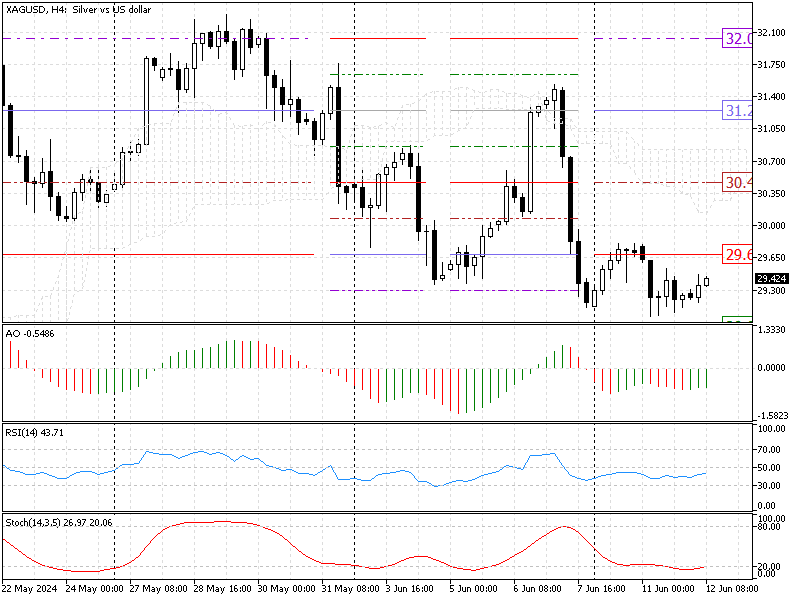

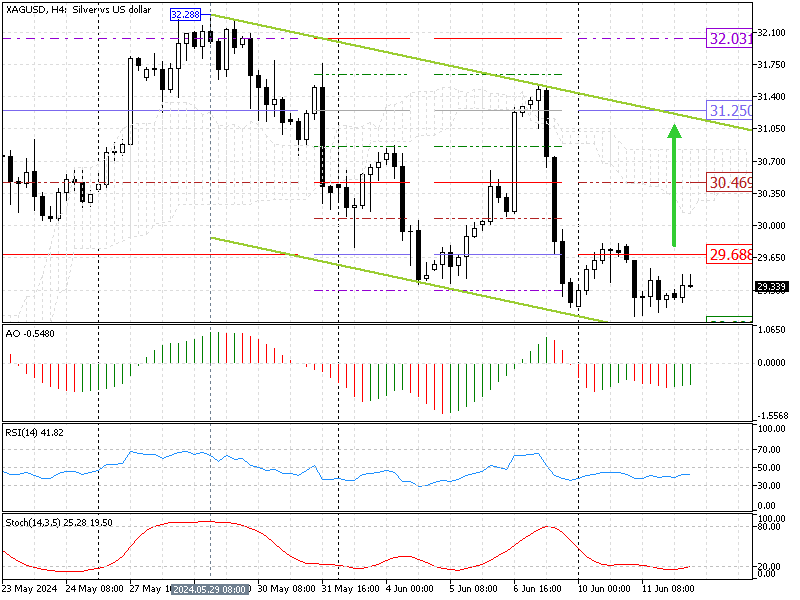

FxNews—Silver has been in a downtrend since April 29, when it was at $32.2. As of this writing, the XAG/USD pair formed a longwick bullish candlestick pattern near the lower line of the bearish flag at approximately $28.9, the Murrey 5/8.

The Silver 4-hour chart below demonstrates the current market price, as well as the technical indicators and Murrey Math levels, which assist us in analyzing the XAG/USD’s next move.

Silver Technical Analysis – 12-June-2024

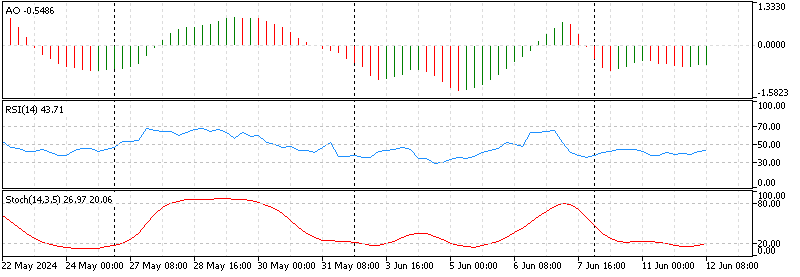

The technical indicators in the XAG/USD 4-hour chart suggest the market is oversold, and the price might rise to test the upper resistance levels.

- The awesome oscillator signals the Twin Peaks pattern below the signal line, meaning the bearish momentum weakens, and the silver price might rise.

- The relative strength index indicator moves sideways alongside the 50 lines, showing 41 in the value. This indicates the market lacks a significant trend.

- The stochastic oscillator value is 19, lingering in the oversold territory. This means the Silver is oversold, and the price might bounce from this point onward.

Silver Price Forecast – 12-June-2024

As mentioned earlier, the primary trend is bearish, but the Silver is oversold, and it is imminent for the Silver price to test the upper resistance levels. That said, the immediate resistance is at Murrey 5/8 at $28.9.

If the Silver price stays above this level, it will likely exceed the key resistance at Murrey 6/8 at $29.6. If this scenario unfolds, the pullback will likely aim the Murrey 7/8 at $30.4, a robust resistance level backed by Ichimoku Cloud.

Bearish Scenario

The Silver price must dip below the Murray 5/8 at $28.9 for the bearish trend to resume. If this occurs, the following key resistance will be the 4/8 Murrey at $28.1.

The Murrey 7/8 at 30.46 backs the bearish scenario.

Silver Key Support and Resistance levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $28.9 / $28.1

- Resistance: $29.6 / $30.4 / $31.2

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.