U.S. natural gas futures rebound as demand grows and exports rise, balancing weather-driven shifts in heating needs.

U.S. natural gas futures have recently rebounded from $2.84, showing stronger demand than expected. Even though warmer weather usually cuts heating needs, growing exports have kept prices buoyant by balancing shifts in consumption.

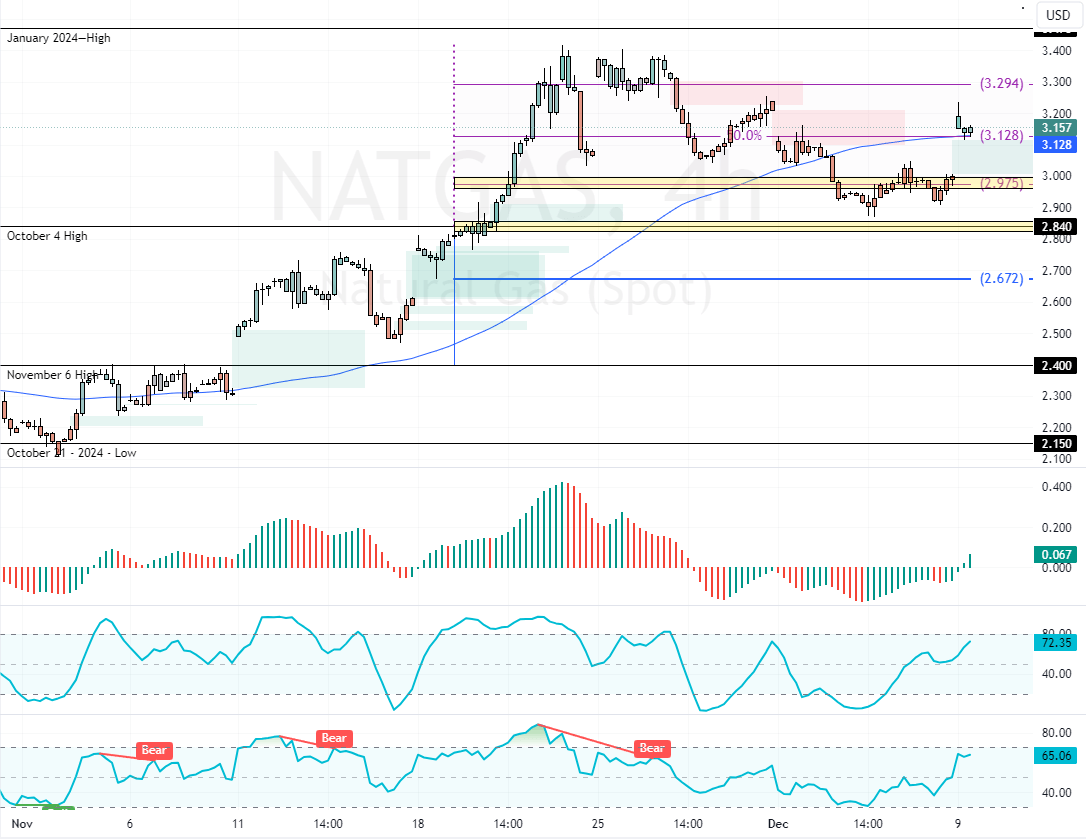

As of this writing, NATGAS trades at approximately $3.12, slightly above the 50.0% Fibonacci level.

- Demand is now higher than forecasts

- Recent rebound after a price drop

- Weather less impactful than anticipated

Growing LNG Exports Strengthen Market Conditions

Increasing feedgas supply to natural gas (LNG) facilities has pushed export volumes toward record highs. These higher export numbers help maintain steady demand, making U.S. natural gas more attractive to buyers, even as domestic weather patterns shift.

- Also read: Gold Prices Reach $2660 Amid Global Tensions

Future Production Growth and Storage Factors

Analysts expect production to rise in the coming years due to strong export demand and price improvements. Meanwhile, U.S. gas storage levels, though tapped by recent withdrawals, remain significant, ensuring that supply can meet growing market needs.