In today’s comprehensive USDJPY technical analysis, we will first scrutinize the current economic conditions in Japan. Following that, we will meticulously delve into the details of the technical analysis of the USDJPY pair.

BoJ’s Strategy Stance

Bloomberg – On Tuesday, the Bank of Japan (BOJ) maintained its negative interest rates while subtly shifting the language regarding its yield curve control (YCC) policy, signaling a potential increase in operational flexibility. Despite holding the short-term interest rate steady at -0.1%, the BOJ now references the upper limit of its YCC band—1%—as a guiding figure for market operations rather than a fixed ceiling.

This nuanced change in communication suggests a strategic pivot towards a more adaptable approach to monetary policy.

Inflation Projections and Economic Strategy

In the face of rising inflation and ongoing global economic challenges, the BOJ has reiterated its commitment to its aggressive asset purchase program and quantitative easing measures. The central bank’s steadfast approach aims to bolster the economy amidst the dual challenges of a weakening yen and persistent inflation.

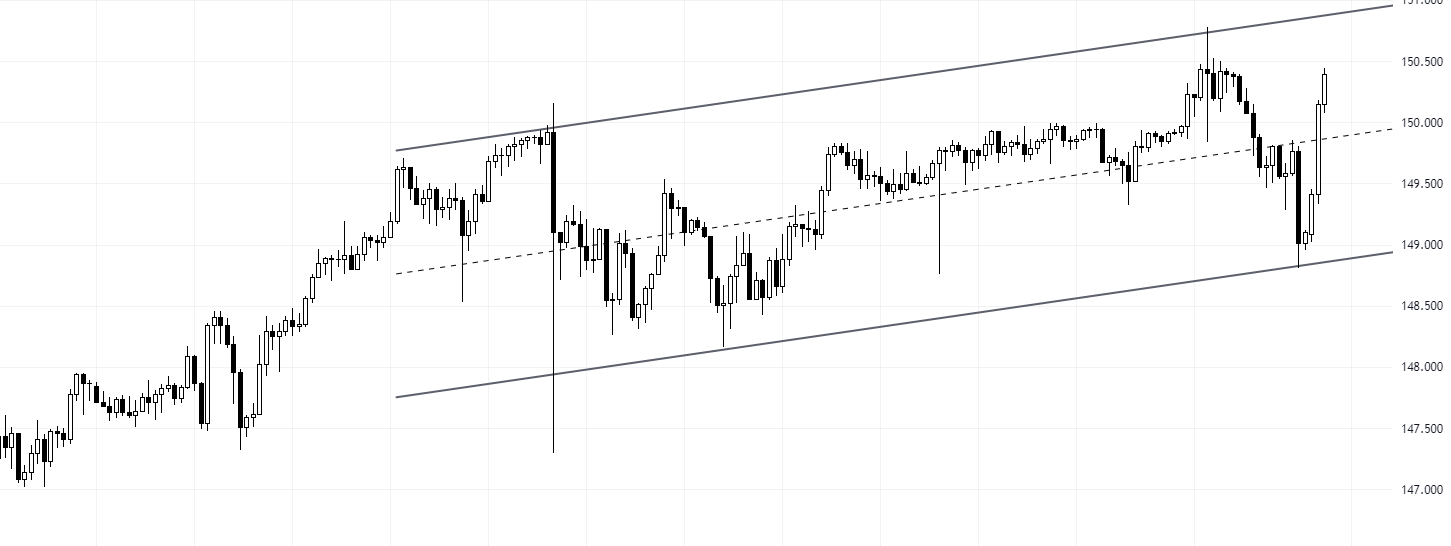

USDJPY Technical Analysis

FxNews – Following the BOJ’s announcement, the yen experienced a modest decline, dipping 0.5% and momentarily crossing the 150 threshold against the dollar. This reaction underscores the market’s anticipation of a potentially more assertive stance from the BOJ. Concurrently, yields on Japanese government bonds saw a reduction in gains, staying well under the 1% mark.

The BOJ has projected that core consumer inflation will hover above its 2% goal into fiscal 2024, with a tendency for price risks to tilt upwards for fiscal 2023. This outlook is partly driven by the anticipated impact of rising import costs, which are likely to be transferred to consumers by domestic businesses.

Recent statistics have confirmed these inflationary trends, with consumer prices in Japan climbing higher than anticipated in September and inflation in Tokyo surpassing forecasts in October. This marks a sustained period of inflation exceeding the BOJ’s target for a year and a half.

Economic Growth and External Pressures

The central bank has also signaled a potential deceleration in Japanese economic growth, exacerbated by the slowing economies of its major trading partners. This global downturn underscores the BOJ’s need to persist with its monetary stimulus initiatives.

Despite Japan’s economy showing relative resilience this year, the growth rate has moderated from quarter to quarter, pressured by rising inflation. The deteriorating economic conditions in key export markets pose additional challenges, indicating further headwinds for the world’s third-largest economy.