FxNews—Hello and welcome. I am J.J. Edwards, and I will share my experience with the Envelopes indicator in this article. I will answer the most common questions and provide real-trading samples by delving into the deep details of the indicator.

The goal is to learn all aspects of this technical indicator. ‘How to read the envelopes indicator,’ ‘When and how to use the envelopes indicator on the forex chart,’ and the calculation and the best settings for the envelopes indicator.

If you’ve been following my articles on forex technical analysis, my market approach should already be familiar. A cornerstone of my technical analysis involves identifying overbought and oversold prices on the chart. Traders can anticipate market pullbacks by recognizing when the market is saturated due to buying or selling pressure. This classic strategy of mine aims to mitigate trading risks.

A multitude of indicators exist designed to help traders identify saturated areas. Among these, the envelopes indicator stands out as one notable example. This particular indicator bears similarities to the Bollinger band. If you’re unfamiliar with the Bollinger Band indicator, I recommend reading the article Unveiling the Secrets of Bollinger Bands Trading. I’m confident it will enhance your understanding of overbought and oversold conditions in the market.

Historical Background of Envelopes Indicator

FxNews—The Envelopes indicator is a vital tool in technical analysis. It is built on the principle of moving averages, which have been employed to even out price information and spot trends.

The Envelopes indicator enhances this principle by incorporating two additional moving averages set at a specific distance from the central line. This development probably came about as traders looked for methods to measure market volatility and conditions of being overbought or oversold.

What is The Envelopes Indicator?

The Envelopes indicator presents an additional trading strategy within a trend channel, either on a rollback or when the boundaries are breached. This tool, rooted in the concept of moving averages, constructs a dynamic range on the price chart. The price will oscillate within this range for most of the market duration.

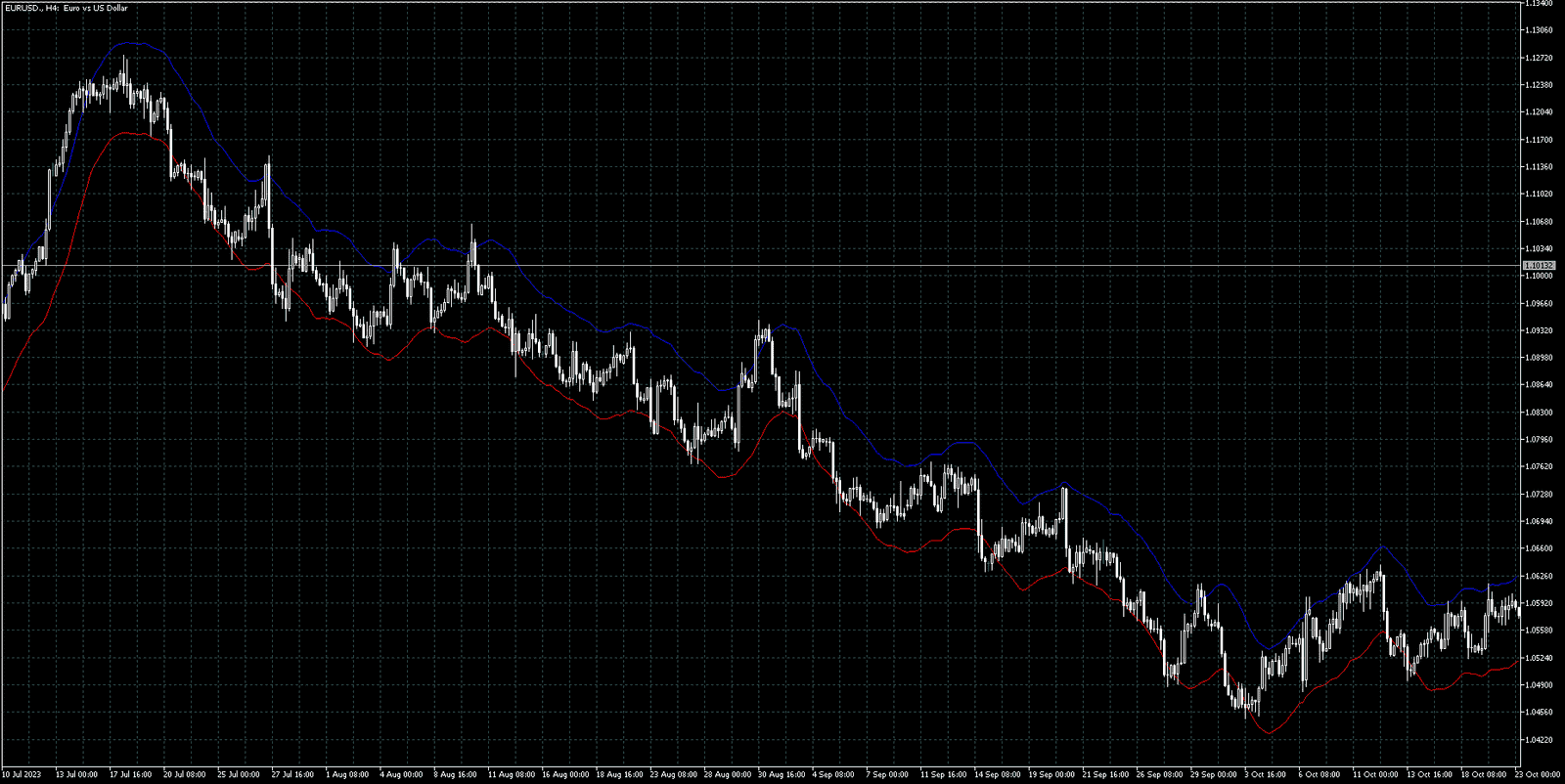

Let’s simplify the definition of the Envelopes indicator. Refer to the chart provided below. This chart illustrates the EUR/USD currency pair, specifically on a 4-hour timeframe from the fourth quarter of 2023.

While most traders primarily utilize the indicator for buy and sell signals, it’s important to note that it offers additional functionality. Specifically, envelopes can serve as a trader’s assistant, providing valuable insights into whether the market is trending or ranging.

This information is crucial, especially considering that ranging markets bounce erratically. As a result, trading in range markets often carries a greater risk than trading in trending markets.

There are three primary types of markets, and the indicator can assist us in identifying them.

- Bullish Market: This refers to a market condition where the price of a trading asset is on an upward trend.

- Bearish Market: Conversely, this is a market condition where the price of a trading asset is decreasing.

- Range Market: This describes a market condition where the price of a trading asset fluctuates within a narrow price range.

The direction of the indicator provides valuable insights. If it’s pointing upward, it signifies a bullish market, prompting traders to strategize their trades accordingly. If the indicator is trending downward, it suggests a bearish market.

Lastly, if the indicator channels move sideways, they indicate a ranging market. This information is crucial for traders to adapt their strategies to market conditions. The following image provides a sample of a ranging market.

How to Use the Envelopes Indicator in Forex?

Looking at the EUR/USD 4-hour chart, you’ll notice that the market fluctuates within the ‘envelopes’ line. This channel serves as an indicator of the potential price direction. In this case, the channel is trending downwards, suggesting a bearish market. In such a market, my strategy would be to seek selling opportunities.

At the heart of the moving average is a third line. This line signifies the average price over the 4 hours, given that our chart is set to that timeframe. If the chart were set to a 1-hour timetable or any other timeframe, the indicator would display the average price for that period.

The upper and lower bands act as buffer zones surrounding the middle one. All three lines are moving averages, forming a range within which the price might oscillate. Consequently, the indicator provides lagging data on the market’s potential bounce-off or rebound points. You can visualize it as a ball bouncing between these two bands.

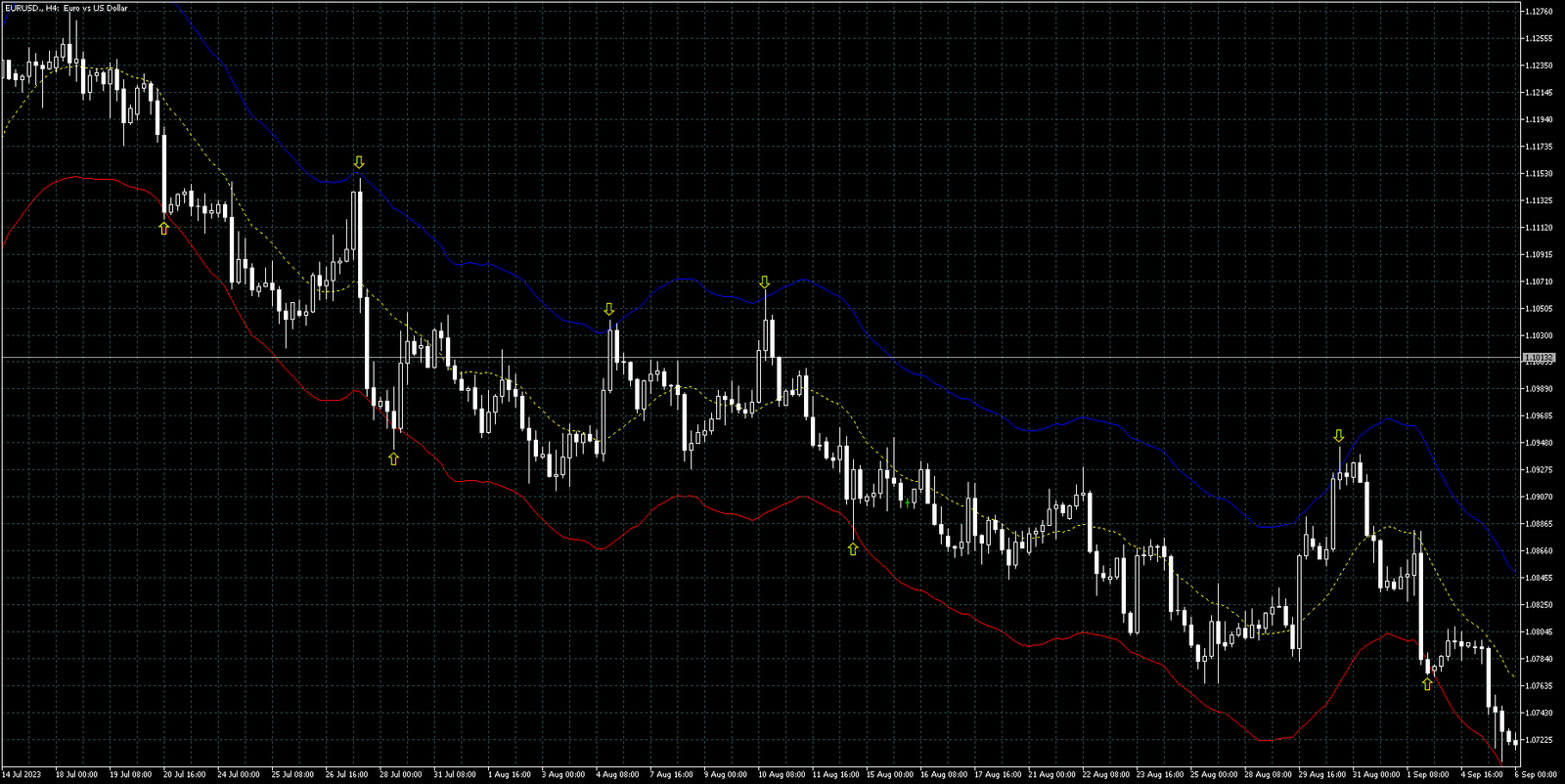

Please refer to the image below from the EUR/USD H4 chart. Note the areas where the market was breached.

Having observed the chart, I’ll explain the rollback and boundary-breaking strategies associated with the Envelopes indicator.

Envelopes Rollback Trading Strategies

One of the most popular strategies among traders using the indicator is the ‘Envelopes rollback.’

Envelopes rollback: There are instances when the market bounces as the price hits the upper or lower line of the indicator. In such cases, the market retreats into the tunnel, allowing the primary trend to persist.

The image below is a prime example of the ‘envelopes rollback’ signal.

Notably, the U.S. oil price bounced each time it made contact with either the upper or lower band. However, this image represents an ideal market condition where a trend is followed.

It’s important to remember that the market can display erratic behavior influenced by global economic conditions. Factors such as wars, changes in interest rates, or hawkish or dovish speeches from central banks can swiftly disrupt any technical analysis.

Envelopes Indicator Breaking Boundaries Trading Strategy

Breaking Boundaries: If the price of a trading asset breaches the top or bottom line and sustains there, it could indicate a substantial shift in price direction. Traders often use this as a hint to modify their trading strategies.

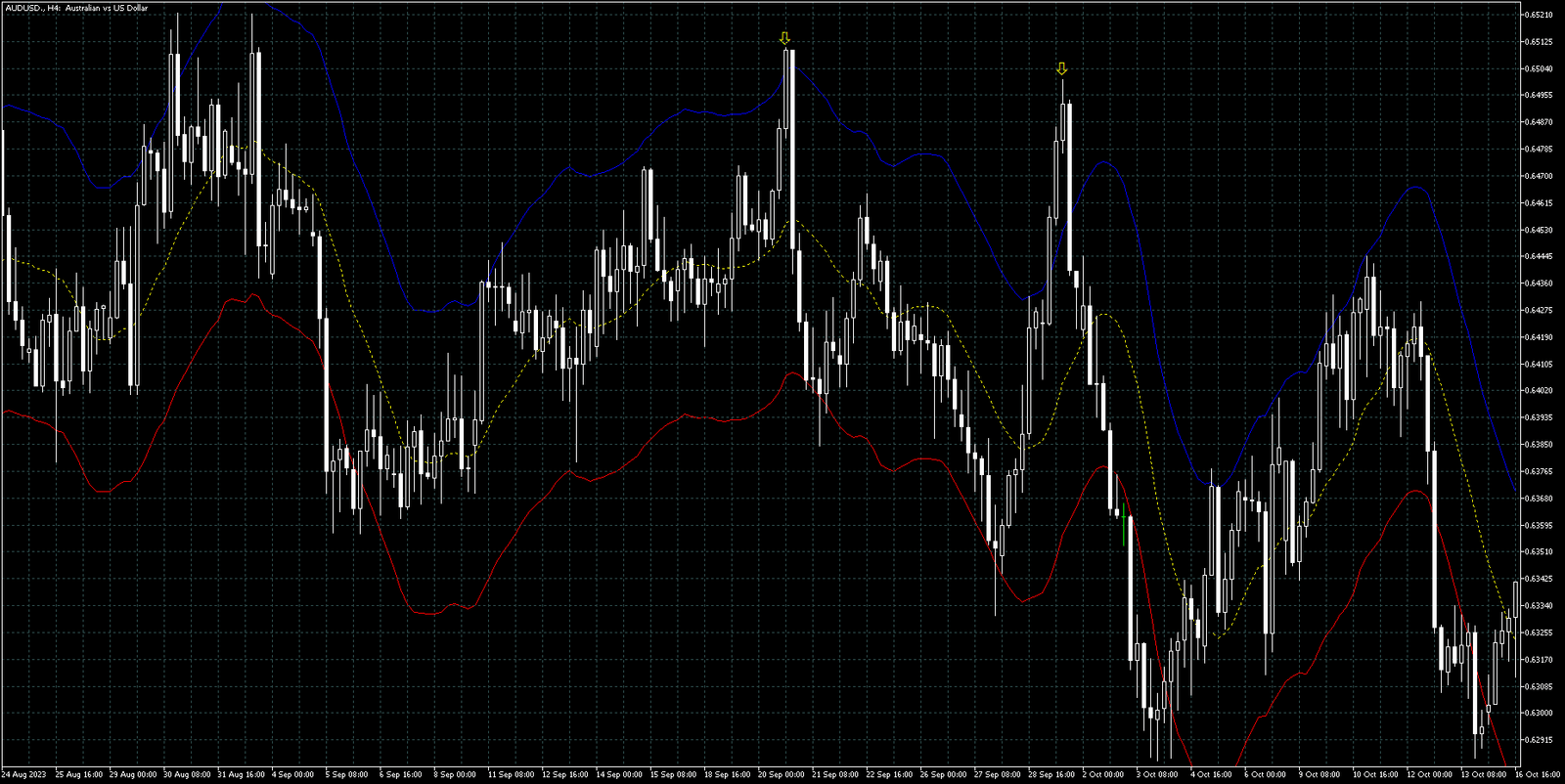

The chart below shows the AUD/USD currency pair on a 4-hour chart. A robust bullish bias pushed the AUD/USD price beyond the envelopes lines. The price remained outside the upper band for over 40 trading hours, suggesting the market was saturated for a prolonged period.

Interestingly, the more significant the overbought condition, the greater the potential market pullback. Think of it as a spring coil; the harder you compress, the higher it jumps.

That’s precisely how the AUD/USD price responded to the extreme bullish pressure. As a result, the pullback went beyond where the bullish wave had started.

Best Settings for the Envelopes Indicator

The indicator is composed of three moving averages. Interestingly, the flexibility of the indicator’s settings allows us to modify the types of these moving averages.

There are four types of moving averages in the indicator’s settings:

- Simple

- Exponential

- Smoothed

- Linear Weighted

In addition to the moving averages, three parameters can be adjusted within the indicator’s settings:

- Period: This is the number of periods used to calculate the moving average.

- Deviation or the percentage width: This is the percentage that determines the envelopes’ width. It’s set at a fixed rate above and below the moving average.

- Levels: This is for adding and customizing the horizontal line at specific values on the indicator’s chart.

The best setting for the indicator depends heavily on the market condition. The ideal way to find the best settings is to eyeball the upper and lower bands of the indicator. The bands of the envelopes must be near the highs and lows on the chart. We can tell if the indicator’s setting is wrong if the bands are too far from the highs or too close to the center.

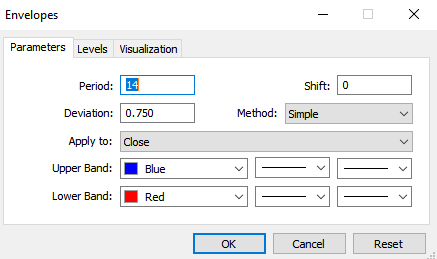

When you attach MetaTrader 5/4 to the chart, as shown in the image above, the indicator settings are completely off the grid.

The default settings of the indicator are as follows:

- Period: 14

- Shift: 0

- Deviation: 0.1

The setting’s deviation seems to be off, as evidenced by the bands sticking too close to the market’s center. For optimal results, the deviation should ideally range from 0.5 to 1

The Envelopes settings for the chart below are set as follows:

- Period: 14

- Shift: 0

- Deviation: 0.8

The chart shows lines for highs, lows, and overbought or oversold areas. Because the market constantly changes, you don’t need to dig into the chart’s past to adjust the settings. Based on the current market trend, this indicator’s settings are correct. Now that you understand the indicator, keep practicing and tweaking the settings to find your perfect fit.

How to Add Envelopes to MetaTrader 5

In this article, we are using the MetaTrader 5 platform. To add the chart to your MT5 platform, follow the step-by-step guide below:

- Open MetaTrader 5 by clicking on the icon from the desktop.

- Log in to your trading account from the terminal’s menu: File > Login to Trade Account.

- Attach a chart of your choice to the platform from the Market Watch window. The Market Watch window can be accessed by pressing Control + M together.

- Open the ‘Navigator’ window. The ‘Navigator’ window can be accessed by pressing Control + N.

- Double-click on the indicator or drag and drop it onto the chart.

If you have followed all the steps correctly, the chart should look like this. However, I have changed the colors based on my preference. You can also customize it by adjusting the settings.

Interpreting Envelopes Trading Signals

Overbought Signal: The Overbought Signal is triggered when the price reaches or surpasses the upper envelopes line, suggesting that the currency pair might be overvalued. This could indicate that the price is inflated, and a downward correction or reversal might be imminent.

Oversold Signal: Conversely, the Oversold Signal is activated when the price reaches or falls below the lower envelopes line, signaling a potential undervalued condition. This might imply that the price is deflated, and an upward correction could be expected.

In the AUD/USD chart below, the market bounced back from the overbought area. When the price breached the lower lines, it pulled back inside the channel. This sample chart demonstrates how to use the envelopes indicator in forex trading.

Combining the Envelope Indicator with Other Indicators

Envelopes are part of the trend and volatility indicators. They help measure how fast a security’s price changes. Their main job is to check whether a security’s price fluctuation is strong or weak over time.

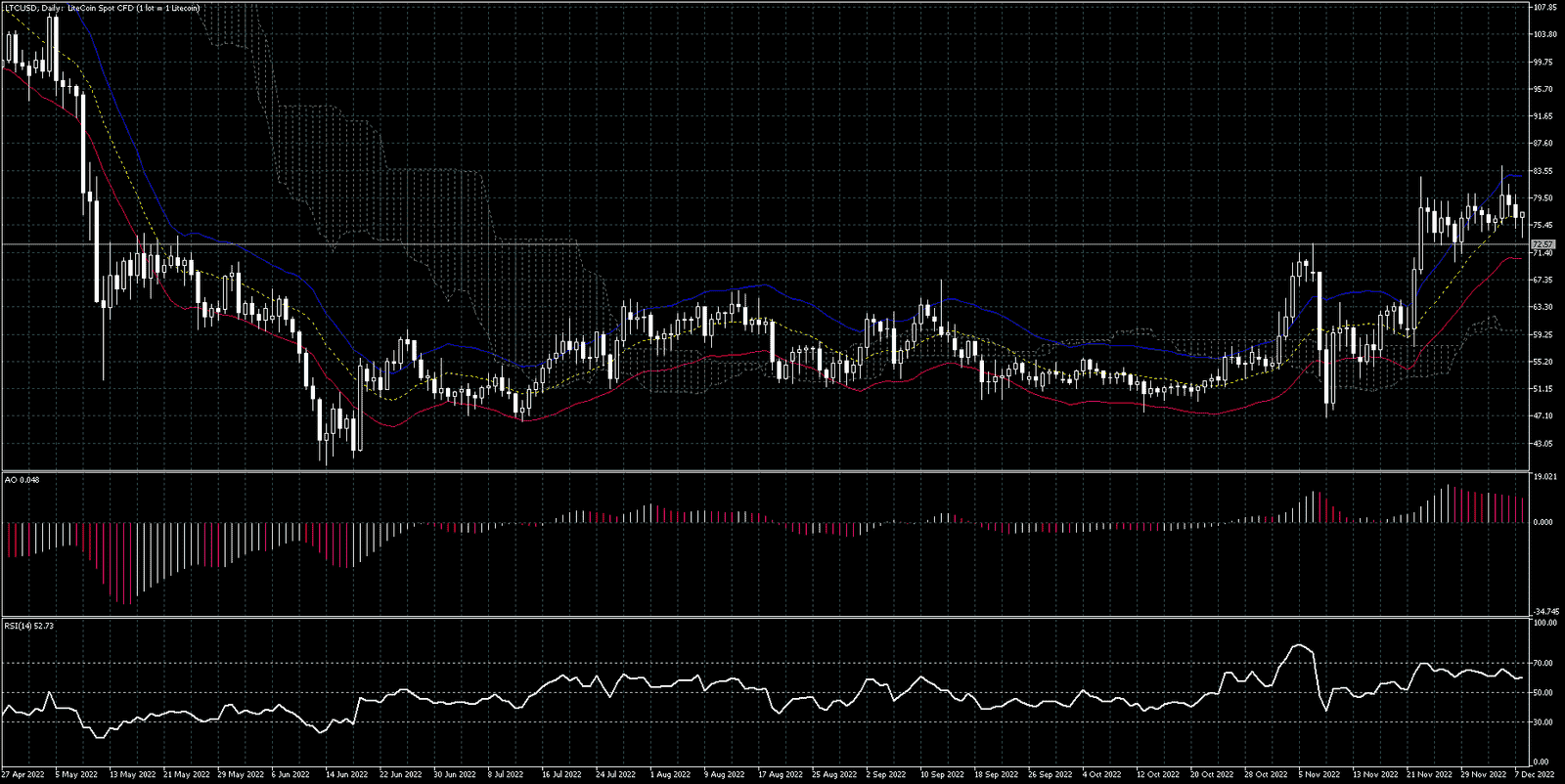

RSI, moving averages, MACD, and stochastic are similar. So, using another momentum indicator with envelopes might give us duplicate chart data. That’s why I’ll use Ichimoku Kinko Hyo in this guide. This trend-following indicator gives info on support, resistance, and trend direction.

For the third indicator, I used the Awesome Oscillator. It helps us spot the entry point with its bar color and divergence signals. Besides the Envelopes, I’ve also added the RSI indicator. It’s a backup tool to confirm when conditions are overbought or oversold.

Gold Analysis with the Envelopes Trading Strategy

After examining the gold chart on the 4-hour timeframe, the settings for the envelopes are as follows:

- Period: 14

- Shift: 0

- Deviation: 1

By adjusting the deviation parameter to 1, the technical indicator’s upper and lower bands align with the XAU/USD price’s highs and lows. With this setting, the overbought areas are now clearly visible on the chart.

Buy Signal:

- The price of the trading security must breach the lower line of the envelopes.

- The RSI indicator must hover below the 30 level. This confirms the market is oversold.

- The emergence of bullish candlestick patterns. These could be hammers, inverted hammers, Dojis, or bullish engulfing patterns.

- The next candle, after the emergence of the bullish candlestick pattern, is the entry point.

Sell Signal:

- The price of the trading security must breach the upper line of the envelopes.

- The RSI indicator must hover above the 70 level. This confirms the market is overbought.

- The emergence of bearish candlestick patterns. These could be inverted hammers, Doji, bearish engulfing patterns, or long-wick candlesticks.

- The next candle, after the emergence of the bearish candlestick pattern, is the entry point.

Target Profit:

- The first target profit should be the median line of the envelopes, and the second target profit should be the upper line if you are bullish or the lower line if you are bearish.

I hope you have enjoyed this article. If you have any questions about the trading strategy, please do not hesitate to contact me. I will be glad to address all of your questions.