United States natural gas futures have decreased to $3.04 per million British thermal units (MMBtu), hitting a two-week low. The price drop is mainly due to rising production levels and milder weather forecasts, which are expected to reduce demand.

- Natural gas prices fell to $3.04/MMBtu.

- This marks a two-week low in the market.

- Increased production is influencing lower prices.

- Forecasts predict milder weather, reducing demand.

December Sees Near-Record in Production

In December, natural gas production in the Lower 48 states increased to 101.9 billion cubic feet daily (bcfd). This represents steady growth since November and brings production close to all-time highs.

Experts Predict Natural Gas Price Recovery by 2025

Weather predictions from December 8 to 18 indicate warmer temperatures, which could lower gas demand from 135.9 bcfd this week to 127.7 bcfd next week.

Analysts anticipate that natural gas prices might recover by 2025 due to growing demand for liquefied natural gas (LNG) exports after an expected significant drop in 2024 caused by production cuts.

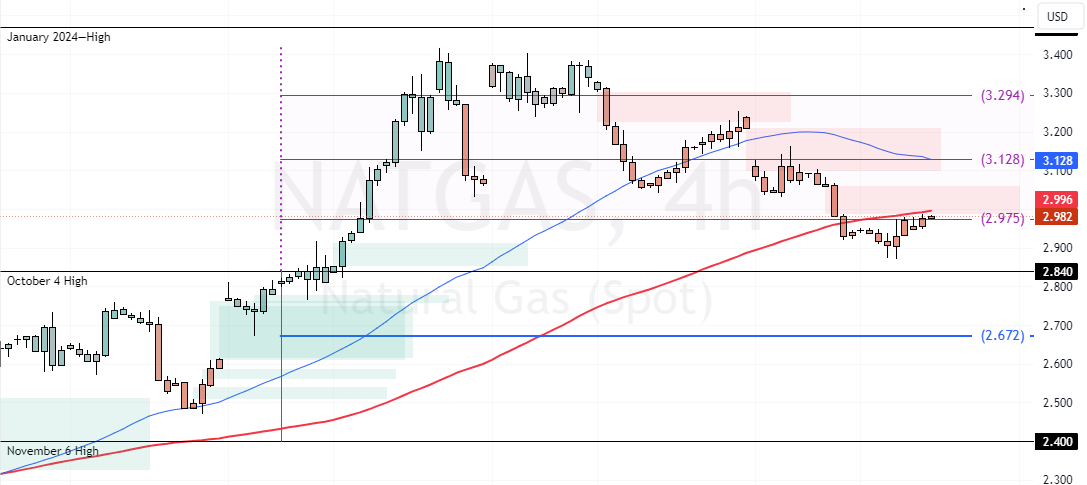

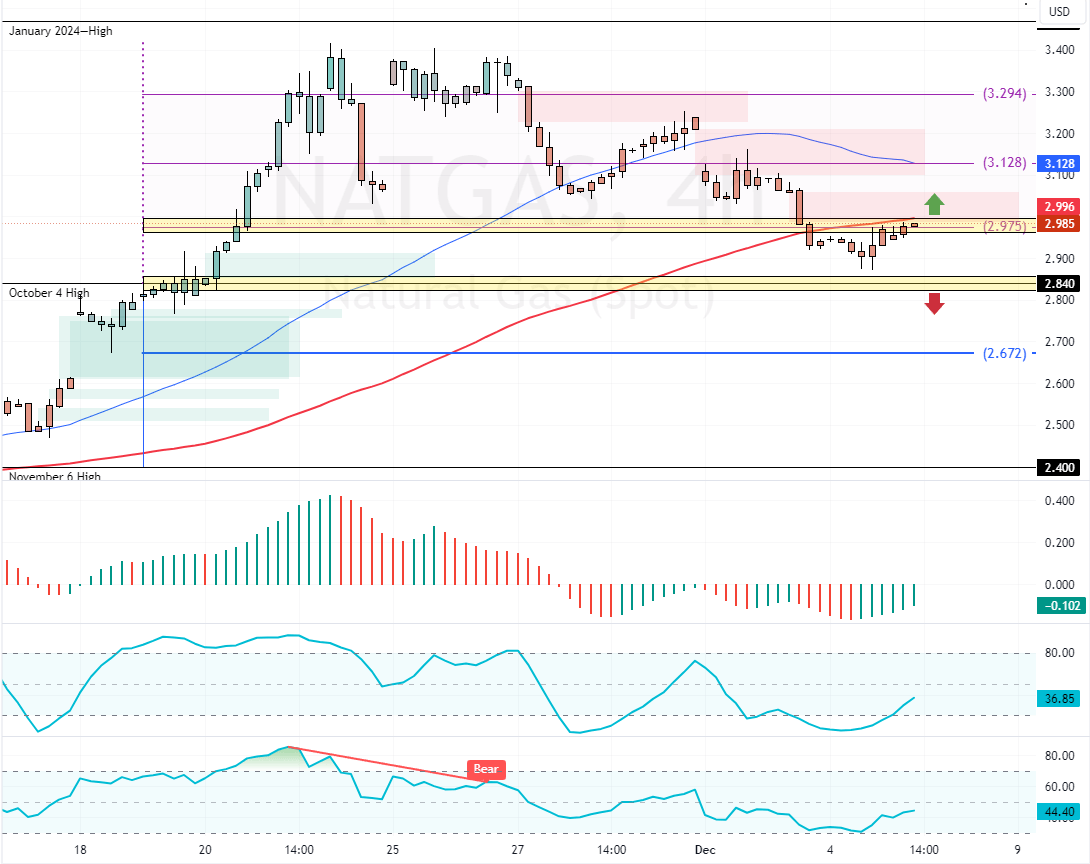

NATGAS Technical Analysis

The NATGAS prices are rising from the $2.84 critical support. Meanwhile, the Stochastic oscillator stepped outside the oversold signal, meaning the market is not saturated from sellers.

Immediate resistance is at $2.98, backed by the 100-SMA. From a technical perspective, the uptrend will likely resume if bulls stabilize NATGAS above this level. In this scenario, the next bullish target could be $3.12, backed by the 50-SMA.

The Bearish Scenario

Please note that a new downtrend wave could begin if Natural Gas prices dip below $2.84. If this scenario unfolds, the prices could dip toward $2.67.