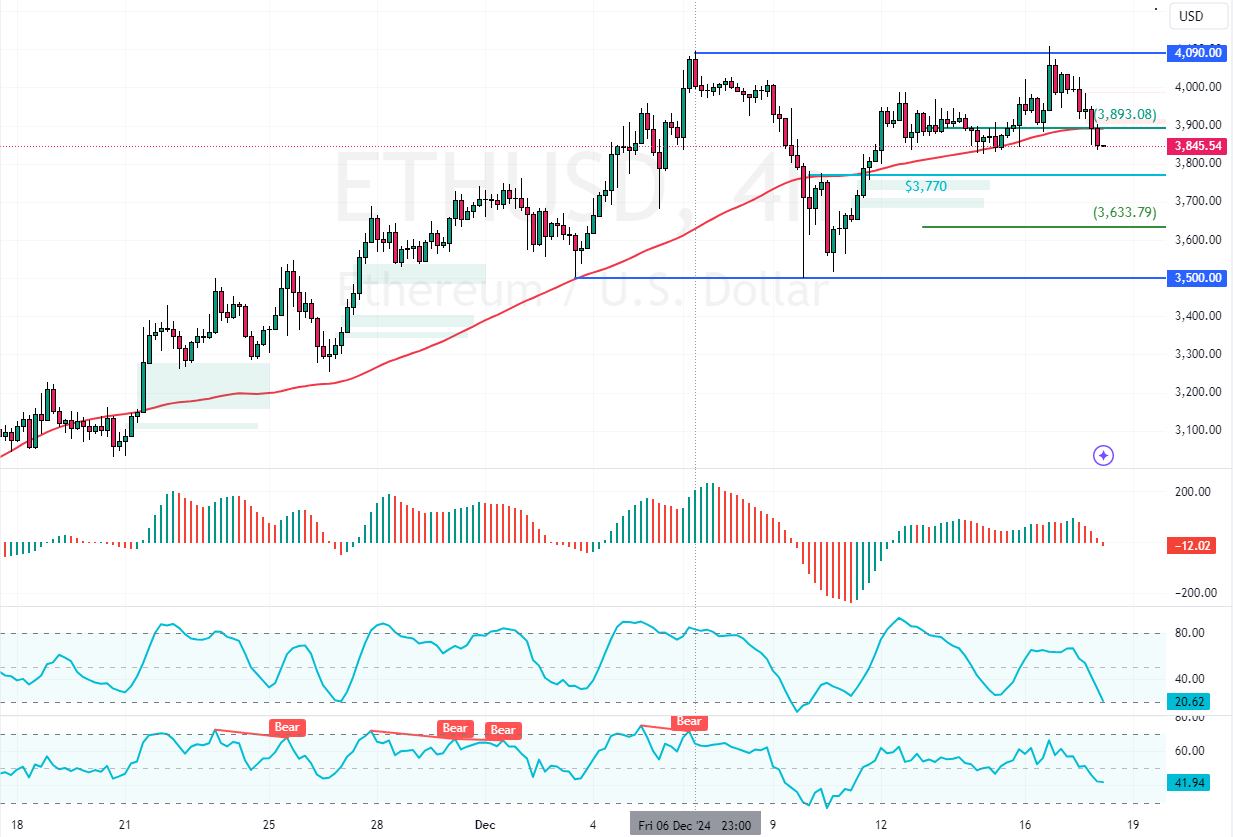

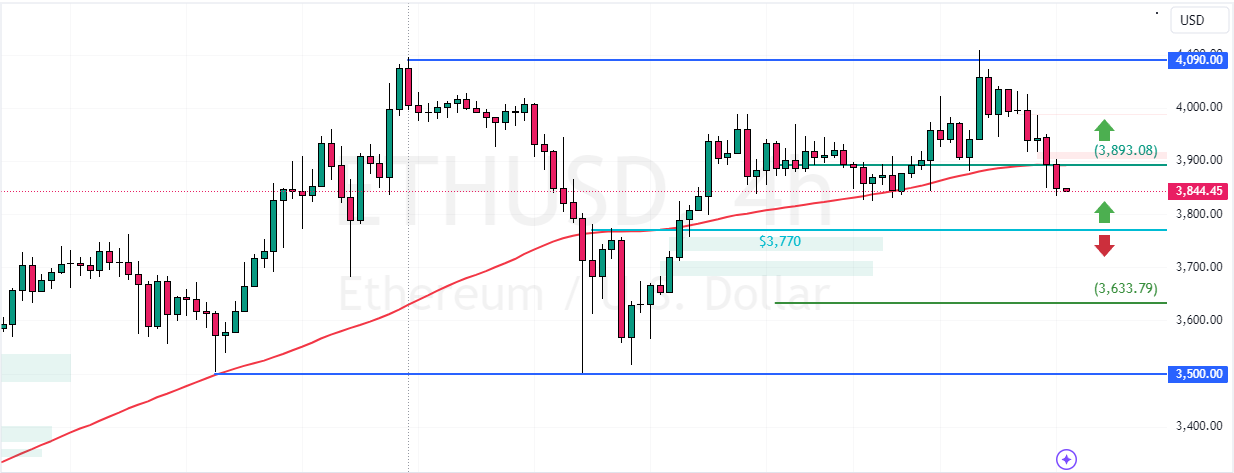

Ethereum bulls failed to surpass $4,090 on their second attempt, resulting in prices dipping from the December high. The market outlook remains bullish above $3,770. However, for the uptrend to resume, bulls must stabilize above the $3,890 resistance.

Ethereum Technical Analysis – 18-December-2024

As of this writing, ETH/USD trades at approximately $3,850, stabilizing below the 75-period simple moving average.

As for the technical indicators, the awesome oscillator histogram is red, below the signal line, meaning the bear market strengthened. Additionally, the RSI 14 and Stochastic Oscillator depict 42 and 31 in the description and are declining, implying the market is not oversold and the current bearish wave could resume.

Watch Ethereum Test $3890 for Bullish Breakout

Despite the bearish signals given by the technical tools, the Ethereum trend outlook remains bullish as long the prices are above the $3,770 critical support level, which divides the bull market from the bear market.

That said, the immediate resistance is at $3,890. From a technical perspective, the uptrend will likely resume if bulls stabilize Ethereum above this bullish barrier. In this scenario, the December high at $4,090 could be revisited for the third time.

The Bearish Scenario

The bullish outlook should be invalidated if bears push the prices below $3,770. If this scenario unfolds, the downtrend could extend to $3,630.