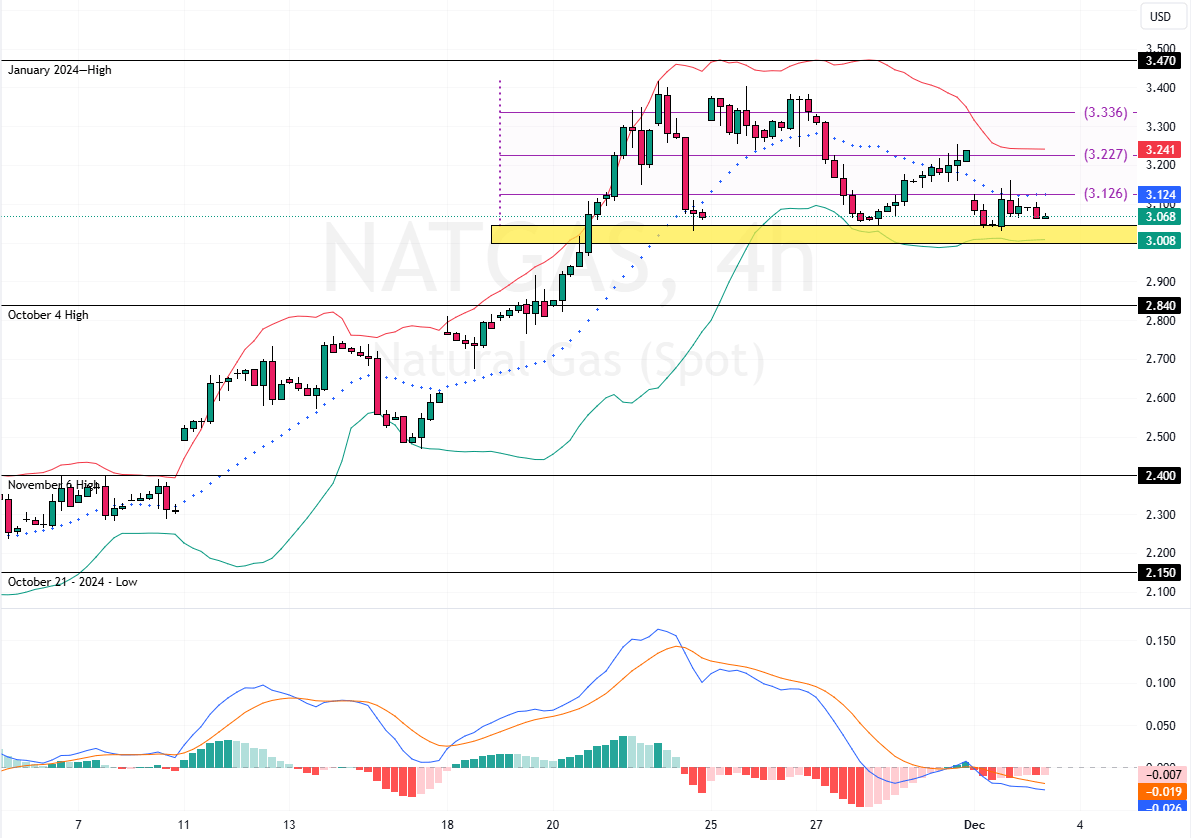

Natural gas futures in the United States have taken a significant downturn, falling over 5% to $3.0 per million British thermal units (MMBtu). This marks the lowest price point in more than a week, reversing the sharp 20% increase seen in November.

The decline is largely attributed to the latest weather forecasts predicting milder conditions in mid-December, which follow a brief period of colder temperatures that had temporarily boosted prices.

- Price Drop: Over 5% decrease to below $3.20/MMBtu.

- Weather Impact: Mild forecast after a brief cold spell.

- November Surge: Prices initially rose 20%.

Impact of Weather and Demand on Gas Prices

As the weather forecasts adjust to a warmer mid-December, expectations for heating demand have intervened. Utilities are now less pressured to draw extensively from natural gas storage, a change from recent trends where colder-than-usual weather had increased consumption needs.

This shift in demand dynamics is helping to stabilize the market, preventing further spikes in gas prices seen earlier in the month.

Long-Term Outlook and Production Trends

While US gas production remains strong at 101.5 billion cubic feet per day, it still trails behind last year’s peak rates. Despite this, the market is balanced with cautious production rates maintained by producers to avoid the pitfalls of oversupply, which have historically plagued the industry.

Looking ahead, analysts anticipate a rise in demand provoked by increased exports of liquefied natural gas (LNG) by 2025. However, the market’s current pullback reflects the immediate impacts of near-term weather forecasts and these longer-term supply and demand balance considerations.