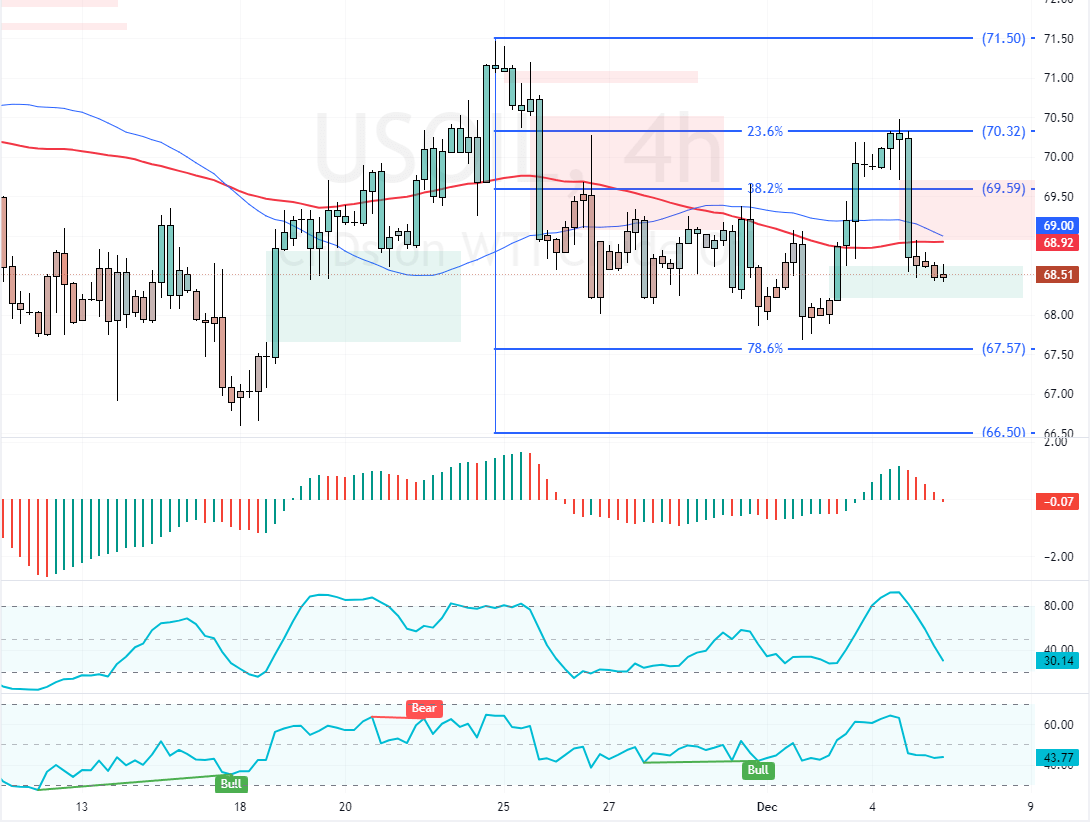

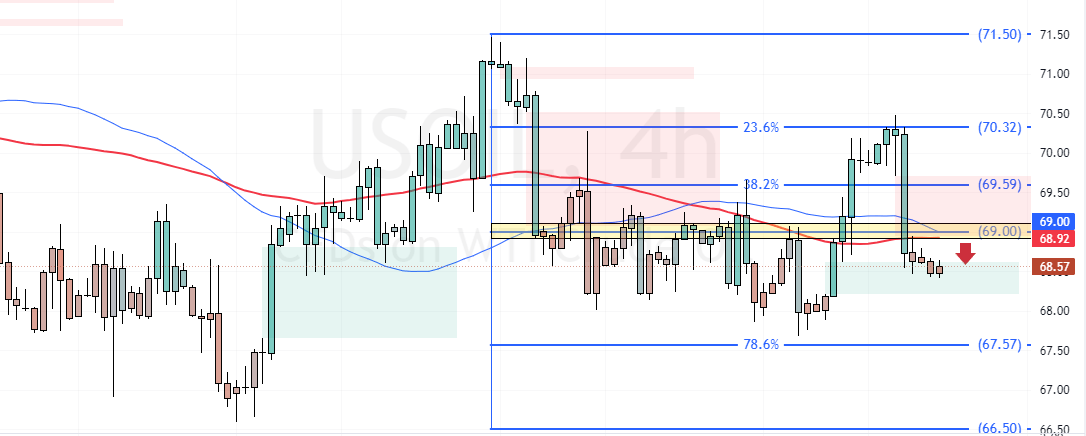

FxNews—WTI crude oil prices dipped from the 23.6% Fibonacci resistance level at $70, trading at approximately $68.6 in today’s trading session. Traders are closely watching the important OPEC+ meeting later today to see what decisions will be made about oil production policies.

- WTI crude oil holds at $68.5 per barrel after a recent decline.

- Traders anticipate key decisions from the OPEC+ meeting.

- Potential delay in output increase to prevent oversupply.

- OPEC+ Considers Delaying Output Increase to Avoid Glut

Oil Prices Set to Stabilize as OPEC+ Delays Output Hike

Reports suggest that OPEC+ is close to agreeing to postpone its plan to increase oil output by another three months. This move aims to prevent an oversupply in the market next year. They hope to stabilize the commodity‘s prices by holding back on increasing production.

Rising Geopolitical Tensions Affect Market

The latest EIA data presents a mixed outlook for the oil market. U.S. crude stockpiles fell by over 5 million barrels, the largest weekly decline since August.

However, nationwide crude production hit a record high, showing strong output from non-OPEC+ countries. Meanwhile, geopolitical tensions—including a shaky ceasefire in the Middle East and political unrest in South Korea—add uncertainty to the market.

Crude Oil Technical Analysis

Black gold trades bearishly below the 100-SMA. The immediate resistance is at $69.0. From a technical perspective, Oil prices could revisit the $67.5 support as long as the bears keep the market below the resistance.