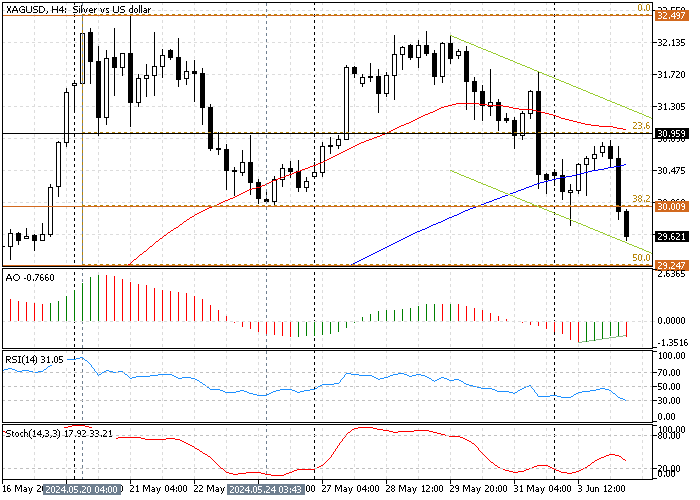

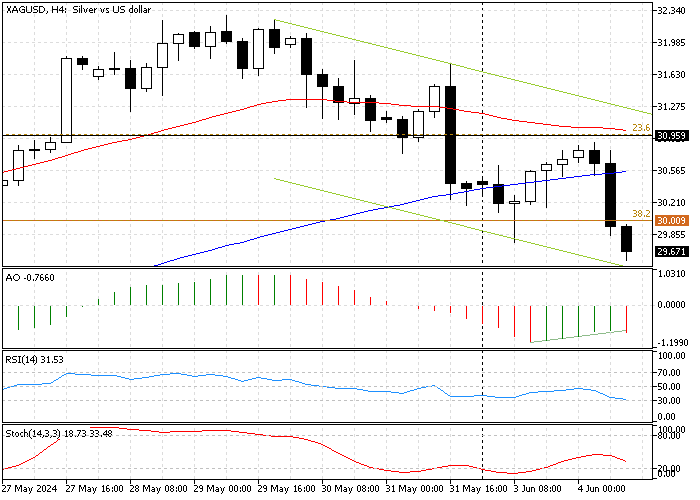

Silver is in a short-term downtrend against the U.S. Dollar. In today’s trading session, the sellers of XAG/USD closed the price below the 38.2% Fibonacci resistance level and SMA 100. Silver is at $29.5 as of this writing, testing the lower line of the bearish flag.

The XAG/USD 4-hour chart below shows the Fibonacci levels, the bearish flag, moving averages (SMA 50 and SMA 100), and other technical tools.

Silver Technical Analysis – 4-June-2023

- The awesome oscillator signals divergence. This means the silver trend might reverse from a bear market to a bull market or initiate a correction phase.

- The relative strength index indicators (RSI 14) depict 31 in the description and approach the oversold area. This fall in the RSI suggests that Silver might become oversold soon.

- The stochastic oscillator hovers around 33, which means the Silver price is not oversold or overbought. This indicates that the bearish trend is losing momentum.

These developments in the technical indicators suggest that the silver price might become oversold soon, and the price might bounce from this point to test the higher resistance levels.

Silver Price Forecast – 4-June-2024

The next resistance level is the %50 Fibonacci at $29.24. The decline will likely continue since the pair has broken below the 36.2% Fibonacci at $30. But we have the technical tools warning us about a consolidation phase. That said, the price might rise to test the broken SMA 100 at around $30.5, followed by $30.9 before the decline continues.

We suggest waiting for the silver price to complete its consolidation cycle before joining the short-term bear market. Therefore, monitoring the price action and looking for bearish candlestick patterns near the critical resistance levels is crucial.

Hint: A cross above the $30.95 key resistance will invalidate the short-term bear market.

Bullish Scenario

The primary trend is bullish, but to resume, the bulls must cross above the upper line of the bearish flag. This level is supported by SMA 50 and the 23.6% Fibonacci at $30.9.

Buyers could again test May’s all-time high at $32.4 if this scenario unfolds. Furthermore, the SMA 50 will support the bullish scenario if the breakout occurs.

Silver Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $29.24

- Resistance: $30 / $30.53 / $30.95

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.