Cathie Wood’s ARK Invest made a new move in the crypto market by buying $2.2 million worth of Coinbase (COIN) shares. This marks the firm’s first purchase of Coinbase stock since September 11. ARK Invest added 12,994 COIN shares to its Fintech Innovation ETF (ARKF) earlier this week.

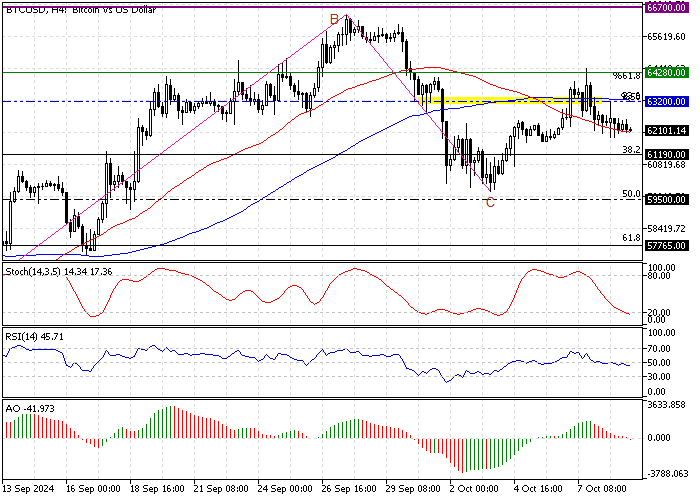

The chart below demonstrates the Coinbase shares, trading at approximately 167.6 as of this writing.

ARKF’s Growing Stake in Coinbase

With this purchase, ARKF’s investment in Coinbase has increased. It now holds about $67 million in COIN stock, which makes up 7.43% of its total value.

Despite this, COIN shares dipped slightly, closing 0.73% lower at $167.69 on the day of the purchase. However, ARK Invest seems to see potential in Coinbase, perhaps anticipating a rise in the stock value as the cryptocurrency market shows signs of life.

Recent Performance of Coinbase Stock

Since ARK’s last acquisition of Coinbase shares, the stock has risen by about 6.5%. But it’s still 20% below its level in late August, suggesting the market is still uncertain.

In October, Bitcoin prices tend to surge historically, which could be one reason ARK chose to boost its Coinbase stake now. A rise in Bitcoin often leads to increased trading activity on crypto exchanges like Coinbase, potentially driving up COIN’s value.

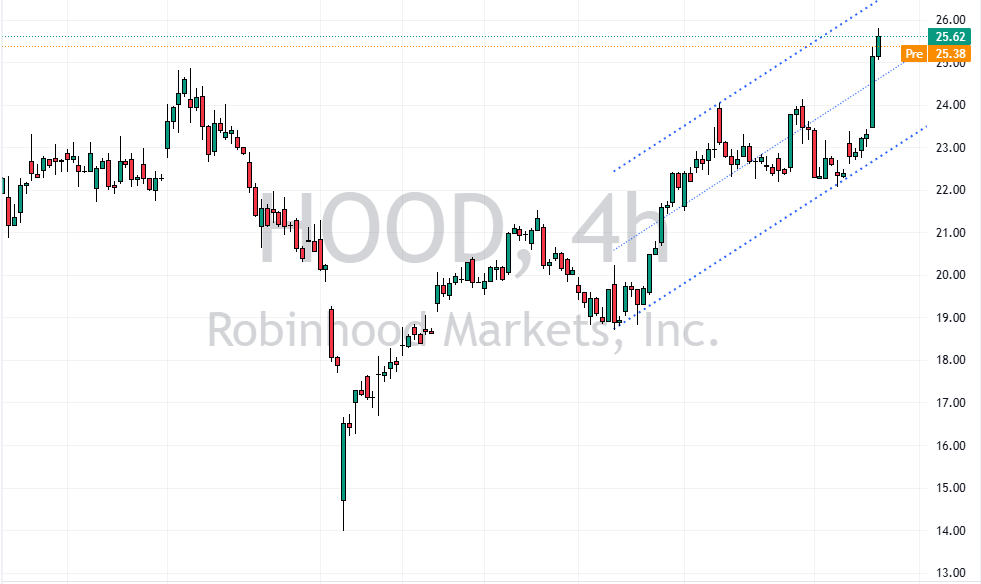

ARK Adjusts Its Holdings in Robinhood

At the same time, ARK adjusted its holdings in Robinhood (HOOD). The firm sold 135,665 shares of Robinhood, valued at nearly $3.5 million. This move was likely to meet an SEC regulation limiting how much exposure funds can have to certain companies.

Specifically, the SEC rule prevents funds from holding more than 5% of their portfolio in companies that earn over 15% of their revenue from selling securities.

Robinhood’s Stock on the Rise

Despite ARK’s decision to sell some of its Robinhood shares, the stock increased significantly, jumping nearly 10% and closing at $25.38 on Tuesday. This could indicate positive market sentiment around Robinhood, even as ARK adjusts its portfolio.

Conclusion: ARK’s Strategy for the Crypto Market

Cathie Wood’s ARK Invest continues to strategically manage its positions in the volatile fintech and crypto space. By increasing its investment in Coinbase, ARK may be positioning itself for future gains if the crypto market rebounds.

At the same time, reducing Robinhood shares ensures compliance with regulations, showing ARK’s careful balancing of opportunities and risks in its portfolio.