FxNews—In the third quarter of 2024, confidence among businesses in Singapore’s manufacturing sector fell to 10, a significant drop from the previous quarter’s three-year peak of 23.

This downturn is largely due to a notable decline in confidence within the electronics industry, where sentiment fell from 40 to 14. The semiconductor sub-sector saw a particularly steep fall in morale, plummeting from 46 to 16.

Singapore’s Tech and Engineering Industry Sentiment Declines

Additionally, the outlook for computer peripherals and data storage turned negative, moving from a positive 17 to -9. There was also a slight decrease in optimism in the precision engineering sector, which dropped from 12 to 7, and in the general manufacturing sector, from 17 to 16.

On a more positive note, the chemicals sector slightly improved its outlook, moving from 2 to 3. The transport engineering sector also grew, increasing sentiment from 26 to 30. The biomedical manufacturing sector’s outlook adjusted to neutral, changing from -2 to 0.

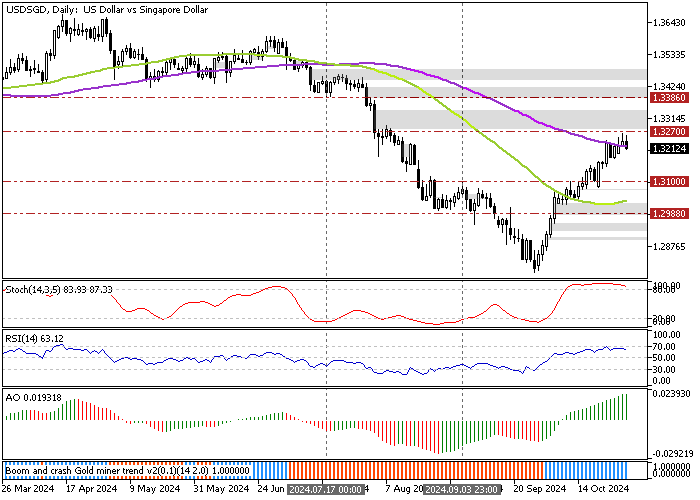

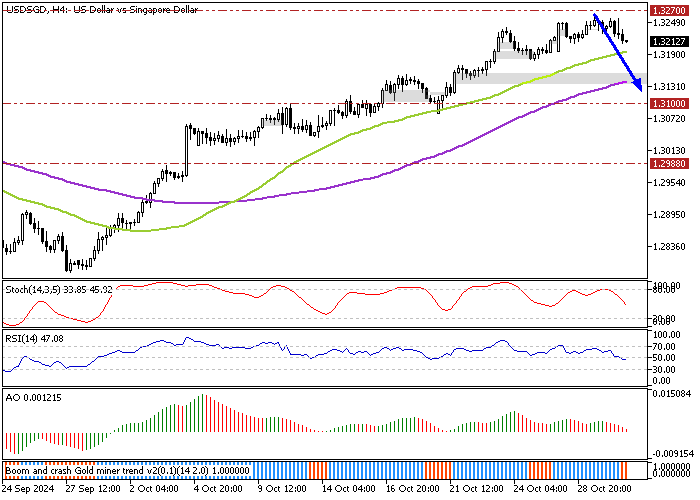

USDSGD Technical Analysis & Price Forecast

The U.S. dollar has been in a bull market against Singapore’s since September 27. The uptrend eased this week after the price tested the 100-period simple moving average as resistance at 1.327. This bullish barrier is in conjunction with the March 8 low, making it a strong resistance.

Concurrently, the Stochastic Oscillator hovers in the overbought territory, meaning the Greenback is overpriced against Singapore’s currency. Therefore, from a technical standpoint, a new consolidation is likely to begin if the 1.327 resistance holds. In this scenario, USD/SGD has the potential to decline toward the September 3 high at 1.31.

Bullish Scenario

Conversely, the bullish trend resumes if buyers pull USD/SGD above the critical resistance of 1.327. If this scenario unfolds, the next bullish target could be 1.3386, the July 17 low.

Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.310 / 1.2988

- Resistance: 1.327 / 1.3386