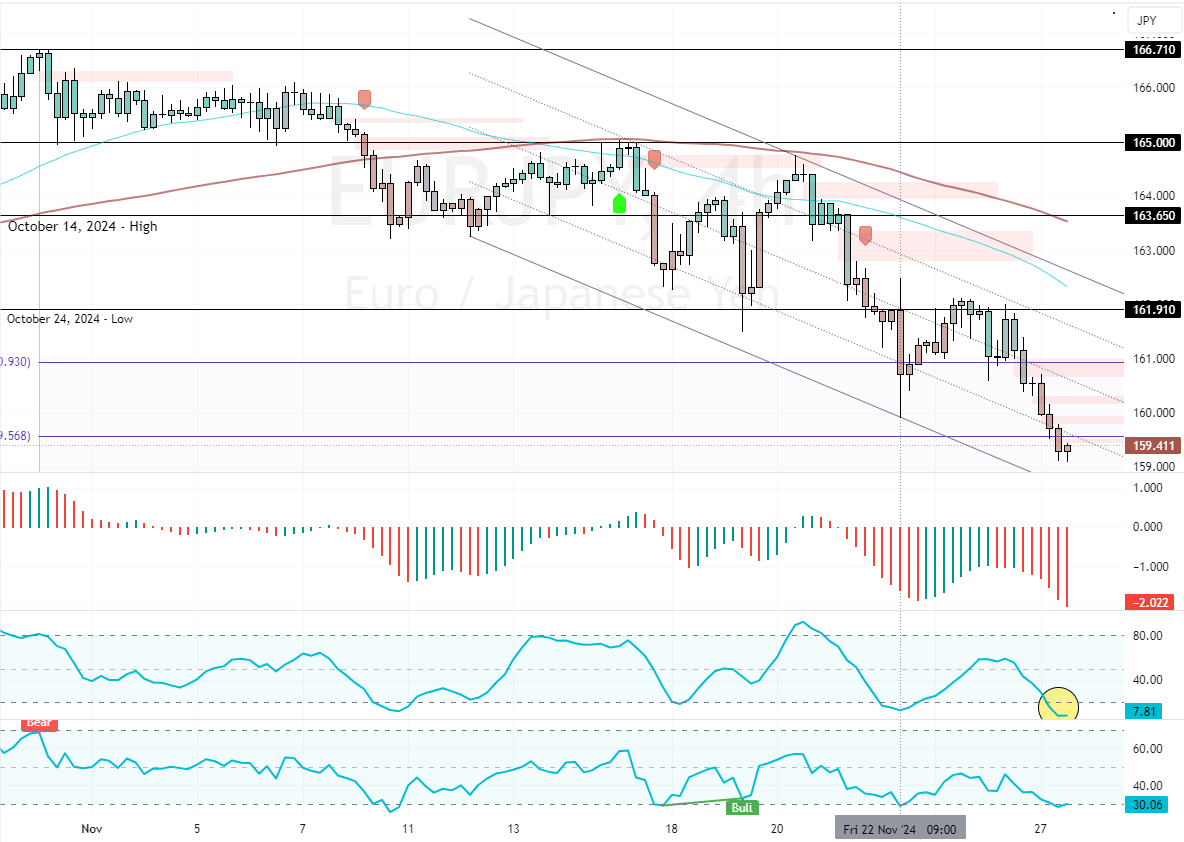

FxNews—The Euro is in a bear market against the Japanese Yen, below the daily 50-period simple moving average. In today’s trading session, the currency pair broke below the 61.8% Fibonacci support level, resuming its bearish trajectory.

As of this writing, EUR/JPY trades at approximately 159.4, stabilizing below the Fibonacci level.

Stochastic Shows EURJPY Oversold Expect Rally

Zooming into the 4-hour chart, we notice the Stochastic Oscillator depicts 7 in the description, meaning EUR/JPY is oversold. Therefore, markets expect prices to rebound or consolidate.

That being said, the outlook for the EUR/JPY trend remains bearish as long as the prices are below the 161.9 mark or below the descending trendline.

- Also read: Mexico’s GDP Surges But USDMXN Rises!

EURJPY Downtrend Resumes Despite Oversold Signals

Since the Japanese Yen seems to be overpriced in the short term, joining the bear market at this price is not advisable. Therefore, we suggest waiting patiently for the pair to consolidate near the upper resistance levels.

In this scenario, the 161.0 resistance could provide a decent ask price for retail traders and investors to plan a new selling strategy. Therefore, monitoring this level for bearish signals, such as candlestick patterns, is highly recommended.

Please note that if EUR/JPY maintains below 161.9, the next bearish target could be the 78.6% Fibonacci support level at 157.6.