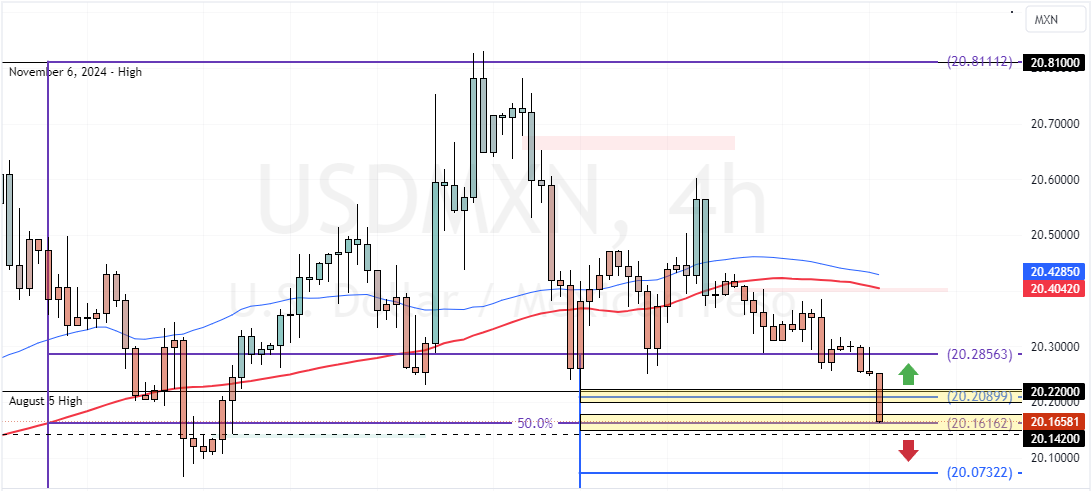

FxNews—The USD/MXN pair trades bearish, below the 50- and 100-period simple moving average. As of this writing, the currency pair tests the 50% Fibonacci retracement level at 20.16 as support.

USDMXN Technical Analysis

As for the technical indicators, we notice the Stochastic Oscillator is hovering in the oversold territory, showing 11 in the description. This means the Mexican peso is overpriced against the greenback, at least for a short while.

USDMXN Tests Key Support at 20.16

The immediate resistance is at 20.16, the 50% Fibonacci level. From a technical perspective, the bears should close and stabilize the USD/MXN prices below this resistance so that the downtrend can resume.

If this scenario unfolds, the next bearish target could be the 20.07 mark.

Bullish Scenario

The immediate resistance is at 20.20. The bearish outlook should be invalidated if USD/MXN exceeds this resistance level. In this scenario, the price could rise toward the 20.28 mark, backed by the 38.2% Fibonacci resistance level.