The Reserve Bank of Australia (RBA) noted in its September meeting that underlying inflation remained high. However, it expected the headline Consumer Price Index (CPI) for August to be below 3%, mainly because government electricity support provides some relief to households.

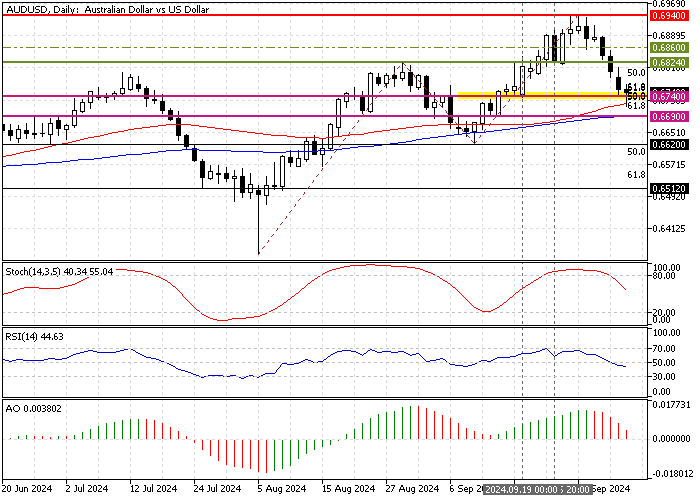

As of this writing, the AUD/USD currency pair trades at approximately $0.674, bouncing from the Fibonacci cluster. The daily chart below demonstrates the price and the key support and resistance levels.

Monetary Policy to Stay Restrictive

The RBA emphasized that monetary policy would need to stay tight until it is confident that inflation is moving toward the target range of 2-3%. This means interest rates will likely remain higher for longer to help control rising prices.

Furthermore, Australia’s economy has been underperforming, with GDP growth weaker than anticipated. Household spending, in particular, has been disappointing, and the export forecast has worsened, which could further drag down future growth.

Labor Market Still Tight but Easing

Although the labor market is still tighter than expected for full employment, it has begun to ease as predicted. This suggests that while jobs are still available, fewer opportunities may exist compared to previous months.

RBA’s Independent Stance on Interest Rates

The RBA also discussed global trends in monetary easing but decided that Australia doesn’t need to follow other countries in reducing interest rates. More substantial inflation and labor market conditions at home justify keeping rates higher rather than moving in sync with global economic shifts.

AUDUSD Technical Analysis – 8-October-2024

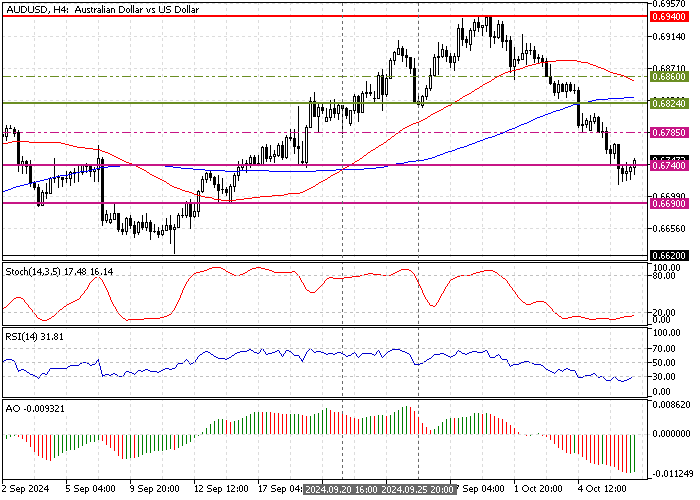

The Australian dollar is in a bear market against the U.S. dollar, trading slightly above the $0.674 resistance. The primary trend is bearish because the AUD/USD price is below the 50- and 100-period moving averages. However, the momentum indicators signal the market is oversold.

- The Stochastic oscillator depicts 17 in the description, meaning the U.S. Dollar is overpriced in this situation.

- The Relative Strength Index indicator returned from oversold territory, recording 32 in the description, signifying that the bull market gained some momentum.

Overall, the technical indicators suggest the primary trend is bearish. However, the AUD/USD pair has the potential to consolidate near the upper resistance levels.

AUDUSD Forecast – 8-October-2024

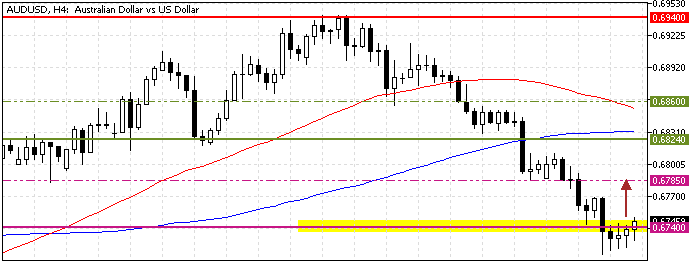

The key resistance level that eased the bear market is at the September 19 low, the $0.674 mark. From a technical perspective, due to the oversold condition, the AUD/USD bulls can raise the price and target the immediate resistance area at $0.6785 (September 20 Low).

Furthermore, if the buying pressure pulls the price above the $0.6785 mark, the next bullish target could be the September 25 low at $0.6824, backed by the 100-period simple moving average.

Please note that the bull market should be invalidated if the AUD/USD price dips and stabilizes below the $0.674 support.

- Also read: GBPUSD Consolidates as FTSE 100 Dips

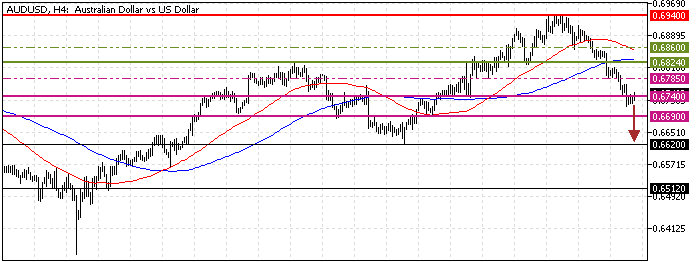

AUDUSD Bearish Scenario – 8-October-2024

The downtrend will likely resume if the bears (sellers) stabilize the price below the immediate resistance at $0.674. If this scenario unfolds, the bears will move to the next supply area at $0.669.

Please note that the bear market should be invalidated if the price exceeds the 100-period SMA or $0.682.

AUDUSD Support and Resistance – 8-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $0.674 / $0.669

- Resistance: $0.678 / $0.682