MetaTrader 5 (MT5) is a leading platform for traders worldwide, offering advanced technical analysis tools, trading systems, and mobile trading capabilities. Among its suite of indicators, the Standard Deviation Indicator is a critical tool for assessing market volatility—a fundamental aspect of trading that influences strategy and risk management.

What is the Standard Deviation indicator in Forex

Standard deviation is a statistical measure that quantifies the distribution of a dataset relative to its mean. Trading reflects how widely prices are spread around the average price. The Standard Deviation Indicator in MT5 utilizes this concept to gauge the market’s volatility, providing traders with insights into the potential for price movement.

Volatility and Identifying Sideways Markets with Standard Deviation

Understanding volatility is essential for traders as it affects decision-making and strategy. High volatility signals significant price movements, offering profit opportunities but with higher risk.

Conversely, low volatility indicates minimal price movement, which might signal consolidation phases or the calm before a significant market move.

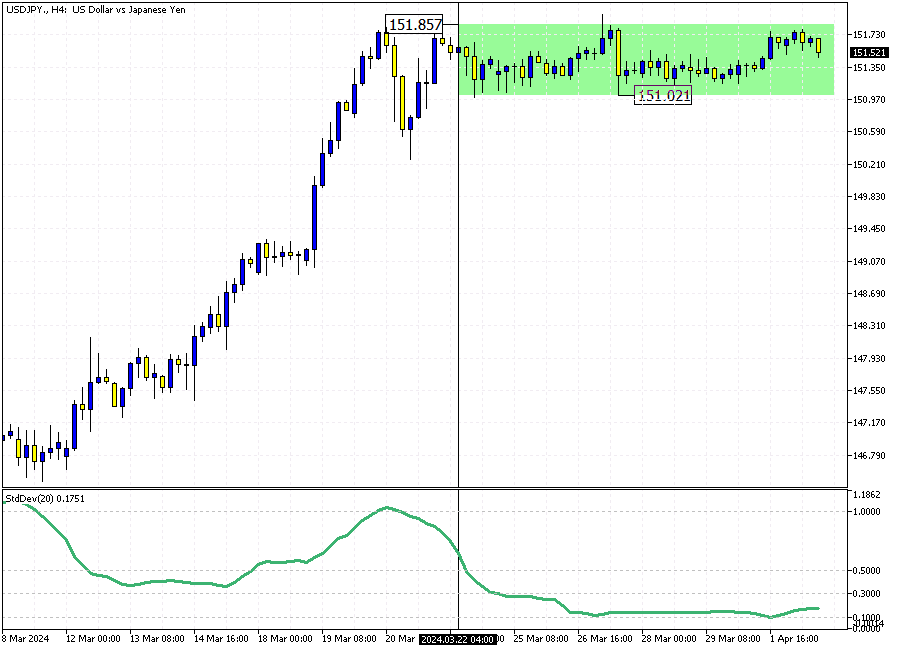

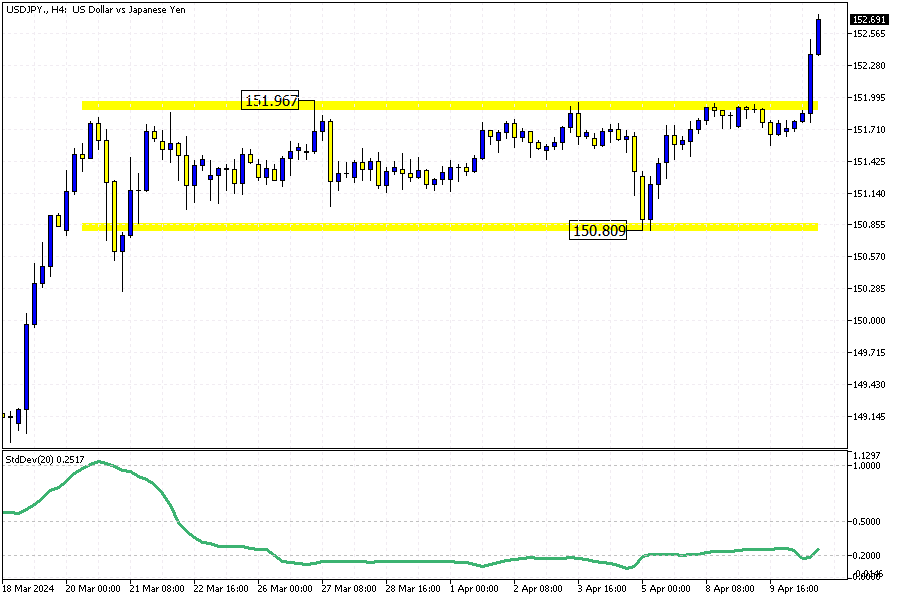

Example: The chart below represents the USDJPY pair in the 4-hour time frame. The U.S. Dollar has been trading in a narrow range between 151.8 and 151.0 since March 3, and the price remains within that range as of this writing. The Standard Deviation indicator on MetaTrader 5 helps us identify periods when the market lacks sufficient volatility or a significant trend. The USDJPY 4-hour chart below shows that the Standard Deviation remains below the 0.3 level, indicating the market is moving sideways.

To detect the development of a new trend, the Standard Deviation should rise above the 0.3 or 0.5 level. At this point, traders would recognize the entrance of new market participants and the emergence of a new trend or wave on the horizon.

Please note that we do not recommend trading in a sideways market. The direction of the market’s Trend is unknown, and it can move significantly against us due to impactful news.

The Standard Deviation Indicator in MT5

Adding the Standard Deviation Indicator to a chart in MT5 is straightforward. Traders can customize the period setting to adjust sensitivity.

A shorter period makes the indicator more responsive to price changes, while a longer period smoothing out the volatility curve, providing a broader view of market volatility.

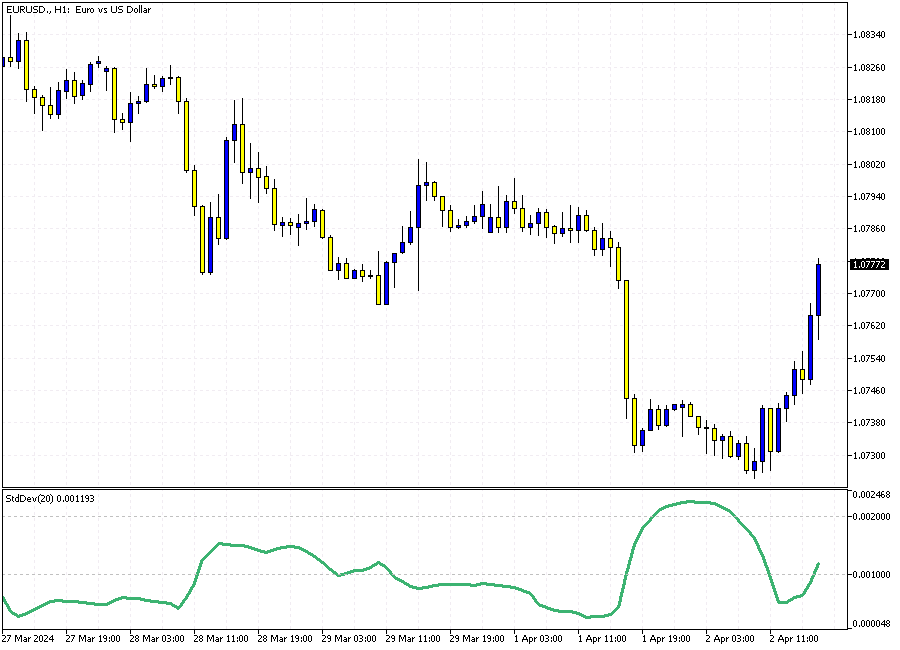

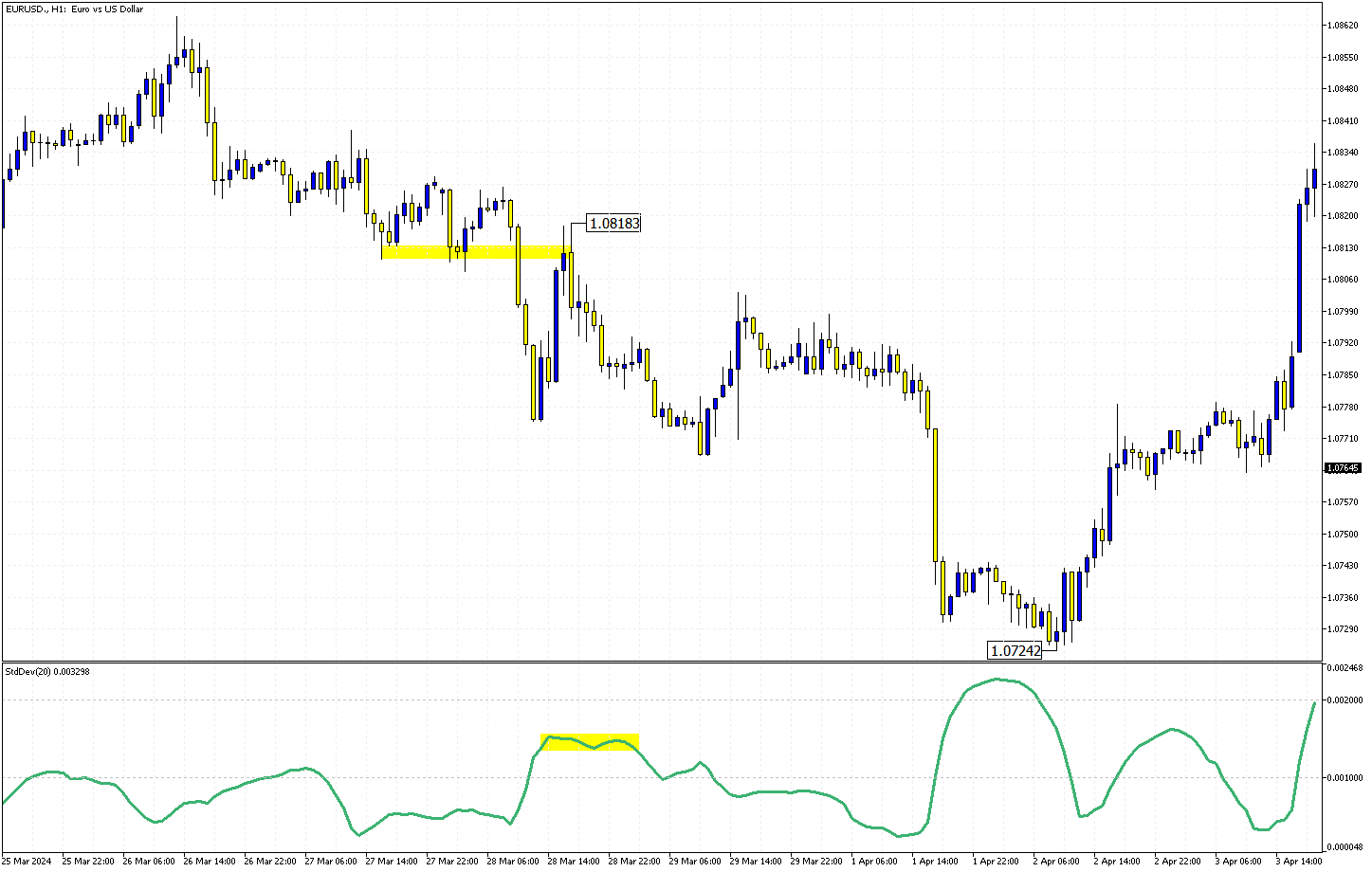

The EUR/USD chart below displays the Standard Deviation indicator on the 1-hour chart. Market volatility becomes more tangible and may fluctuate more frequently on lower time frames, including the 1-hour and 30-minute charts. Therefore, traders should be aware of trading in the lower time frames since it involves more risk.

I wouldn’t say it’s impossible to determine the primary Trend of a trading asset using shorter time frames, but it certainly makes the technical analysis more challenging. Therefore, it’s recommended to utilize higher time frames, like the 4-hour and daily charts, to identify the primary Trend and then use the shorter time frames to pinpoint entry points.

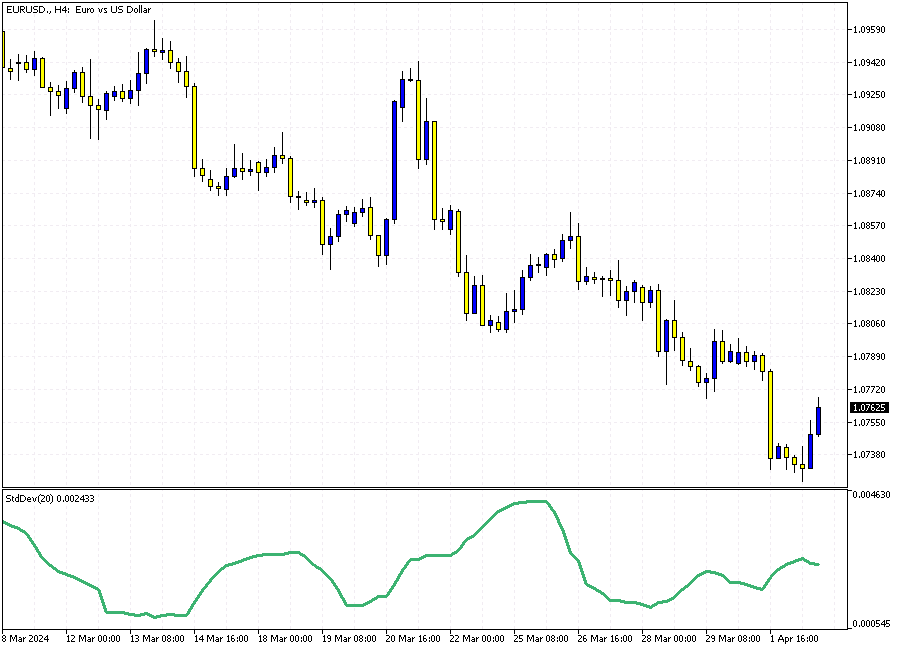

The 4-hour chart below represents the EUR/USD currency pair attached to the Standard Deviation indicator. If you compare the chart below to the 1-hour chart above, you can see that market volatility is more tangible in the lower time frames, and the curves are smoother in the EUR/USD pair.

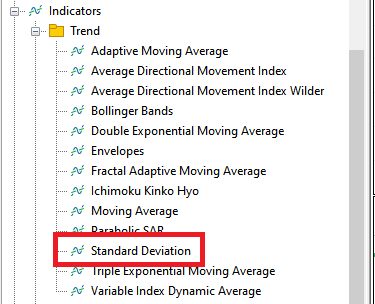

Installation Guide for the Standard Deviation Indicator

The MetaTrader 5 platform provides the Standard Deviation indicator for free. To add the indicator to your chart, follow the instructions below:

Open the MetaTrader 5 platform; if you don’t have one, you can always download it from MetaQuote’s official website.

- Go to ‘Indicators‘ from the ‘Navigator‘ window.

- If you don’t see the ‘Navigator’ window, add it to your platform’s windows by pressing Ctrl + M.

- Select Trend from the ‘Indicators’ category.

- Double-click on Standard Deviation from the list. Alternatively, you can drag and drop the indicator onto your chart.

Interpreting the Standard Deviation Signals

The indicator fluctuates with changes in market volatility. The indicator’s value is displayed on the right side of the window, with the smallest amount being zero, indicating a market without any trend. However, the value varies among different trading instruments. It’s important to note that one setting cannot be applied universally across all trading securities. Traders should adjust the indicator’s settings according to the trading asset they intend to trade.

- Higher values indicate increased volatility, suggesting caution or the potential for a trend reversal.

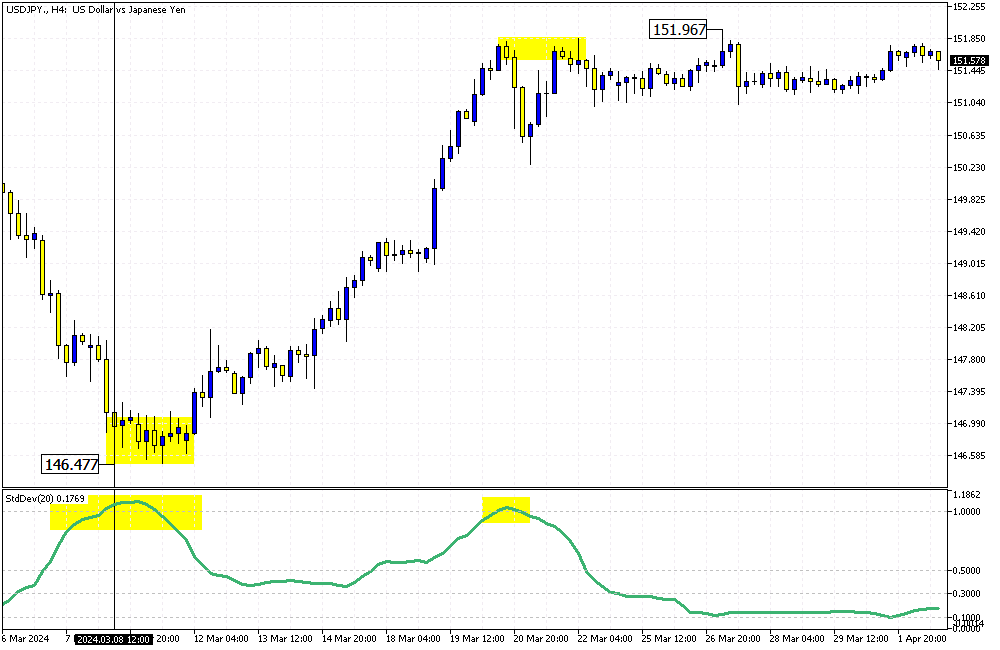

Example: The Standard Deviation indicator was hovering above 1.0 when the USDJPY price dipped as low as 146.4. As shown in the 4-hour chart below, the higher value of the Standard Deviation indicator signaled a trend reversal, and the price of the U.S. Dollar began to increase against the Japanese Yen on March 8.

The bullish wave again eased after the pair hit the 151.9 ceiling after March 20. Concurrently, the Standard Deviation indicator was above 1.0, and the market entered a consolidation phase.

In conclusion, when the Standard Deviation indicator value increases significantly, the chance of a market reversal or entering into a consolidation phase increases. This can assist traders in finding entry points either in pullbacks or breakouts.

Conversely, Lower values suggest a stable market, which might be conducive to strategies that rely on small, consistent gains. The key is understanding the context: sudden spikes in standard deviation could indicate impending market moves.

The USDJPY chart above shows the market stability above the 150.0 mark as the Standard Deviation hovers above the 0.1 level.

Standard Deviation Indicator: Trading in Low and High Volatile Markets

Traders can employ different strategies based on the volatility readings from the Standard Deviation Indicator:

In high-volatility markets, consider strategies that capitalize on significant price movements. However, robust risk management should be implemented to mitigate the increased risk.

In this EURUSD 1-hour chart, we see the price returning to the 1.081 resistance area while the standard deviation indicator value was high, hovering around 0.0015. This can be interpreted as the EURUSD market exhibiting high volatility; therefore, the downtrend will continue if the price stays below the 1.081 area.

The European currency’s failure to surpass the mentioned resistance level continued the downtrend, hitting as low as 1.072, as shown in the chart.

Many professionals use a decent strategy to surf the pullbacks. However, the key to this strategy is to monitor the resistance and support levels closely and meticulously. Watching out for candlestick patterns is also a significant aid in spotting reversal points.

In low-volatility scenarios, strategies might focus on smaller, more predictable price movements. Monitor a gradual increase in volatility to prepare for potential breakouts.

Standard deviation can inform traders about periods of low market volatility. This can also be observed by examining the security chart. We are in a low-volatility market if the price moves sideways in a narrow area.

The USDJPY 4-hour chart below provides an excellent example of how to trade in a low-volatility market using the standard deviation indicator. In this chart, the standard deviation value is increasing from 0.1 to above 0.2. Please note that the value of this indicator can vary across different trading instruments. This data indicates that the market is preparing to break out of the range zone in one direction. It might either rise or fall.

In this case, as shown in the picture, the U.S. Dollar broke through the 151.9 resistance area, continuing the uptrend, while the standard deviation value increased to 0.24 at the time of writing.

Using standard deviation in a low-volatility market can be challenging, primarily because investors are waiting for important economic news and data from central global banks. Therefore, it is crucial to monitor the economic calendar closely when employing this strategy.

Enhancing Standard Deviation with Other Technical Tools

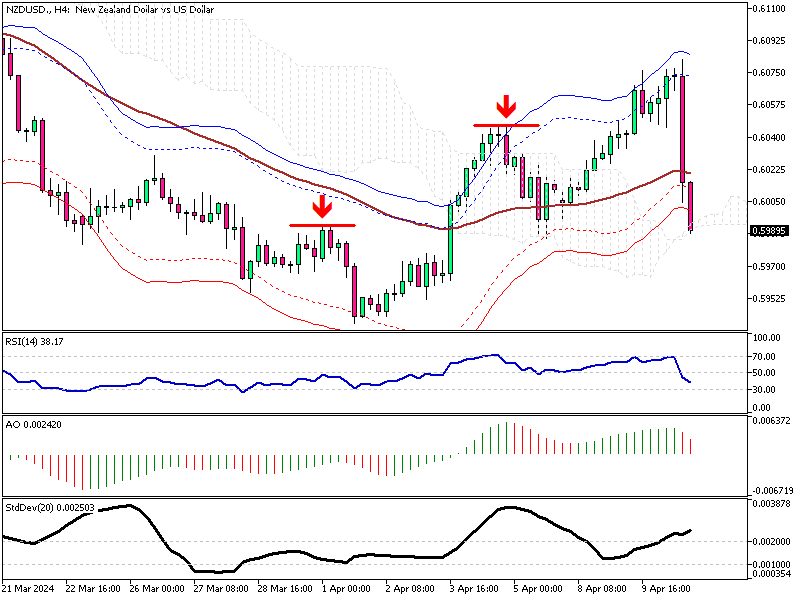

Trading securities with just one indicator has never been wise; therefore, we suggest combining the Standard Deviation indicator with other tools. These tools include Moving Averages for identifying trend direction, RSI to gauge market momentum, and the Awesome Oscillator for its unique feature in signaling divergences. From a technical standpoint, this approach to market analysis can enhance decision-making and filter out false trading signals.

The NZD/USD chart below, combined with the aforementioned technical indicators and the Envelopes indicator, which shows the oversold and overbought market, provides a vision of utilizing multiple indicators in your trading strategies.

For a comprehensive market analysis, combine the Standard Deviation Indicator with other tools like moving averages to identify trends or the Relative Strength Index (RSI) to gauge market momentum. This multifaceted approach can enhance decision-making and strategy formulation.

3 Tips for Trading High-Volatility Market with Standard Deviation

- Regularly monitor the trends and adjust your trading strategy accordingly.

- Do not only rely on the Standard Deviation Indicator; mix this trading tool with other analysis indicators for a better and more comprehensive view.

- Practice on demo accounts on multiple currency pairs for at least six months to understand the indicator’s behavior in various market conditions.

Final Word

Regardless of your trading platform, the standard deviation indicator is a practical tool for understanding market swings. It helps professional and retail traders gain a more comprehensive understanding of a security chart.

However, this tool can’t help much in managing risks. Therefore, it should be combined with other indicators, such as super trends or moving averages; they can also help manage stop losses more efficiently.

By accepting the power of technical indicators, boosting their knowledge, and utilizing them correctly, you will feel safer when executing a trade by being ready for any scenario.

I hope this article has helped you understand the concept of the Standard Deviation indicator. If you have any questions, please feel free to leave me a message. I will be glad to assist you.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.