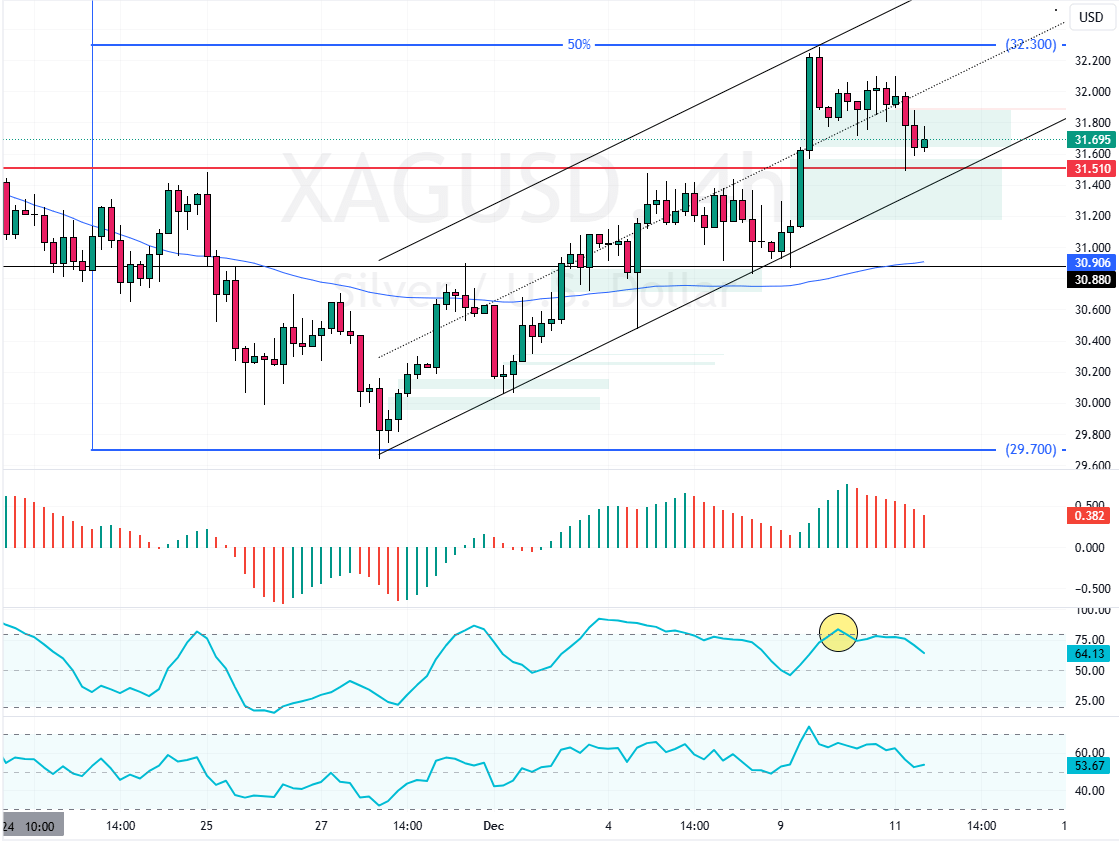

FxNews—The XAG/USD prices dipped from $32.3, a decline that was expected from a technical perspective as the Stochastic Oscillator was hovering overbought.

On the fundamental front, Traders grew wary due to concerns over China’s weakening currency and unclear industrial demand. Tensions linked to tariffs and China’s pledge to loosen monetary policy heightened uncertainty, making export conditions cheaper yet less stable.

As of this writing, the commodity trades at approximately $31.5, testing critical support, a pivotal point between the bull and the bear markets.

- China’s willingness to devalue the Yuan amid US trade threats.

- Ongoing doubts about promised economic support boosting demand.

- Overcapacity in China’s solar industry shaping supply controls.

Monetary Policy and Future Expectations

Investors also anticipate the Federal Reserve’s decision to lower interest rates by 25 basis points. This move reduces the cost of holding silver, yet lingering questions about China’s true demand remain.

- Good reads: Natural Gas Prices Rally to $3.2 on High Demand

As a result, sentiment stays cautious, with both global trade policies and central bank actions set to influence silver’s price direction.