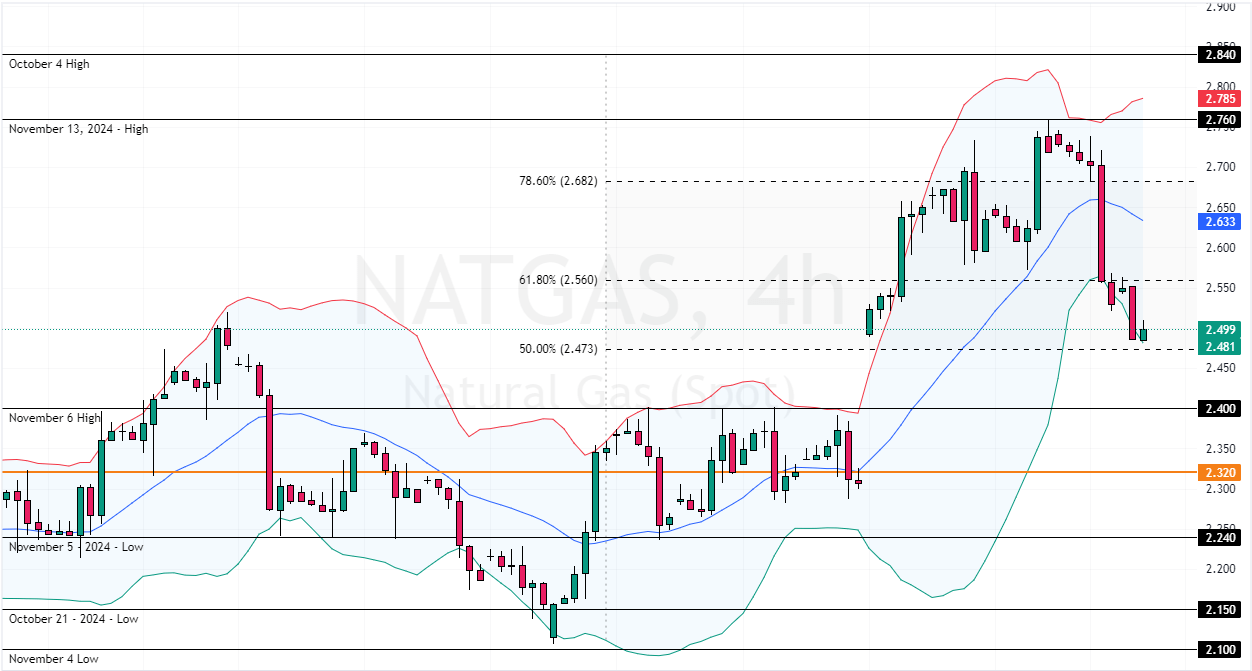

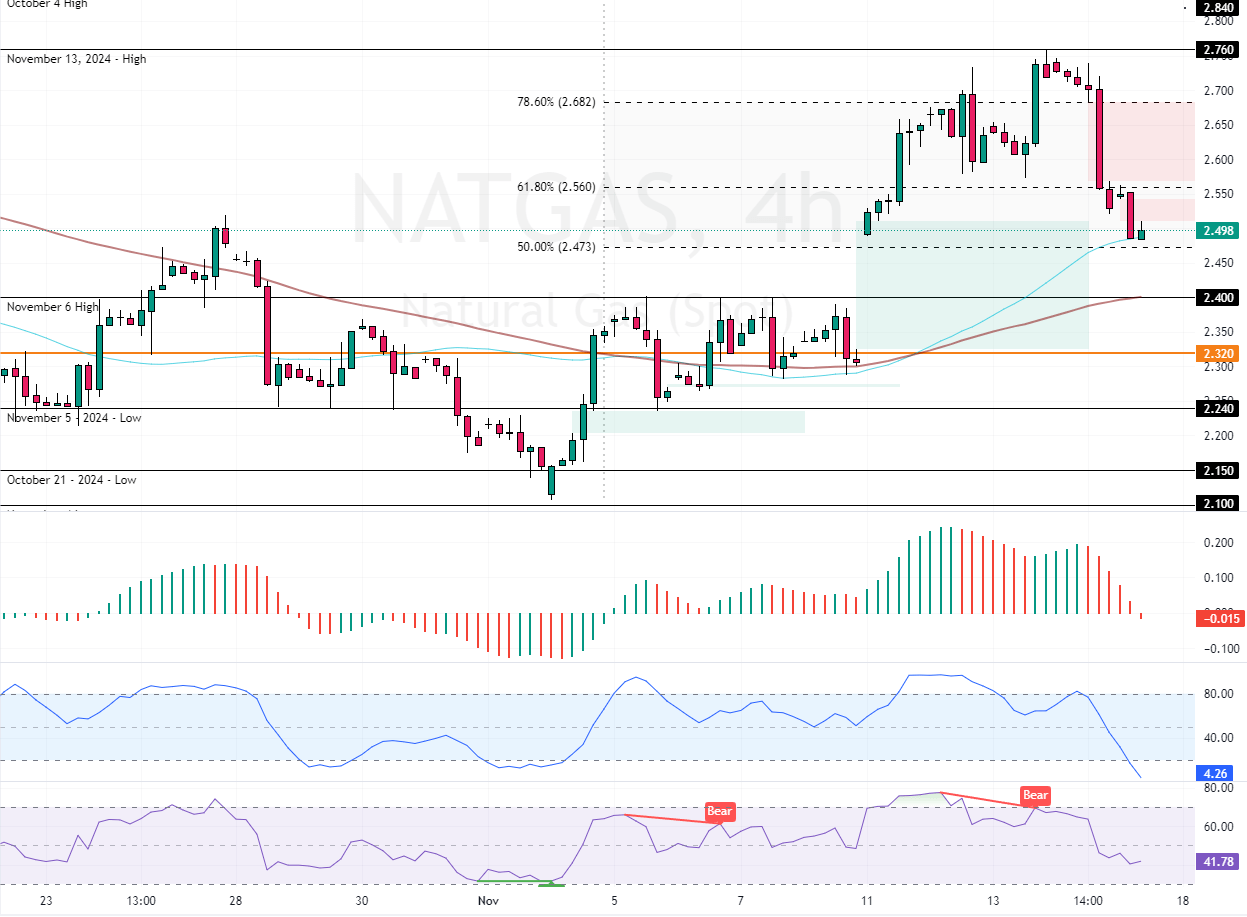

FxNews—Natural gas prices failed to maintain their position above the 78.6% Fibonacci retracement level at $2.68, pulled back after going as high as $2.75 on November 13. As of this writing, NATGAS trades at approximately $2.47, testing the 50% Fibonacci as resistance.

Natural Gas Prices Dip to $2.4 After EIA Report Surprise

The Natural Gas prices declined mainly due to the recent Energy Information Administration (EIA) report stating that storage has experienced a slightly lower-than-expected increase. The forecast was 42 bcf, but the actual release was 43 bcf, resulting in a decline in the Natural Gas prices.

Currently, NATGAS faces a surplus of 6.1% more than expected.

Low Gas Output Could Spike NATGAS Prices Next Month

Furthermore, forecasts st that warmer temperatures until November 20 will decrease Natural Gas demand globally. Because of the disruption in gas production after Hurricane Rafael in the Gulf of Mexico, productions dimmed to 100 bcfd, a drop from 1.1.3 bcc in October.

This decrease in Gas production could affect NATGAS prices later next month as it affects supplies.

NATGAS Technical Analysis – 15-November-2024

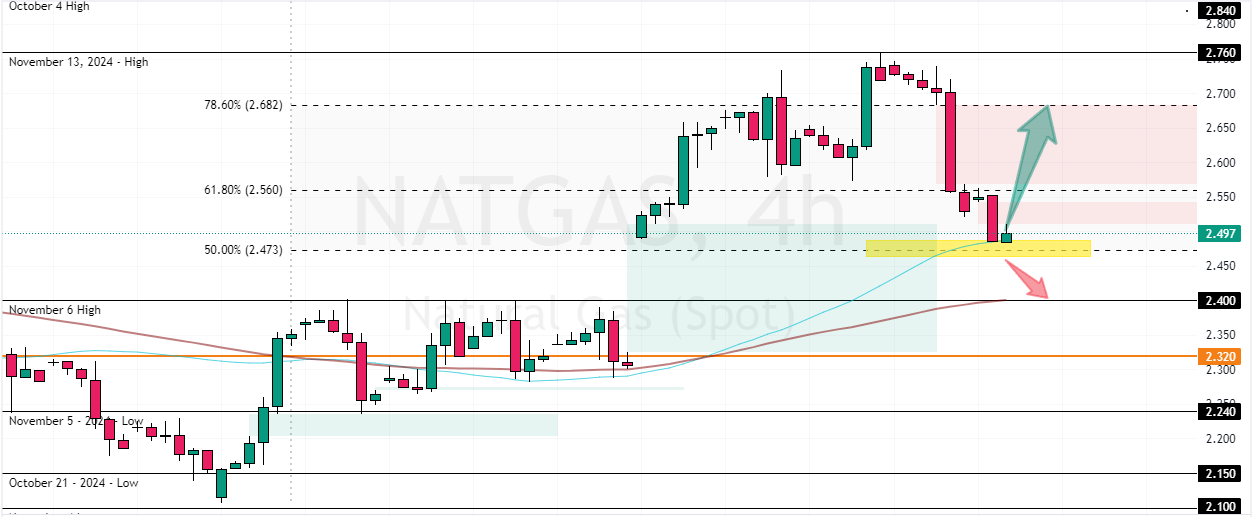

As of this writing, NATGAS tests the %50 Fibonacci level at $2.47 as support, a critical supply zone that might lead to a further downtrend if the prices breach below it. Interestingly, the 2.47 support is backed by the 50-period moving average, making it a robust bearish barrier.

As for the technical indicators, the Stochastic Oscillator stepped into the oversold territory, depicting 3.9 in the description, meaning the market is oversold. Therefore, the expectation of a new bullish wave in NATGAS looms.

NATGAS to Rise If 50-SMA Holds Steady

From a technical perspective, NATGAS prices can potentially rise toward the $2.56 resistance area, backed by the bearish fair value gap, if the 50-SMA holds. Furthermore, if the prices exceed $2.5, the bullish trend will likely resume, aiming to revisit the 78.6% Fibonacci.

On the other hand, the bullish outlook should be invalidated if NATGAS falls below the 2.47 support. If this scenario unfolds, the downtrend can potentially extend to the November 6 high at $2.4.

- Support: 2.47 / 2.4 / 2.32

- Resistance: 2.56 / 2.68