Our latest stock market analysis delves into a week marked by significant fluctuations across major indices and stocks.

Dow Jones Rises Amid S&P, Nasdaq Fall and Inflation Concerns

Bloomberg – On Friday, the Dow Jones ended the day with a gain of 39 points. However, the S&P and the Nasdaq didn’t fare as well, dropping by 0.5% and 1.2%, respectively. This was due to a mix of positive results from large banks and a drop in the value of major stocks, fueled by ongoing worries about inflation.

Additionally, rising oil prices and increasing tensions in the Middle East dampened investor sentiment. The sectors that suffered the most were technology, consumer discretionary, and industrials. Big names like Tesla, Nvidia, Apple, Alphabet, Microsoft, and Amazon saw their shares fall by 1% to 3%.

Boeing’s shares also fell by 3.3% due to increased inspections of a production issue, and Spirit’s shares dropped by 1%. On the other hand, JPMorgan’s shares rose by 1.5%, Wells Fargo’s by 3%, and Citigroup’s fell slightly by 0.2%, even though all three banks reported better-than-expected earnings and revenue.

UnitedHealth’s shares increased by 2.5% after the company raised its profit forecast and reported better-than-expected earnings. Over the week, the S&P 500 rose by 0.6%, the Dow Jones by 0.8%, and the Nasdaq by 0.3%.

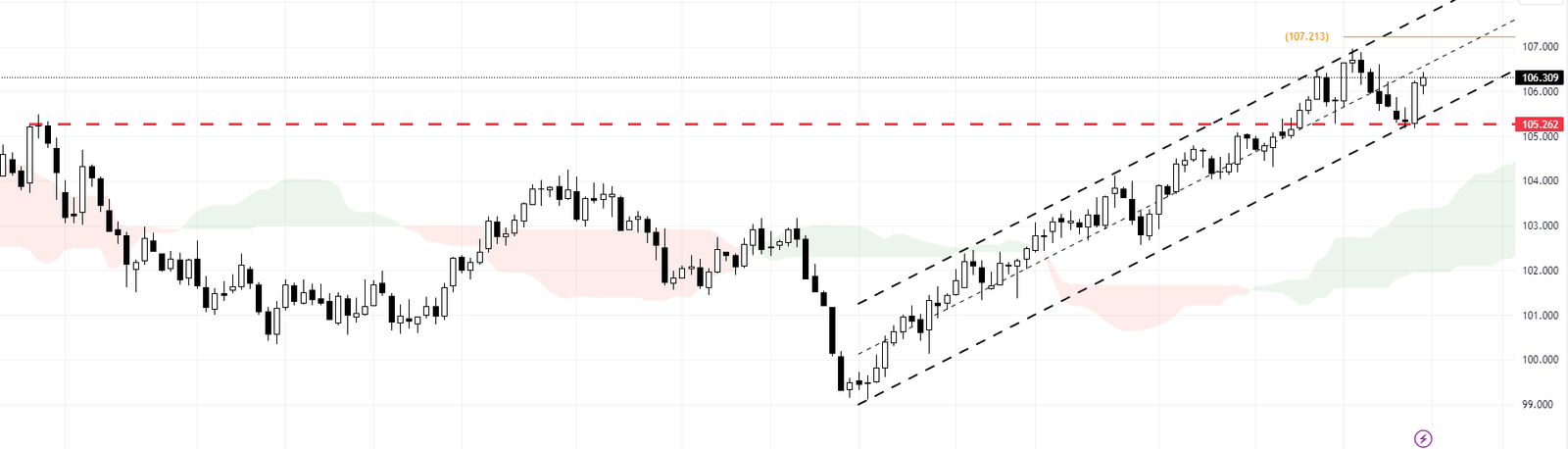

US Index Market Analysis: Daily Chart

The US dollar index has demonstrated a robust performance. The strength of the 105.26 support level has been instrumental in maintaining the US dollar index within the bullish channel. This support level has proven to be a reliable foundation, effectively preventing significant downturns in the index’s value.

The resilience of this support level is further highlighted when the index manages to sustain its position above this threshold. This is a critical observation for traders as it signals potential growth and profitability in their trading strategies. If the US dollar index continues to hold a firm above this support, market analysts and forex traders could set their sights on the previous high of around 107. This target represents a significant milestone in the forex market, indicating a strong bullish trend for the US dollar.

Stock Market Analysis Summary

In conclusion, monitoring these critical levels in the US dollar index could provide valuable insights for strategic trading decisions. As always, staying updated with market trends and adjusting trading strategies is important.