The Swiss franc has slightly strengthened to about 0.886 against the U.S. dollar, moving away from recent four-month lows due to a weaker dollar influenced by developments in U.S. fiscal policy. Strong economic data from the United States has led to expectations that the Federal Reserve might slow down its pace of interest rate cuts.

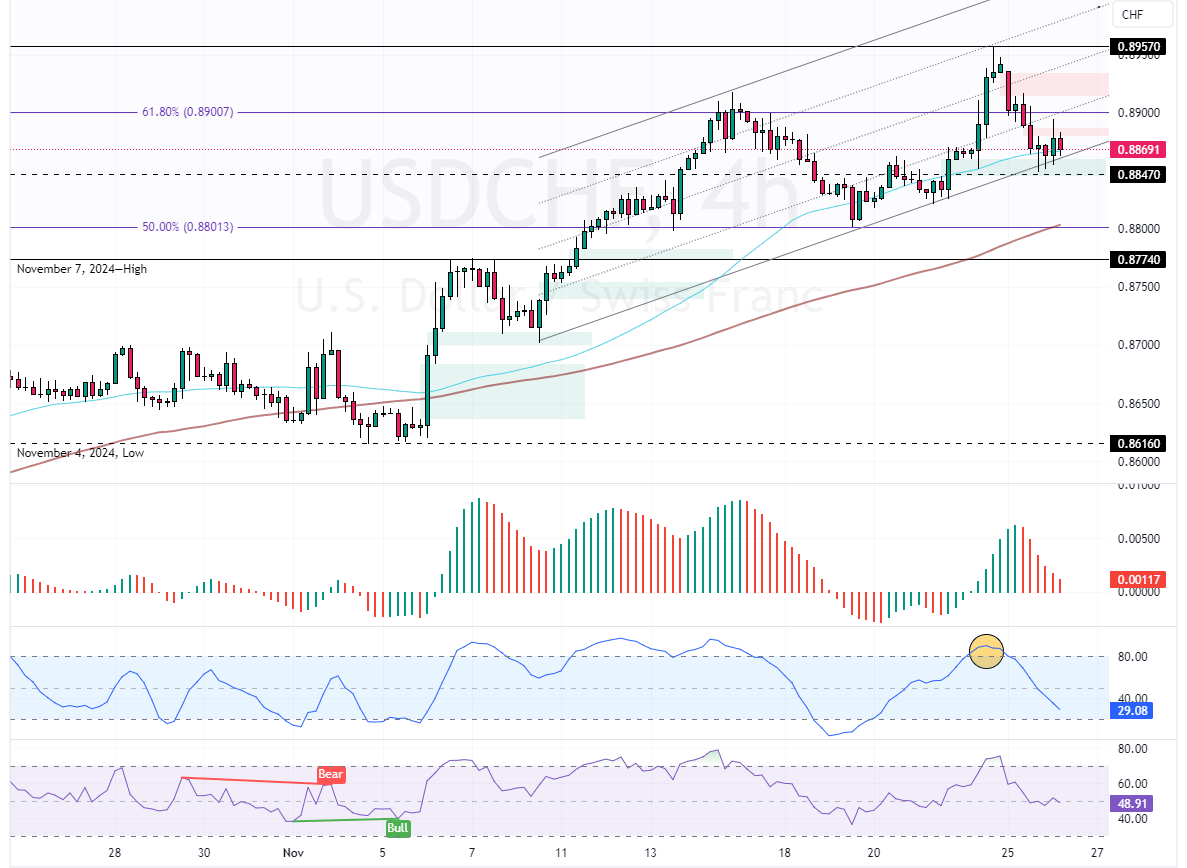

As of this writing, the USD/CHF pair trades at approximately 0.558, testing the ascending trendline as support.

SNB Likely to Cut Rates Amid Low Inflation

In Switzerland, a recent drop in inflation has led markets to anticipate further interest rate reductions by the Swiss National Bank (SNB) later this year and into 2025 to combat deflationary pressures.

SNB Chairman Thomas Jordan emphasized that the central bank will continue prioritizing low inflation within the 0-2% target range, noting that this focus has been crucial to Switzerland’s robust economic performance in recent years.

Greenback Poised to Hit November Highs

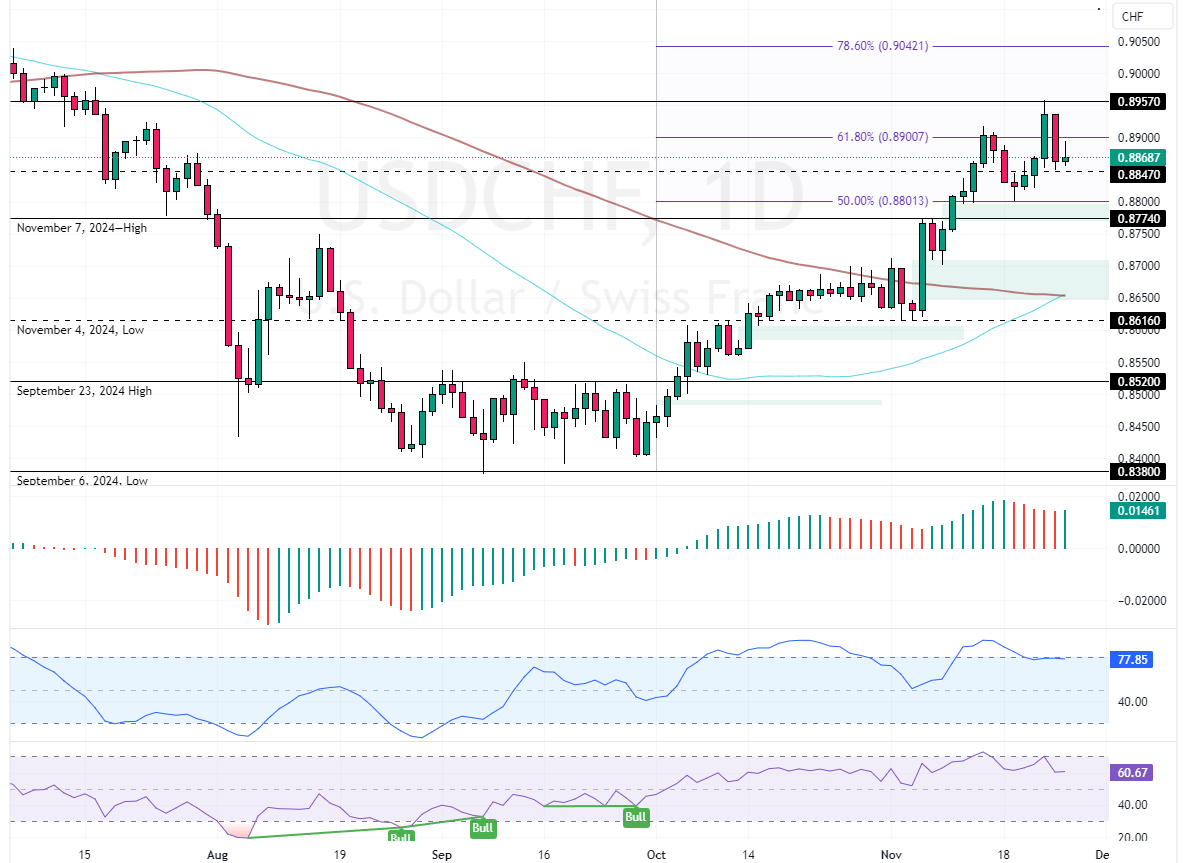

The currency pair’s primary trend is bullish because the prices are above the 50- and 100-period simple moving averages. The recent drop in the USD/CHF value was anticipated due to the Stochastics overbought signal.

That said, the immediate resistance is at 0.890. From a technical perspective, a new bullish wave could form if USD/CHF bulls close and stabilize the market above 0.890. In this scenario, the Greenback will likely march toward the November high at 0.895.

The Bearish Scenario

Please note that the bullish outlook of the USD/CHF pair should be invalidated if the prices dip below the immediate support at 0.8847. If this scenario unfolds, the current downtick in momentum could extend to the %50 Fibonacci retracement level at 0.880.

- Support: 0.8847 / 0.880 / 0.877

- Resistance: 0.890 / 0.895