FxNews—The U.S. dollar pulled back from the July 11 low of 10.37 against the Swedish Krona, trading at about 10.51 in today’s trading session. The currency pair is currently testing the broken ascending trendline as resistance, backed by the 50-period simple moving average in the daily chart.

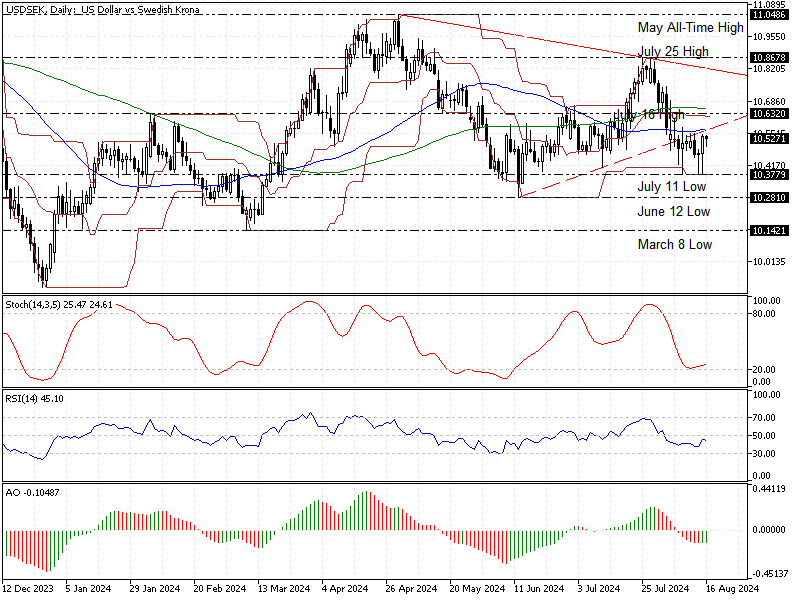

The USD/SEK D1 chart below demonstrates the price, key support and resistance levels, and the technical indicators utilized in today’s analysis.

USDSEK Technical Analysis – 15-August-2024

We zoom into the 4-hour chart to examine the price action and the indicators more closely. As the diagram above shows, the primary trend should be considered bearish because the price is below the 100-period simple moving average. However, the stochastic oscillator has stepped into overbought territory, signaling that the market is saturated from buying.

- The awesome oscillator bars are green and above the signal line, meaning the bull market strengthens.

- The relative strength index has flipped above the median line, recording 53 in the description, signifying that the bull market is gaining momentum.

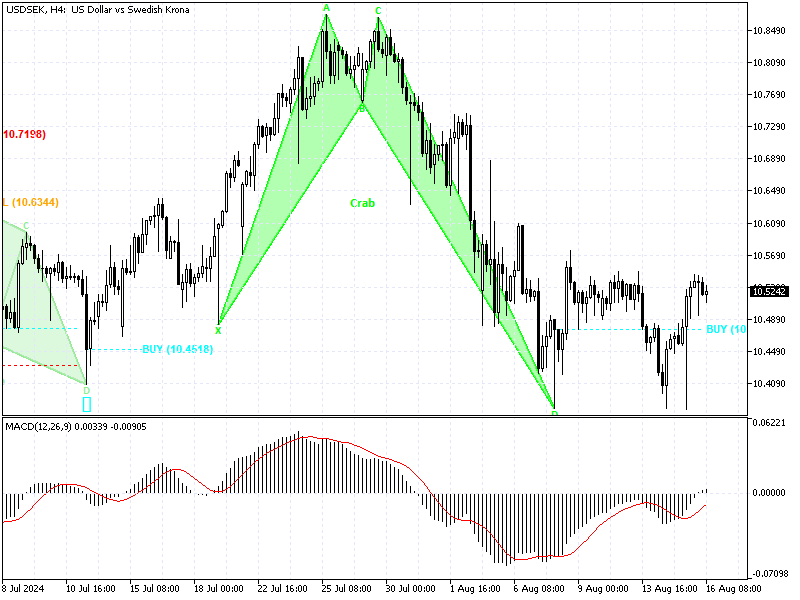

Moving forward to the harmonic pattern, we notice that the 4-hour chart formed a crab pattern, a trend reversal pattern. Interestingly, the MACD indicator signals divergence, which could result in a trend reversal, and it is worth mentioning that the MACD bars are flipped above the signal line.

Regarding the candlestick patterns, we notice a hanging man in the 4-hour chart close to the August 8 high at approximately 10.57. This means the USE/SEK price might resume the downtrend.

Overall, the technical indicators suggest the primary trend is bearish, but the market can reverse from a downtrend to an uptrend.

USDSEK Forecast – 15-August-2024

The key resistance to the bear market is the July 16 high at 10.63. From a technical standpoint, the primary trend will remain bearish if the USE/SEK price is below this resistance.

However, for the downtrend to resume, we need confirmation from the sellers, and that is closing below the July 11 low at 10.37. If this scenario unfolds, the bearish trend from the 10.86 mark will likely extend to the July 12 low at 10.28. Furthermore, if the selling pressure exceeds 10.28, the next supply zone will be the March 8 low at 10.14.

Please note that the bear market should be invalidated if the price exceeds the key resistance at 10.63, backed by the 100-period simple moving average.

- Also read: USD/PLN Forecast – 15-August-2024

USDSEK Bullish Scenario – 15-August-2024

The Crab harmonic pattern in the 4-hour chart supports the bullish scenario. However, only a breakout from the 10.63 key resistance level could trigger the bull market.

If this scenario comes into play, the pullback initiated this week will likely target the July 25 high at 10.86, backed by the descending trendline. Furthermore, if the buying pressure drives the price above the July 25 high, the next bullish target could be the May 2024 all-time high at 11.05.

Notably, the July 11 low at 10.377 will support the bullish scenario if the above-mentioned bullish cross occurs.

USDSEK Support and Resistance Levels – 15-August-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 10.37 / 10.28 / 10.14

- Resistance: 10.63 / 10.86 / 11.04

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.