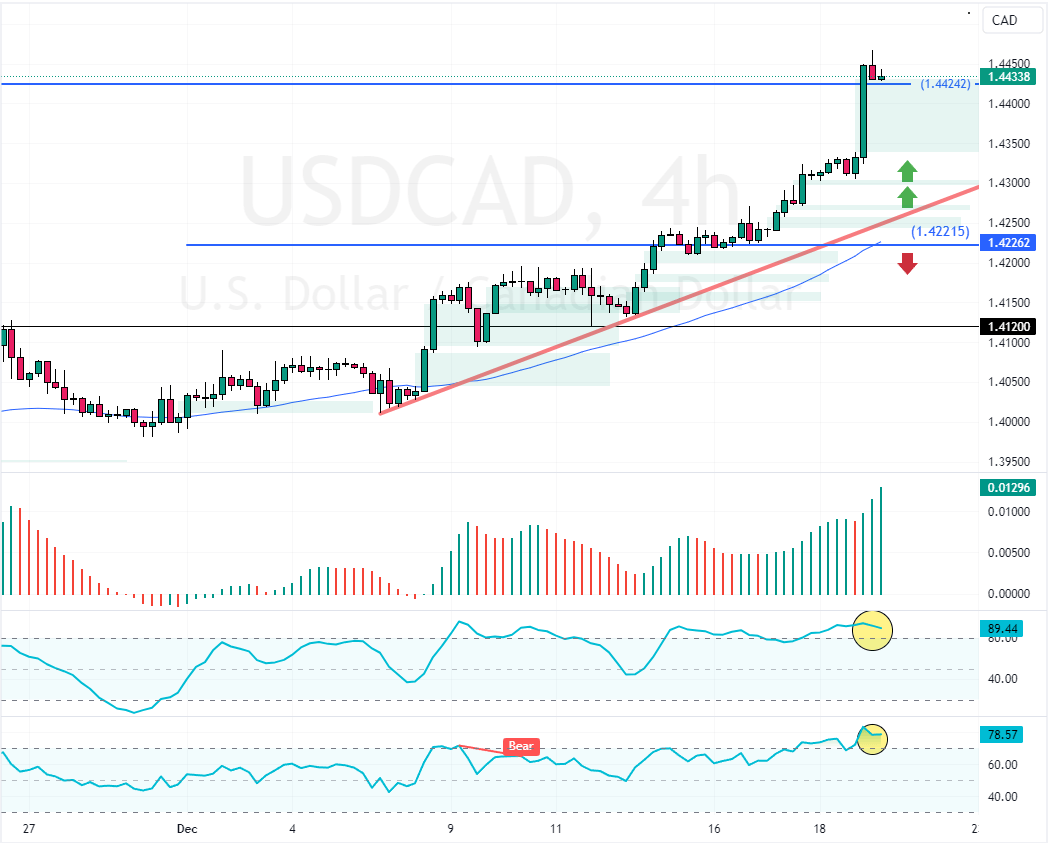

USDCAD uptrend resumed above the 50-period SMA, trading at approximately 1.443 amid overbought signals from Stochastic and RSI 14. Retail traders and investors should wait patiently for the currency pair to consolidate near 1.41.

USDCAD Technical Analysis – 19-December-2024

The Greenback trades a strong uptrend against the Canadian dollar, above the 50-period SMA. While the Awesome Oscillator histogram is green and above zero, RSI 14 and Stochastic hint at an overpriced U.S. dollar.

These developments in the technical indicators suggest while the primary trend is bullish, USD/CAD has the potential to dip, testing the lower support levels before the uptrend resumes.

Watch USDCAD Prices at 1.422 and 1.412 for Bullish Entry

In this scenario, the 1.422 and 1.412 supply areas offer a decent and low-risk entry point for joining the USD/CAD uptrend. Therefore, retail traders and investors should monitor these levels for bullish signals, such as candlestick patterns.

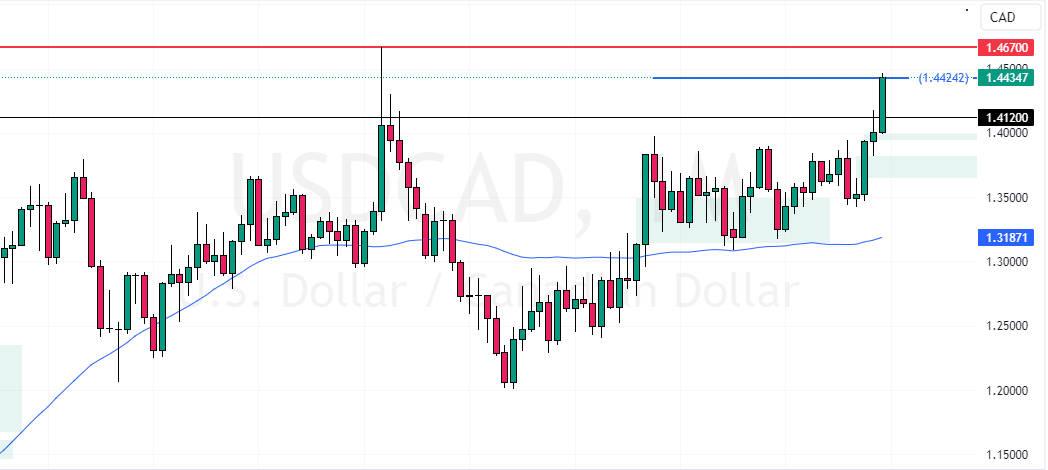

That said, the next bullish target will likely be 1.467 as long as the prices are above 1.412, a support area that divides the bull market from a bear market.