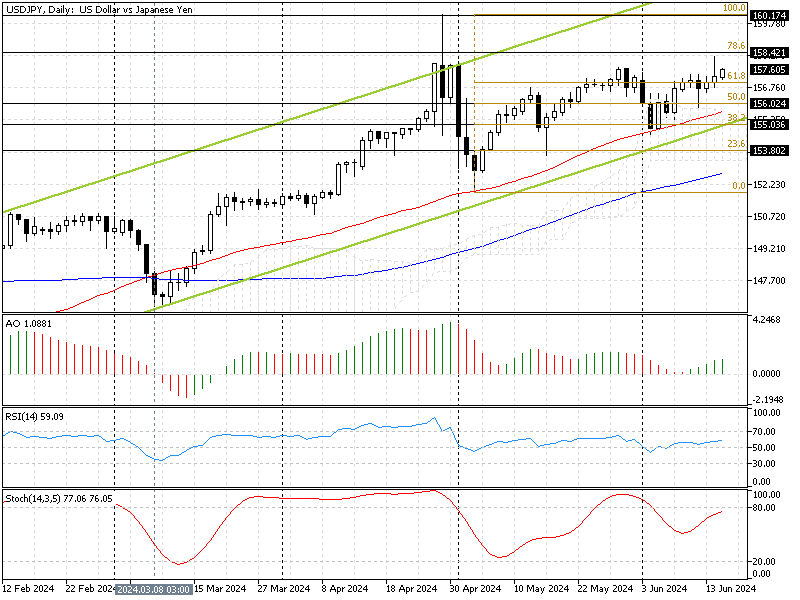

FxNews—The American dollar has traded bullish against the Japanese yen since January 2023. As of the time of writing, the USD/JPY currency pair trades at about 157.5, inside the bullish flag in the daily chart.

The technical indicators in the USD/JPY daily chart (image below) suggest the bull market prevails, and the uptrend will likely resume. The immediate target is April’s all-time high at 160.1.

The daily chart below shows the USD/JPY current exchange rate, the bullish flag, and the key technical indicators.

USDJPY Technical Analysis – 17-June-2024

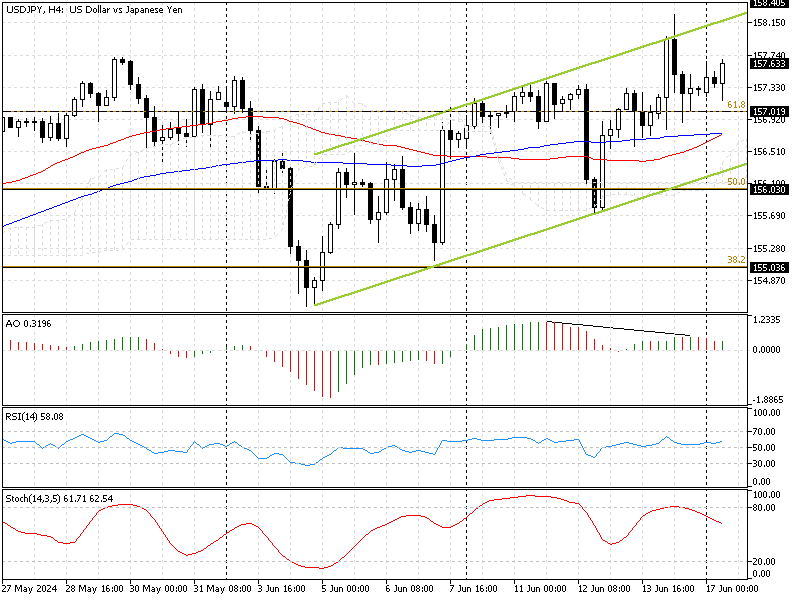

The bullish bias is evident in the trend by looking at the daily or 4-hour chart. The 4-hour chart below shows that the bulls have tapped the upper line of the bullish flag. As a result, the price returned to the 61.8% Fibonacci level at 157.0. But the bull market prevailed again, and the price bounced from the Fibonacci level in the discussion, resuming the uptrend trajectory.

The technical indicators suggest the primary trend is bullish, but the market might step into a consolidation phase.

- The awesome oscillator bars are above the signal line and rising with the current value at 0.31, meaning the bull market is gaining strength.

- The relative strength index (RSI) is above the median line, recording 57 and rising. This RSI (14) growth means the bull market momentum is growing.

- On the other hand, the stochastic oscillator declines, showing 62 in the description, signaling the trend is losing momentum.

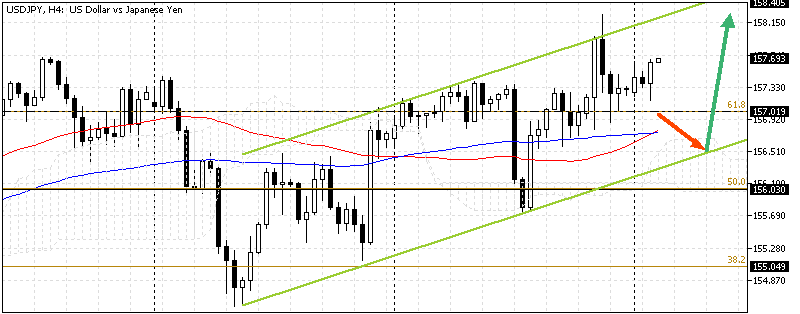

USDJPY Price Forecast – 17-June-2024

The primary trend of the USD/JPY currency pair is bullish. However, traders and investors should approach the market cautiously due to the awesome oscillator’s divergence signal. The AO’s divergence signal could lead the market into a consolidation phase, or the trend might change from a bull market to a bear market.

That said, waiting patiently for the Japanese Yen to erase some of its losses against the U.S. Dollar is recommended. In this scenario, the price might dip to the lower line of the bullish flag in the 4-hour chart at 156.0, a level backed by the 50% Fibonacci level and the Ichimoku Cloud. By monitoring this level for bullish candlestick patterns, such as a hammer or bullish engulfing patterns, traders can join the bull market at a reasonable price and with less risk.

The primary support for this scenario is the Ichimoku cloud. If the USD/JPY price flips below the Cloud, the bull market should be invalidated, and the price might dip to the lower resistance levels.

Bearish Scenario

The awesome oscillator divergence signal could lead the price to dip to lower support levels. If the USD/JPY price falls below the Ichimoku cloud at 156.0, the next support will be the 38.2% Fibonacci at 155.0.

If this scenario unfolds, the broken 50% Fibonacci at 156.0 and the Ichimoku Cloud will play the resistance to the downtrend.

USD/JPY Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 156.0 / 155.0

- Resistance: 158.4 / 160.1

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.