are cautious as they await important monthly reports due in early December. Concerns about upcoming economic data from China, a major buyer of palm oil, are also influencing market sentiment.

Palm Oil Demand Dips Ahead of Lunar New Year

The demand for palm oil remains low and may stay that way until major festivals like the Lunar New Year and Ramadan. In the European Union, palm oil imports for the 2024-25 season (which started in July) reached 1.26 million tons, marking an 18% decrease compared to last year.

A recent slowdown in production is limiting further price declines. The Malaysian Palm Oil Association reported that crude palm oil output fell by 5.2% in the first 20 days of November compared to the previous month.

- Good read: NZ Stock Market Falls Amid Global Concerns

Meanwhile, India, the world’s largest consumer of palm oil, saw purchases reach a three-month high in October as refiners restocked depleted inventories following low imports and strong festive demand.