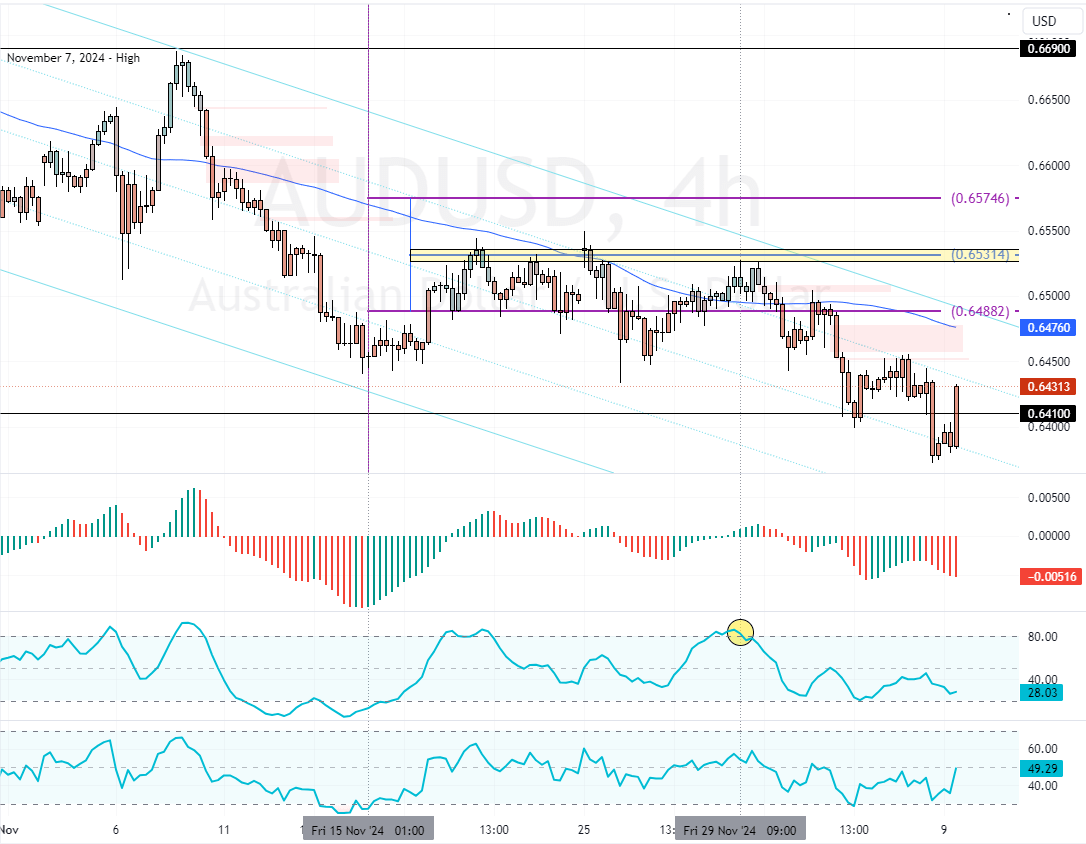

The AUD/USD currency pair stayed under $0.64 on Monday, close to its lowest point in over four months. Investors eagerly await the Reserve Bank of Australia’s (RBA) monetary policy decision this week.

However, most investors expect interest rates to remain unchanged. Concerns arise from Australia’s disappointing economic growth data, which revealed a mere 0.3% quarterly growth in Q3, falling short of the 0.4% expected.

Markets speculate the RBA may adopt a dovish tone, fueling discussions of a potential rate cut in 2024.

- Australian dollar under $0.64, a four-month low.

- GDP growth fell short at 0.3% vs. 0.4% expected.

- Possible RBA dovish stance heightens rate cut debates.

Australia’s Economy Faces Slowing Growth

Economic challenges are mounting as Australia’s growth struggles to meet expectations. The latest GDP data has raised concerns, particularly as quarterly growth dipped to 0.3%.

In response, the market is adjusting its outlook on interest rates, with the possibility of a February rate cut gaining attention. Even so, analysts predict a more traditional move by May. This economic uncertainty continues to weigh heavily on the Aussie dollar, with traders remaining cautious.

Global Factors Add Pressure on the Aussie

Weak inflation data from China, Australia’s largest export market, has further strained the currency. Inflation concerns in China suggest reduced demand for Australian exports, deepening the impact of domestic economic issues.

Moreover, traders are wary of external risks, including potential corrective tariffs. These global factors contribute to the Aussie’s struggle, amplifying concerns about its prospects.