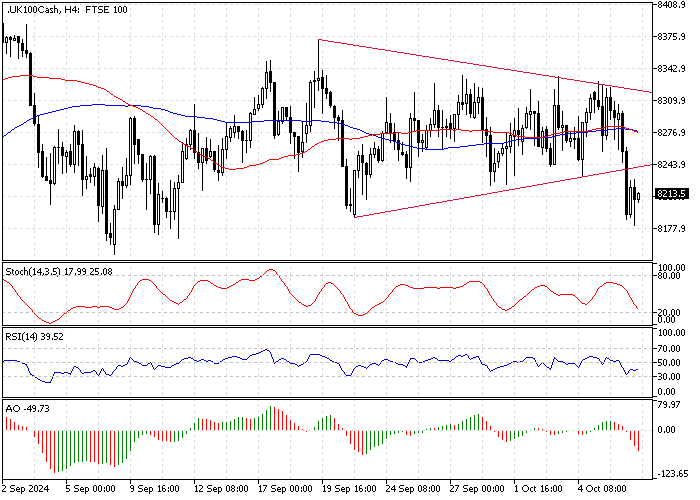

The FTSE 100 faced significant declines, closing by 1.4% at 8,190 this Tuesday. This drop was notably steeper than observed in other major European stock markets. The downturn was mainly due to the Chinese government’s lack of new supportive measures, which affected large mining companies.

The daily chart below shows the FTS100 price as of this writing.

Economic Decisions in China Impact Global Stocks

The Beijing Economic Planning Agency accelerated investments in crucial economic sectors and announced the issuance of new bonds. However, it stopped short of introducing new fiscal stimulus measures. This was contrary to market expectations, leading to a drop in stock prices for companies involved in manufacturing and construction.

Leading Losers: Industrial Giants and Financial Firms

Among the hardest hit were the industrial and ferrous metal mining companies, with significant players like Rio Tinto, Glencore, Anglo-American, and Antofagasta seeing their stock prices fall between 5% and 7%.

Financial firms with substantial exposure to the Chinese market, such as HSBC and Prudential, also faced declines, dropping 4.2% and 4.5%, respectively.

Additionally, the real estate firm Vistry’s stock price drastically declined by 24% following a profit warning.

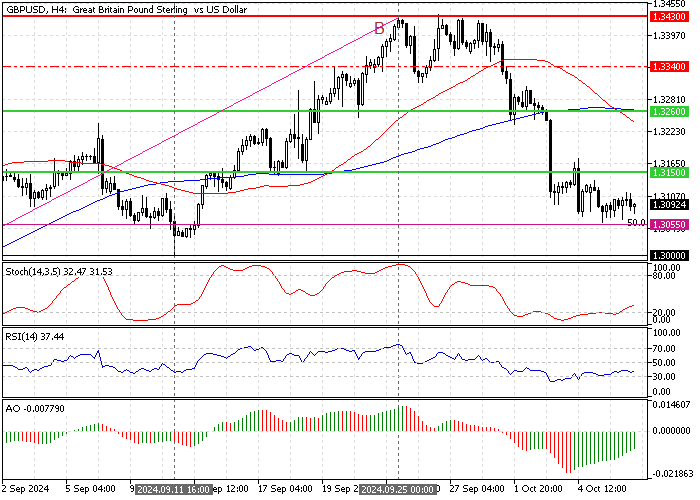

GBPUSD Technical Analysis – 8-October-2024

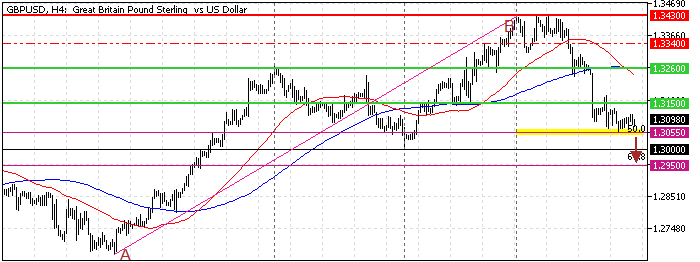

The British pound is in a downtrend, below the 50- and 100-period simple moving averages against the U.S. dollar.

Bearish pressure eased this week when the price dipped to the $1.305 mark, the 50% Fibonacci retracement level of the AB wave. Also, the Stochastic and RSI 14 warned about an oversold market; hence, the current sideways trading in the GBP/USD was long coming.

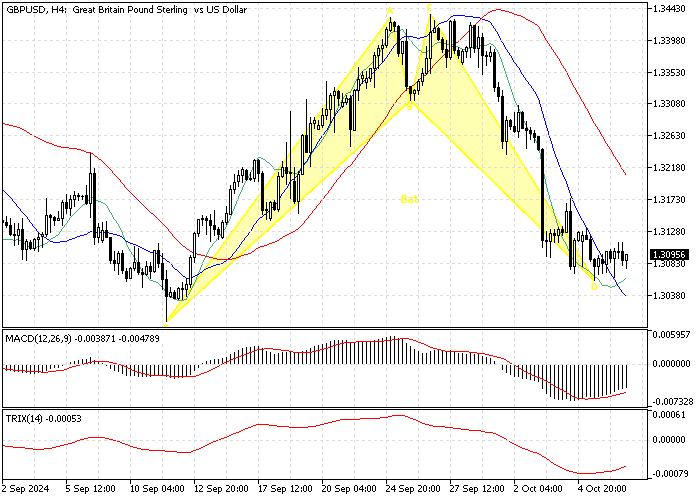

In addition to the momentum indicators, the Awesome Oscillator histogram approaches the signal line from below, signifying a weakening bear market.

As for the harmonic pattern, the 4-hour chart formed a bullish ‘bat’ pattern, signaling trend reversal.

Overall, the technical indicators suggest the primary trend is bearish, but the GBP/USD bulls have the potential to reverse it.

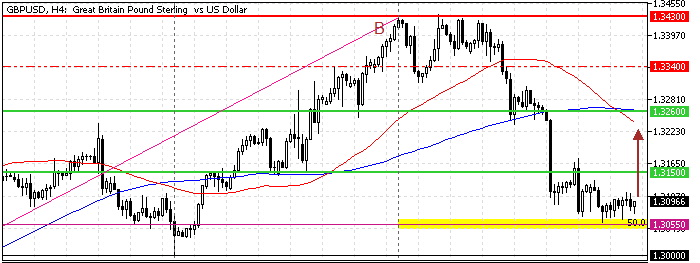

GBPUSD Forecast – 8-October-2024

The September 11 low at $1.30 is the immediate support. From a technical perspective, the GBP/USD bulls could target the 100-period simple moving average at $1.326 if the immediate resistance holds.

Please note that the bullish strategy should be invalidated if the price dips below the September 11 low at $1.30.

GBPUSD Bearish Scenario – 8-October-2024

The downtrend that began at $1.343 will likely be triggered again if the bears (sellers) close and stabilize the GBP/USD price below the critical $1.3 support level.

If this scenario unfolds, the next bearish target could be the %61.8 Fibonacci retracement level at $1.295.

GBPUSD Support and Resistance Levels – 8-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $1.3055 / $1.30 / $1.295

- Resistance: $1.315 / $1.326 / $1.334