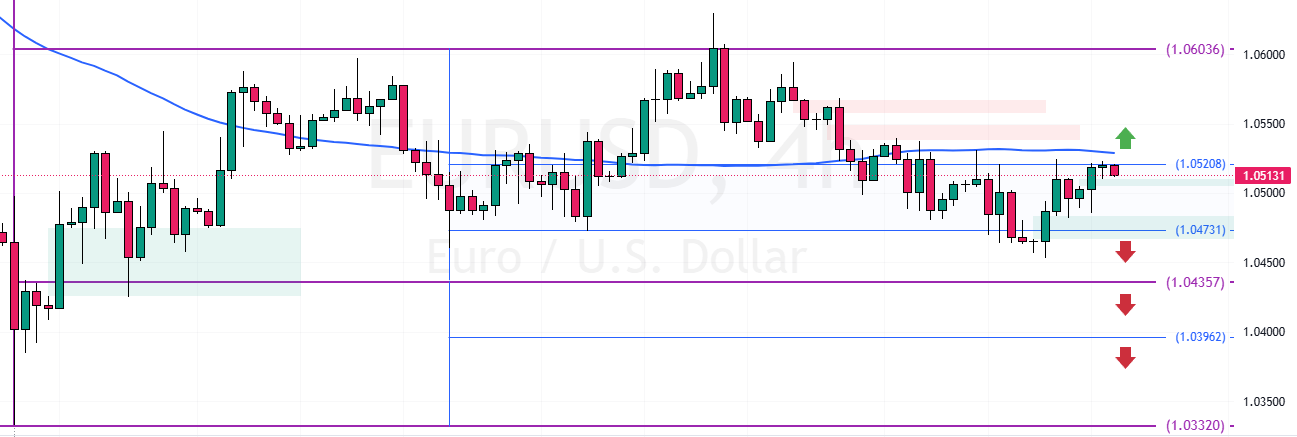

EUR/USD has been trading sideways in a low-momentum market since November 22. A dip below $1.047 could trigger the downtrend, targeting $1.043 followed by $1.039.

EURUSD Technical Analysis – 16-December-2024

FxNews—The currency pair has been trading a low-momentum market, below the 75-period simple moving average. That makes the trend mildly bearish. However, technical indicators such as Awesome Oscillator and Stochastic demonstrate bullish sentiment.

- AO bars are green, nearing the zero line.

- Stochastic records show 72, meaning the euro is not overbought and can potentially rise higher.

Overall, the technical indicators show that the primary trend is bearish and requires a support breakout to resume.

EURUSD May Target $1.043 and $1.039 on Dip

The immediate support is at $1.047. If sellers push the prices below this support, the downtrend will likely be triggered. In this scenario, EUR/USD can dip to $1.043.

Furthermore, if the selling pressure exceeds $1.043, the bears’ path to $1.039 could be paved.

EURUSD Bullish Scenario

Please note that the bearish outlook should be invalidated if EUR/USD closes and stabilizes above $1.052. If this scenario unfolds, the currency pair’s value could rise toward the $1.06 critical resistance.