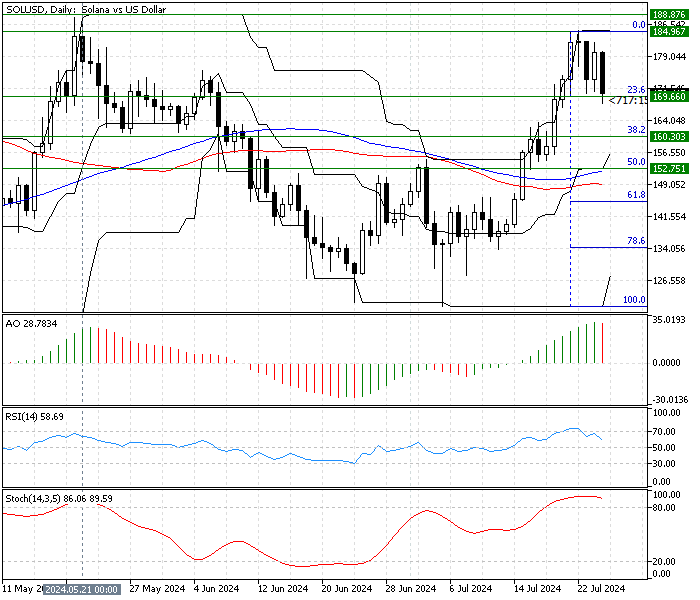

FxNews—Solana‘s uptrend eased after the price neared the May 21 high at approximately $188. As of writing, the SOL/USD cryptocurrency pair trades at about $170, testing the 23.6% Fibonacci level.

The 4-hour chart below demonstrates the price, key Fibonacci levels, and the technical tools utilized in today’s analysis.

Solana Technical Analysis – 25-July-2024

The primary trend is bullish because the price is above the 100-period simple moving average. The current downward momentum was expected because the stochastic oscillator hovers in the overbought territory in the daily chart.

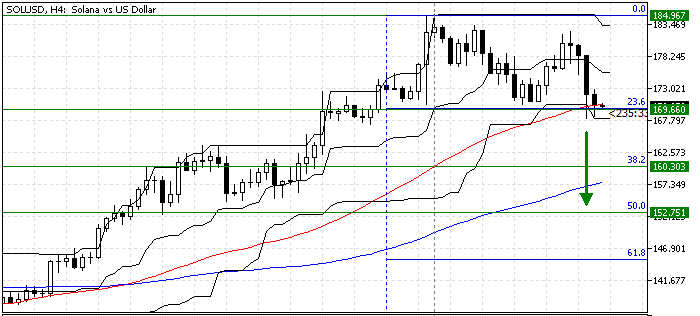

Furthermore, the technical indicators in the 4-hour chart suggest the primary trend is bullish, but the consolidation phase could extend to the lower support levels.

- The awesome oscillator bars are red, approaching the signal line, indicating the bearish momentum strengthens.

- The relative strength index indicator has flipped below the median line, signaling a downtrend.

- The price is above the 50 and 100-period simple moving averages, which is a robust sign for the bull market.

Solana Forecast – 25-July-2024

The 23.6% Fibonacci, which coincides with the 50 SMA at $169.6, is playing the immediate support that has kept the SOL/USD price from declining further. If the price closes and stabilizes below the immediate support, the consolidation phase from 184.9 (July’s high) will likely target the 38.2% Fibonacci at $160.3, backed by the 100-period simple moving average.

Furthermore, if the selling pressure exceeds the $160.3 key support, the bull market should be invalidated, and the primary trend should be considered bearish.

- Read also: Cardano Analysis – 22-July-2024

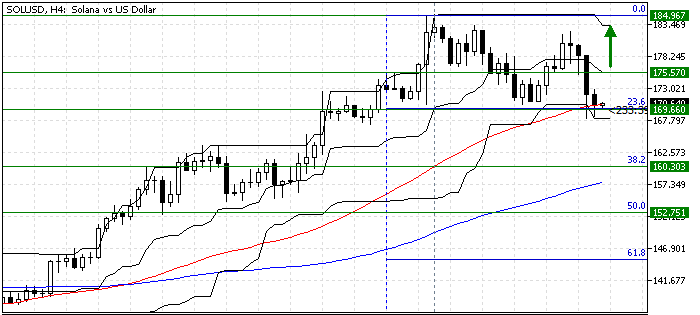

Solana Bullish Scenario – 25-July-2024

As mentioned earlier, the primary trend is bullish. The price must hold above the 23.6% Fibonacci at $169.6. If this scenario unfolds, the July 22 high at $184.9 will likely be tested.

Furthermore, if the buying pressure exceeds $184.9, the next bullish target could be the May 21 high at $188.

SOLUSD Key Levels – 25-July-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $169.6 / $160.3 / $152.7

- Resistance: $184.9 / $188

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.