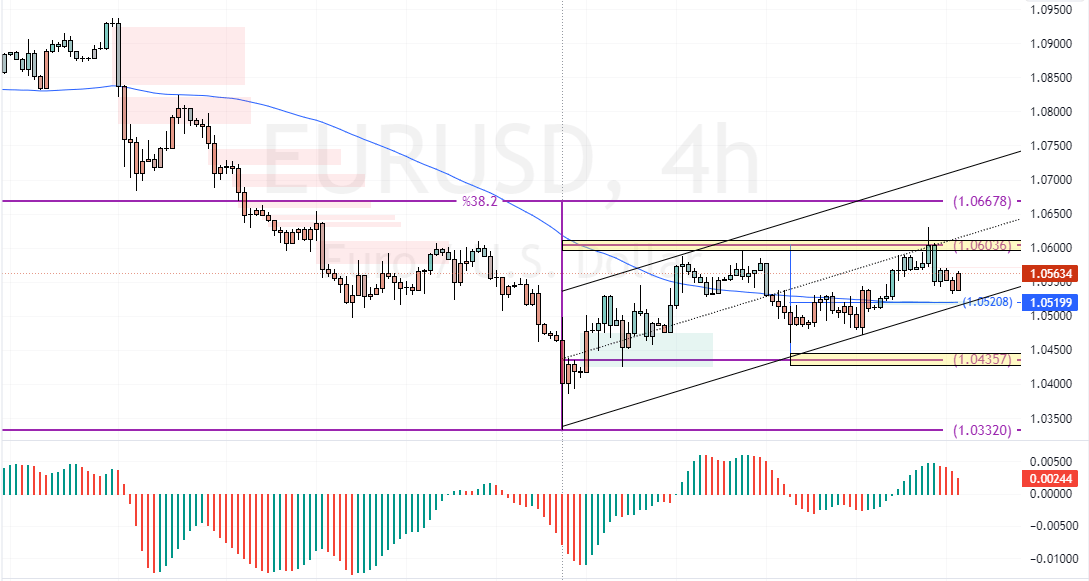

This week, the EUR/USD currency pair hovered near $1.056, reflecting cautious sentiment amid political and economic developments. In France, political turmoil eased when President Emmanuel Macron promised to appoint a new prime minister to secure parliamentary approval for the 2025 budget.

This commitment helped calm markets after initial fears of deeper instability. The euro briefly rallied on Thursday as France avoided a more chaotic outcome.

- The euro stayed near $1.06, maintaining stability.

- Macron’s move to secure budget approval reassured investors.

- France avoided a potentially destabilizing political crisis.

ECB’s Rate Cuts and Inflation Strategy

The European Central Bank (ECB) is expected to cut interest rates by 25 basis points next week, marking its fourth reduction this year. This move aligns with the ECB’s strategy to curb inflation and transition to a neutral policy rate of around 2%.

- Good read: USDJPY Steady at 150 As Japan Economy Grows

President Christine Lagarde has emphasized a cautious approach, favoring steady rate adjustments to support economic recovery while managing risks. Markets anticipate 125 basis points of easing by mid-2025, underscoring the ECB’s focus on stabilizing the Eurozone economy.

Diverging Monetary Policies: ECB vs. Fed

While the ECB is set to continue its easing trajectory, the US Federal Reserve is taking a more conservative stance. Despite strong jobs data signaling resilience in the US economy, bets on a December rate cut have risen.

This contrasts with the ECB’s proactive measures, highlighting different approaches to managing inflation and economic recovery. The Fed’s anticipated smaller rate cuts reflect its cautious optimism about maintaining economic momentum.