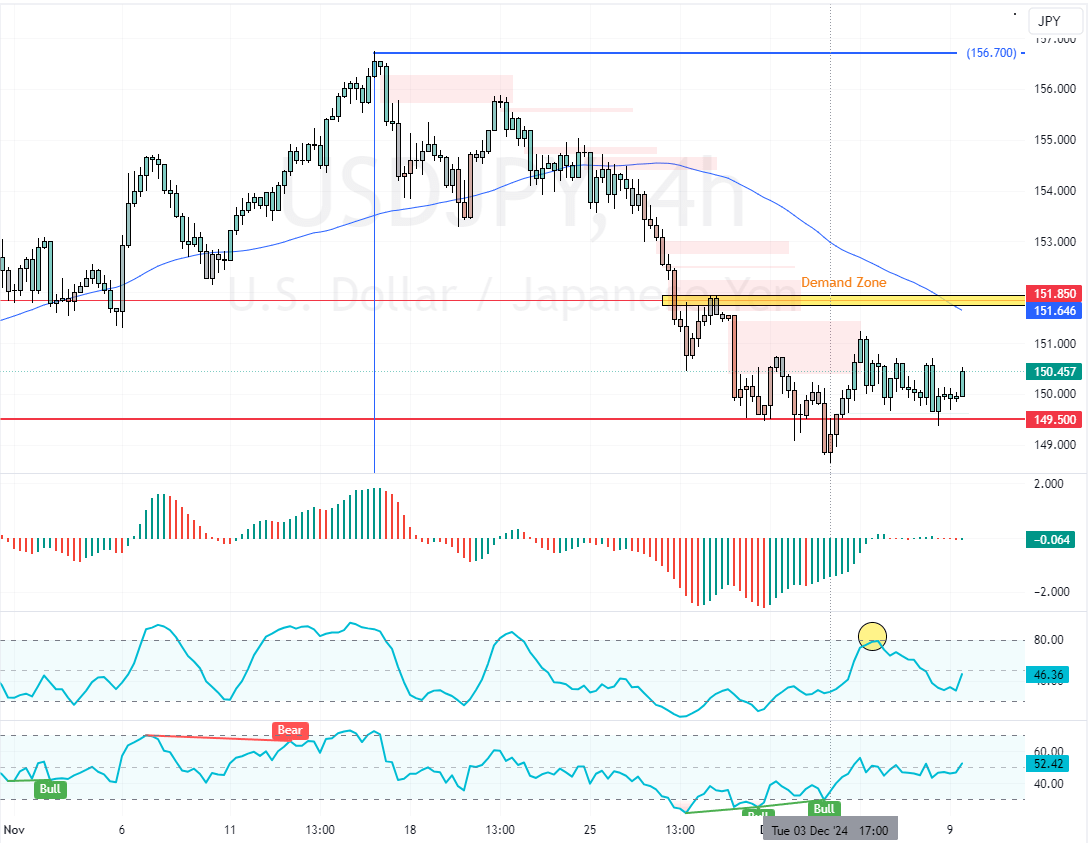

The USD/JPY currency pair held steady at around 150, reflecting calm market conditions. Investors watched as final growth figures for Japan’s economy surpassed earlier predictions.

- Japan’s Q3 growth revised up to 0.3%

- Stronger wage data signals improving labor market

- Investors split on the timing of the next BOJ rate increase

Japan Wages Beat Forecasts Boosting Economy

Recent data showed that Japan’s economy expanded faster than initial forecasts. This follows wage figures that exceeded expectations last week, painting a picture of a more resilient economic environment.

These positive signals suggest that the Bank of Japan may lean toward adjusting its policy stance sooner rather than later.

Bank of Japan Rate Hike Expected Soon

While some analysts expect a possible rate hike as early as December, others foresee a shift in January. The Bank of Japan’s Governor hinted at an increase aligned with current performance.

At the same time, a board member cautioned that wage gains might not last. This perspective creates an atmosphere of anticipation as the market awaits the central bank’s decision.